Non-life insurers settle 15.82pc of claims till date

KATHMANDU: Non-life insurance companies seem to be making some improvement in settlement of claims related to earthquakes of April and May, albeit they are yet to look into a huge portion of complaints.

A total of 16 operational non-life insurers settled 2,466 claims, or 15.82 per cent of the total claims, till on Monday, shows the latest report of the Insurance Board (IB), the insurance sector regulator. In the first week of June, these insurers had settled only 3.6 per cent of the claims.

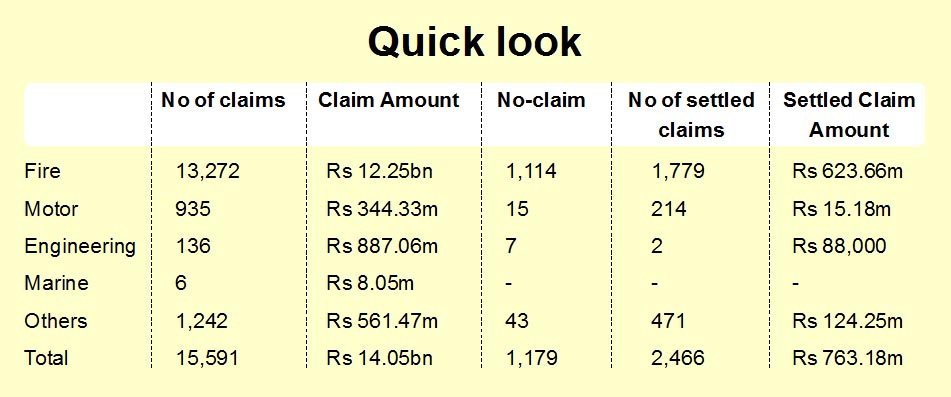

A total of 15,591 claims received by non-life insurers till today are worth Rs 14.05 billion. But so far these companies have released only Rs 763.18 million, or 5.43 per cent of the total claim amount, in compensation.

Around 85 per cent of the claims received by insurance companies are related to fire portfolio, which covers damage caused by earthquake.

“Although the non-life insurance companies are making gradual progress in terms of releasing compensation, they need to put in more effort to expedite this process,” a senior IB official said.

As of today, the highest number of claims was received by Sagarmatha Insurance. It has received 2,544 claims worth Rs 1.30 billion. Of these, only 332 claims, or 13.05 per cent, worth Rs 98.70 million have been settled, shows the IB report

Next in the league table of highest claim recipient is Siddhartha Insurance, with a total of 1,532 claims. These claims are worth Rs 1.59 billion. But as of today, only 230 claims, or 15 per cent, worth Rs 83.07 million were settled.

The third highest claim recipient, according to the IB, is Shikhar Insurance, which has so far received 1,419 claims worth Rs 1.47 billion. The company has so far settled 476 claims, or 33.54 per cent, worth Rs 205.80 million.

The proportion of claims settled by Shikhar Insurance and compensation extended is the highest in the non-life insurance sector.

Non-life insurers have long been saying that delay in assessment of damage due to shortage of insurance surveyors is delaying claim settlement process.

Currently, there are around 400 licensed surveyors in the country. This means each surveyor, on average, is handling around 39 cases.

As a result, only 3,605 survey reports have been filed by surveyors. Of the cases reviewed by insurance surveyors, 1,179 have been deemed as ‘no-claim’ cases, meaning no compensation has to be extended to clients.

Earlier, IB officials had estimated total earthquake-related losses of non-life insurers to stand at around Rs 20 billion.

Of this amount, losses of Rs five billion to Rs six billion may have to be borne by companies themselves and the rest by reinsurance companies located abroad, IB officials said.

Insurance companies here retain only a small portion of risk with them and transfer most of the risk to reinsurers located in India, Malaysia and countries in Africa, among others.