Nepse index surges on positive cues from SEBON

KATHMANDU, JULY 11

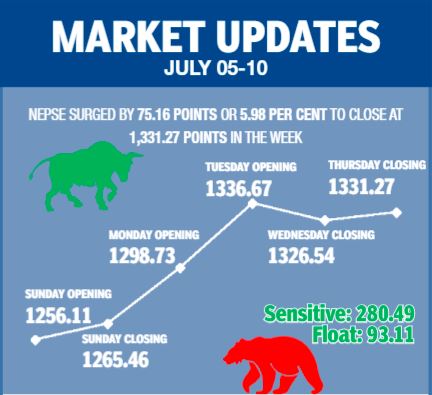

Along with the secondary and commodities market regulator showing positive cues to develop the secondary market, the Nepal Stock Exchange (Nepse) index surged by 5.98 per cent or 75.16 points to 1,331.27 points in the trading week between July 5 and 9.

Share investors have stated that the market is in a bullish trend at the moment as the Securities Board of Nepal (SEBON) has mentioned it will levy capital gains tax worth only five per cent. Earlier, the government had said that it will levy capital gains tax of above 10 per cent on share transactions, said Uttam Aryal, chairperson of Investors Association of Nepal.

“The market is also vibrant as the government is planning to issue broker licence to commercial banks,” Aryal added. Earlier, the Finance Committee under the Federal Parliament had directed the government to issue broker licence to commercial banks.

Aryal further added that the market is also usually up towards the end of fiscal year.

Along with the Nepse index, the sensitive index also went up by 4.26 per cent or 11.46 points to 280.49 points and float index gained 5.24 per cent or 4.64 points to 93.11 points.

The weekly turnover also increased by 223.21 per cent as compared to the previous week to Rs 5.16 billion. In the previous week, the market had witnessed transactions worth Rs 1.59 billion. Similarly, trading volume also surged to 1.36 million stocks changing hands this week from 409,660 in the previous week.

The secondary market had opened on Sunday at 1,256.11 points and went up by 9.35 points by the end of the trading day. It again surged by 33.27 points on Monday and 37.93 points on Tuesday.

However, it dropped by 10.13 points the next day. The local bourse again inched up by 4.57 points on Thursday to close the week at 1,331.27 points.

In the review week, only the trading subgroup landed in the red zone.

It dropped by 3.30 per cent or 29.37 points to land at 860.23 points.

Meanwhile, the hotels subgroup, which was the highest gainer of the week, surged by 13.24 per cent or 178.70 points to 1,527.60 points.

Similarly, non-life insurance gained 12.34 per cent or 676.53 points to 6,157.57 points.

The others subgroup also accelerated by 11.93 per cent or 80.57 points to 755.92 points. Life insurance sub-index, meanwhile, ascended by 9.36 per cent or 685.42 points to 8,007.38 points and microfinance increased by 8.34 per cent or 173.26 points to 2,249.85 points.

Moreover, manufacturing subgroup surged by 5.02 per cent or 130.26 points to 2,720.11 points.

Likewise, banking went up by 3.62 per cent or 39.31 points to 1,124.48 points and hydropower increased by 3.48 per cent or 32.24 points to 957.06 points.

The mutual fund subgroup rose by 3.22 per cent or 0.31 point to 9.92 points. Similarly, finance subgroup went up by 2.88 per cent or 18.33 points to 653.16 points and development banks gained 2.15 per cent or 36.09 points to 1,707.13 points.

In the review week, Nepal Reinsurance Company was the leader in terms of weekly turnover with Rs 795.49 million. It was followed by Nepal Life Insurance Co with Rs 433 million, NMB Bank with Rs 190.29 million, Himalayan Distillery with Rs 187.04 million and Chhimek Laghubitta Bikas Bank with Rs 167.46 million.

In terms of weekly trading volume too, Nepal Reinsurance Company was the forerunner with 1,714,000 transactions. It was followed by NMB Bank with 498,000, Nepal Life Insurance Co with 359,000, Prabhu Bank with 309,000 and Global IME Bank with 301,000 transactions.

Meanwhile, Nepal Reinsurance Company topped in terms of number of transactions with 35,622 transactions. It was followed by Nepal Life Insurance Co with 2,633, NMB Bank with 1,836, Sanjen Jalavidhyut with 1,379 and Nepal Investment Bank with 1,298 transactions.

A version of this article appears in e-paper on July 12, 2020, of The Himalayan Times.