Pre-festive mood grips local stock investors

Kathmandu, September 24

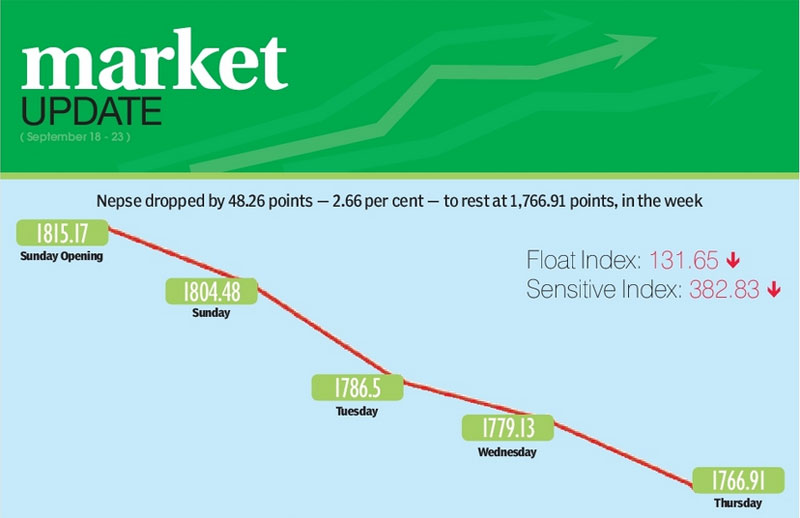

The Nepal Stock Exchange (Nepse) index fell by 48.26 points or 2.66 per cent in the trading week of September 18 to 22, as pre-festive mood gripped share investors.

Selling pressure usually goes up prior to the 10-day Dashain festival, which is starting on October 1, as share investors look to book profit. Hence, the current market movement is in tandem with the normal annual trend.

The benchmark index had opened for trading at 1,815.17 points on Sunday and had dropped 10.69 points by the day’s closing.

The country’s only secondary market remained closed on Monday as the country observed Constitution Day.

The local bourse remained southbound for the remainder of the week, plunging 17.98 points on Tuesday, down 7.37 points on Wednesday and dropping 12.22 points on Thursday.

In total, 7.24 million shares of 152 companies worth Rs 5.65 billion were traded through 23,885 transactions during the week.

The traded amount was 50.84 per cent higher than the preceding week when 18,526 transactions of 6.42 million scrips of 158 firms that amounted to Rs 3.76 billion had been undertaken.

The sensitive index, which gauges the performance of class ‘A’ stocks, fell by 11.05 points or 2.8 per cent to 382.83 points. Similarly, the float index that measures the performance of shares actually traded also dropped 3.89 points or 2.87 per cent to 131.65 points.

Majority of the subgroups landed in the red during the review period, although trading held steady at 202.79 points.

Banking, the share market heavyweight, took a dive of 70.16 points or 4.05 per cent to land at 1,661.26 points.

This was mostly on the back of Nabil’s share value plunging by 26.79 per cent to Rs 1,765. The news of the bank’s trading being suspended in the secondary market on Wednesday for not providing book closure took a toll on investor sentiment.

Hence, investors rushed to offload their shareholdings when the bank’s trading resumed on Thursday. The bank’s market capitalisation had tumbled by Rs 27.82 billion in a single day to stand at Rs 83.92 billion by the time of closing on Thursday.

However, it was manufacturing that saw the biggest plunge in the week, as the sub-index plummeted by 117.23 points or 4.69 per cent to 2,380.22 points, primarily as Unilever Nepal’s share price tumbled by 6.69 per cent to Rs 31,502.

Finance dropped by 13.66 points or 1.62 per cent to 831.39 points. Shareholders of Citizen Investment Trust saw value of their scrips go down by 3.67 per cent to Rs 4,590, among others.

Similarly, development banks fell by 25.06 points or 1.32 per cent to 1,869.35 points and hydropower was down 28.56 points or 1.18 per cent to 2,392.86 points. After leading the pack of gainers in the past week, insurance subgroup reversed course as the sub-index descended by 79.76 points or 0.88 per cent to 8,983.37 points.

Adding to the previous week’s rise of 0.19 per cent, hotels advanced by 48.78 points or 2.20 per cent to 2,260.51 points. Even as Soaltee went up by 1.71 per cent to Rs 417, the gain was capped due to Oriental dropping by 10.80 per cent to Rs 570 and Taragaon Regency slipping 1.07 per cent to Rs 277.

Others sub-index edged up 4.05 points or 0.52 per cent to 777.41 points. Hydroelectricity Investment and Development Company shed 1.64 per cent to Rs 300, but the subgroup buoyed on the back of Nepal Telecom gaining 1.16 per cent to Rs 696.

Meanwhile, Citizen Investment Trust was forerunner in terms of weekly turnover with Rs 1.21 billion, followed by Sunrise Bank with Rs 282.79 million, Nabil Bank with Rs 266.81 million, NIC Asia Bank with Rs 194.24 million and Nepal Bangladesh Bank with Rs 172.42 million.

NIBL Samriddhi Fund – I topped the chart in terms of trading volume with 863,000 of its scrips changing hands. With 1,359 transactions, NIC Asia recorded most number of transactions.