Nepse ends 2015 in upbeat mood

Kathmandu, January 2

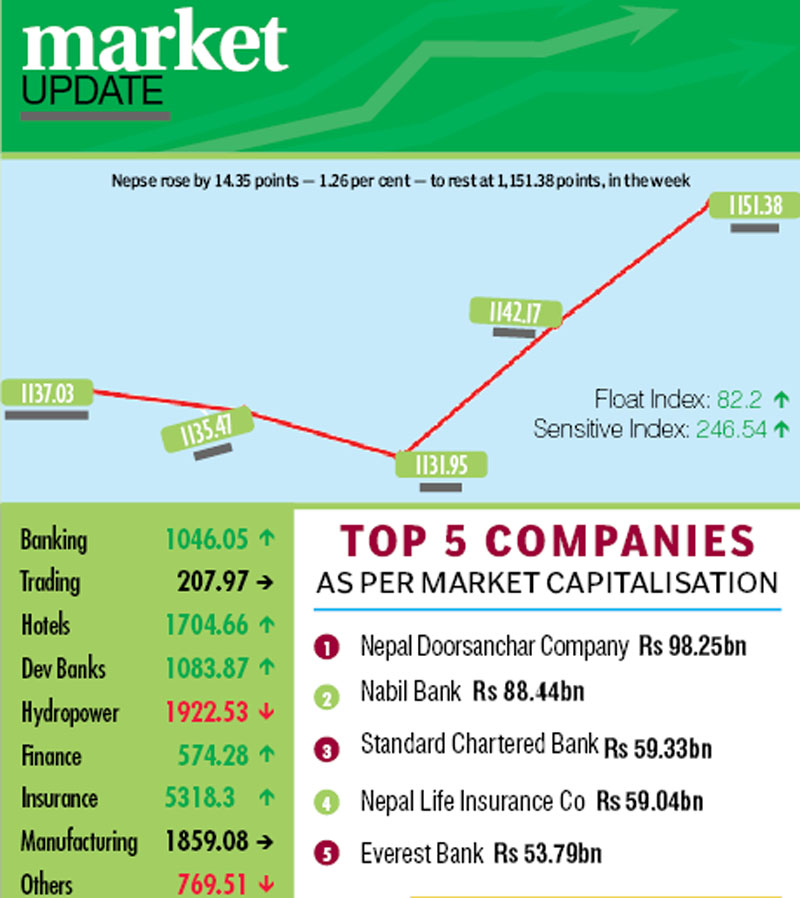

The country’s only secondary market bid adieu to the year 2015 on a positive note, with the Nepal Stock Exchange (Nepse) index clocking a weekly gain of 14.35 points to rest at 1,151.38 points, from December 27 to 31.

Starting the trading week at 1,137.03 points on Sunday, the benchmark index had shed 1.56 points by the day’s closing. It dropped another 3.52 points on Monday. However, Nepse more than recovered the loss of the previous two days by surging 10.22 points on Tuesday. The local bourse was closed on Wednesday in celebration of Tamu Lhosar. On Thursday, Nepse added another 9.21 points, and recorded a week-on-week rise of 1.26 per cent.

In total, 3.90 million shares of 153 companies worth Rs 1.84 billion were traded through 16,125 transactions during the week. The traded amount was 17.83 per cent less than the previous week when 21,787 transactions of 3.47 million scrips of 158 firms were undertaken that amounted to Rs 2.23 billion.

The sensitive index, which gauges the performance of class ‘A’ stocks, rose 1.06 per cent to 246.54 points. Likewise, the float index that measures the performance of shares actually traded also went up 1.26 per cent to 82.2 points during the review period.

Among the subgroups, manufacturing and trading remained constant at 1,859.08 points and 207.97 points, respectively.

As for the rest of the sub-indices, hydropower and others landed in the red whereas the remaining subgroups recorded gains.

Development banks took the lead among the gainers, up 3.46 per cent to 1,083.87 points. Nagbeli surged by Rs 640 to Rs 3,445 and Chhimek gained Rs 115 to Rs 1,650.

Insurance trailed close behind with a rise of 3.25 per cent to 5,318.3 points. Nepal Life Insurance rose by Rs 55 to Rs 3,405, National Life

Insurance by Rs 80 to Rs 2,440, while Life Insurance Co Nepal by Rs 51 to Rs 3,700.

Banking, the subgroup with the highest weightage on Nepse index, added 0.91 per cent to 1,046.05 points. Stock value of Standard Chartered went up by Rs 135 to Rs 2,645 and Nabil rose by Rs 45 to Rs 1,860, among others.

Compared to the previous week’s massive slump of 6.16 per cent, hotels fared pretty well during the review period by inching up 0.44 per cent to 1,704.66 points. Although Oriental’s stock price plunged by Rs 18 to Rs 422, the loss was offset by Soaltee rising by four rupees to Rs 320 and Taragaon Regency up one rupee to Rs 209. Finance also managed to land in the green this time around by edging up 0.03 per cent to 574.28 points.

Meanwhile, hydropower dropped 0.47 per cent to 1,922.53 points. Even though Ridi rose by Rs 11 to Rs 368 and Arun Valley inched up two rupees to Rs 260, the sub-index was weighed down by Chilime losing one rupee to close at Rs 1,174, and Butwal Power Co down Rs 12 to Rs 540, among others

The others subgroup annulled the previous week’s gain of 0.15 per cent by dipping 0.15 per cent in the review period because of Nepal Telecom’s stock price down by one rupee to Rs 655.

Nepal Bank topped the chart in terms of turnover with Rs 141.97 million, followed by National Life Insurance with Rs 119.89 million, NIC Asia Bank with Rs 111.2 million, Garima Bikas Bank (Promoter Share) with Rs 89.51 million and Prime Commercial Bank (Promoter Share) with Rs 66.24 million.

Garima Bikas Bank (Promoter Share) was the forerunner in terms of shares traded with 523,000 of its scrips changing hands, while ILFCO Microfinance Bittiya Sanstha came at the top in terms of transactions, clocking 2,420 deals.