Nepse index retreats below 1,050 pts

Kathmandu, November 28

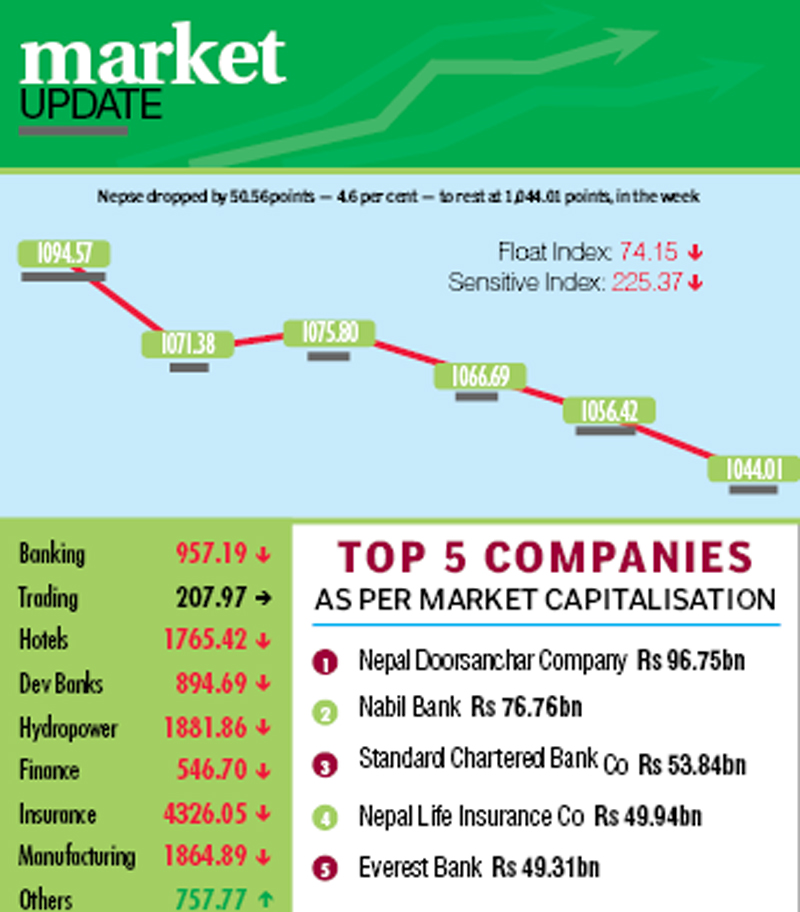

The country’s only secondary market saw massive volatility as the political gridlock continues to cripple the country’s economy, which has been compounded by India’s unofficial blockade. Hence, the Nepal Stock Exchange (Nepse) index plummeted by 50.56 points or 4.6 per cent week-on-week to retract below the psychological level of 1,050 points in the week, from November 22 to 26.

“Stock investors are wary of the current crisis that has gripped the country and market movement is in conjunction with the deteriorating political situation,” explained Dipak Karki, a stock market analyst.

While he opined that there was no reason to be too anxious, he said, “Perhaps the state should address the concerns of capital market to stabilise benchmark index.”

Opening at 1,094.57 points on Sunday, the benchmark index had plunged by 23.19 points by the day’s closing. On Monday, the local bourse added 4.42 points, but the Nepse index continued its downward trajectory, dropping by 9.11 points on Tuesday, 10.27 points on Wednesday, and 12.41 points on Thursday to close the week at a nearly four-month low of 1,044.01 points. The last time Nepse had closed at the current level was on August 6, when it had rested at 1040.36 points.

Altogether 2.4 million shares of 150 companies worth Rs 1.24 billion were traded through 12,615 transactions in the week. The traded amount is 63.78 per cent higher than the preceding week when 4,868 transactions of 1.59 million scrips of 143 firms that amounted to Rs 758.23 million had been undertaken.

The sensitive index, which gauges the performance of class ‘A’ stocks, descended by 10.89 points to 225.37 points. Likewise, the float index that measures the performance of shares actually traded also dropped 3.9 points to 74.15 points, during the review period.

Trading continued to remain constant at 207.97 points for yet another week. Meanwhile, others was the only subgroup to land in the green zone, inching up 0.15 per cent to 757.77 points on the back of Nepal Telecom’s share price going up by one rupee to Rs 645.

On the other hand, all the remaining subgroups landed in the red, with the banking subgroup dropping by a massive 5.85 per cent to 957.19 points. Nabil’s share price plunged by Rs 188 to Rs 2,100, Standard Chartered’s by Rs 134 to Rs 2,400, and Himalayan Bank’s by Rs 64 to Rs 1,250, among others.

On its heels, the insurance subgroup too slumped by 5.71 per cent to 4,326.05 points. Insurance firms like Life Insurance Co Nepal saw its stock value drop by Rs 185 to Rs 3,100 and National Life Insurance dropped by Rs 109 to Rs 2,023.

Adding to the previous week’s loss of 2.03 per cent, hydropower descended by another 4.17 per cent to 1,881.86 points. Chilime’s share price landed at Rs 1,307, down Rs 60 and Sanima Mai’s at Rs 725, down Rs 65.

Contrary to the previous week when development banks had recorded a minimal loss, the subgroup dived by 3.58 per cent to 894.69 points. Even as Nagbeli’s stock price rose by Rs 35 to Rs 1,832, the gain was offset by development banks such as Chhimek slumping by Rs 109 to Rs 1,611 and Nirdhan Utthan by Rs 200 to Rs 1,680.

Hotels dipped 2.52 per cent to 1,765.42 points as Soaltee was down Rs 12 to Rs 415 and Oriental was down Rs 15 to Rs 420.

The losses witnessed by manufacturing and finance subgroups were comparatively muted — down 1.68 per cent to 1,864.89 points and down 1.39 per cent to 546.7 points, respectively.

Nepal Life Insurance Co topped the chart with the highest turnover of Rs 88.11 million, followed by Everest Bank with Rs 86.31 million, Sana Kisan Bikas Bank with Rs 72.85 million, Nabil Bank (Promoter Share) with Rs 59.48 and NIC Asia Bank with Rs 48.50 million.

Siddhartha Equity Oriented Scheme was the forerunner in terms of number of shares traded with 174,000 of its scrips changing hands. Api Power Co recorded most number of transactions — 4,883.