NOC lessens its loan burden

KATHMANDU: Nepal Oil Corporation (NOC) — the state-owned petroleum supply monopoly — has repaid loan of Rs 4.78 billion to Employment Provident Fund (EPF) and Citizen Investment Trust (CIT), on Monday.

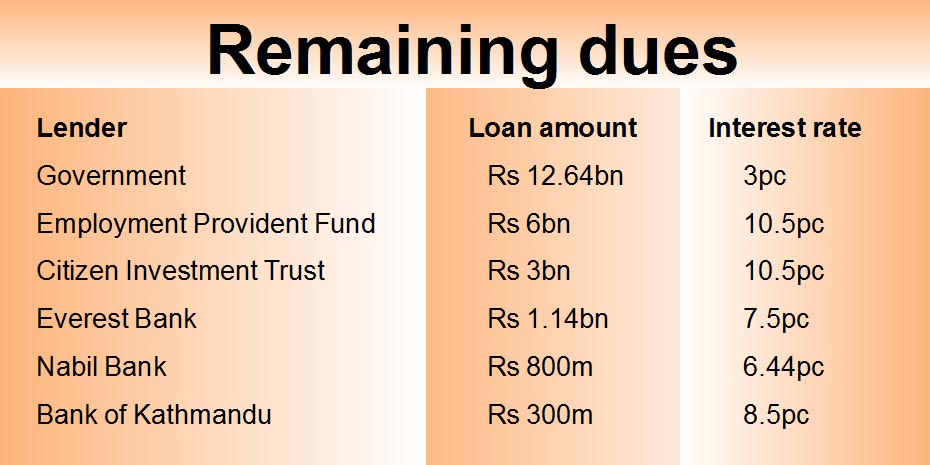

NOC has cleared Rs 2.85 billion owed to EPF and Rs 1.93 billion to CIT. After on Monday’s repayment, NOC now owes Rs six billion and Rs three billion to EPF and CIT, respectively.

So far this fiscal, NOC had returned back Rs four billion to CIT, Rs 3.50 billion to EPF and cleared outstanding dues of Indian Oil Corporation (IOC) worth Rs 3.22 billion. NOC pays higher interest rates to CIT and EPF compared to its other financers. Now, NOC’s total loan stands at Rs 23.88 billion, as per NOC Spokesperson Mukunda Ghimire.

As its loan burden is gradually coming down — it has reduced loan burden worth Rs 10.72 billion within this fiscal — the state oil monopoly has said that its surcharge in fuel prices that was jacked up for the purpose of repaying interest amount to its lenders, will be gradually reduced while adjusting fuel prices on July 1.

NOC had borrowed the money to import fuel as it had faced shortage of cash due to low market price compared to import price.

From September 29 last year, the government has enforced automatic pricing mechanism in fuel prices.

While automatic pricing has been enforced in petrol, diesel and kerosene, the government is yet to enforce such mechanism in cooking gas or LPG and aviation turbine fuel (ATF). Though ATF has been sold in profit from the beginning, NOC incurs huge loss in LPG. Currently, NOC incurs loss of Rs 61.93 in sale of each cylinder of LPG. Monthly consumption of LPG in the country is 1.6 million cylinders.