Nepalis exhaust over 85% of income on consumption

Expenditure on alcohol, cigarettes, tobacco-related products falls in last nine years

Kathmandu, September 17

An average Nepali household is spending Rs 86 of every Rs 100 it earns on consumption, despite moderate rise in income, indicating rapid deterioration in the savings culture in the country.

Average household, on average, earns Rs 30,121 per month at present, of which Rs 25,928 is spent on consumption, show the findings of the Fifth Household Budget Survey released today by Nepal Rastra Bank (NRB). This is an indication that average household is saving only 13.92 per cent of the monthly income.

Nine years ago, when a similar survey was conducted, average Nepali household was saving 44.76 per cent of monthly income of Rs 27,391.

“These trends show that the country is becoming more and more consumption oriented,” Chief of NRB’s Research Division Nara Bahadur Thapa told The Himalayan Times.

Hike in consumption spending may not be that bad for the economy. But since Nepal is a net importing country, surge in consumption indicates more and more funds are leaving the country to finance imports.

The NRB report also shows that savings culture is even worse in urban areas of the country.

Urban residents, on average, earn Rs 32,336 per month, but save only 11.94 per cent of that income, shows the survey conducted in 8,028 households of 55 districts for a year beginning February 13, 2014.

Urban residents are spending more despite posting a moderate hike in income of 1.26 per cent in the last nine years.

Urban residents were earning Rs 31,935 per month nine years ago. Today, their average monthly income stands at Rs 32,336.

In contrast, average monthly income of rural households has increased by 23.78 per cent in the last nine years to Rs 27,551.

But along with income, monthly expenditure of rural households has also surged by 91.35 per cent in the last nine years to Rs 22,928.

“This is the result of increment in flow of money sent by Nepalis working abroad in the last one decade,” said Thapa.

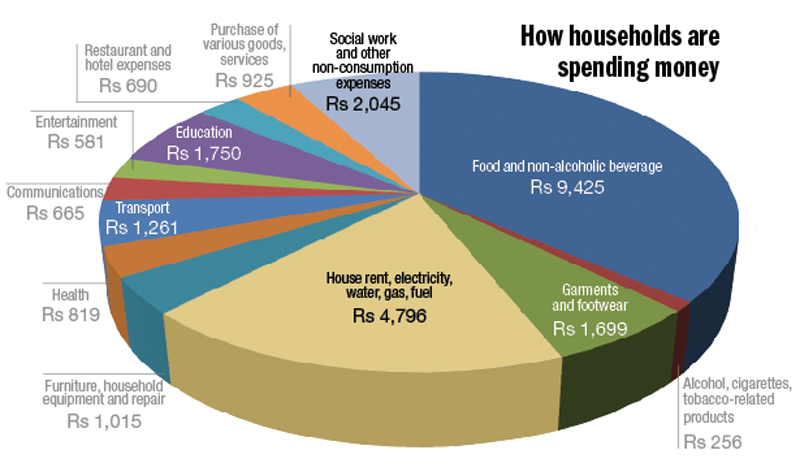

Expenditure pattern of rural households shows that a big portion — or 39.70 per cent — of their expenditure budget goes towards purchase of food and non-alcoholic beverage. Urban households, on the other hand, spend 34.07 per cent of expenditure budget on food and non-alcoholic beverage.

Other goods and services that are raising expenses of rural households are house rents and water, electricity, cooking gas and fuel.

Around 14.89 per cent of the total rural expenditure budget goes towards covering these costs. Urban households, on the other hand, exhaust 20.96 per cent of expenditure budget on these goods and services.

A look into the report shows that most of the expenses of urban and rural households have gone up in the last nine years. However, one good and surprising news is the decline in spending on alcohol, cigarettes and tobacco-related products.

Nine years ago, an average Nepali household was spending Rs 326 per month on these products. Today, an average household spends Rs 256 on these items.

Despite this, it is still rural households that are spending more on these hazardous

products.

An average rural household currently spends Rs 299 on alcohol, cigarettes and tobacco-related products per month, as against Rs 220 of urban households.

Nine years ago, rural households were spending Rs 332 per month on these items, as against expenditure of Rs 321 made by urban households.