Precious metals shine as Fed stands pat on rate

(Figures in rupees per dollar. Source: NRB)

Kathmandu, September 24

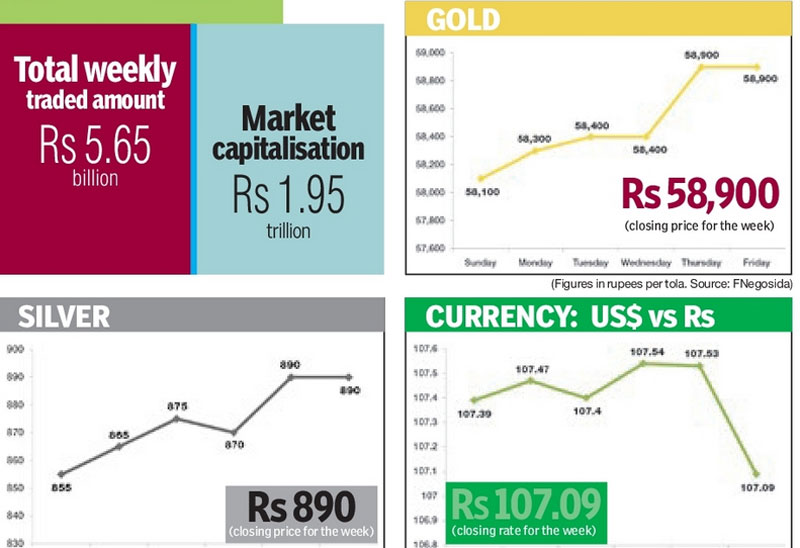

The inaction by the US Federal Reserve revived investor appetite for precious metals in the week of September 18 to 23, with gold price surging by Rs 800 per tola or 1.38 per cent and silver up Rs 35 a tola or 4.09 per cent over the course of the trading week.

“While a cut in the Fed’s outlook for rates and the weaker US dollar no doubt played a part, the continued efforts by Bank of Japan to bolster economic stimulus also helped,” Blooomberg reported Australia & New Zealand Banking Group Ltd as saying in a note explaining the rally of precious metals.

Gold is highly exposed to monetary policy, particularly in the United States, as higher interest rates lift the opportunity cost of holding non-yielding assets and boost the dollar, in which the precious metal is priced.

Markets will closely analyse upcoming US data for clues as to the timing of any rate rise, according to Reuters. The price of precious metals in the domestic market is governed by their rates in the international market.

Gold was priced at Rs 58,100 per tola on Sunday. The price of the precious yellow metal rose by Rs 200 a tola to be traded at Rs 58,300 per tola on Monday.

On Tuesday, bullion price edged up by Rs 100 a tola to be traded at Rs 58,400 per tola and remained constant the next day.

On Thursday, the price of precious yellow metal surged by Rs 500 per tola in a single day to be traded at Rs 58,900 a tola. Its price remained same on Friday.

Similarly, silver was being traded at Rs 855 per tola on Sunday. The price of the white metal rose by Rs 10 per tola on Monday to be traded at Rs 865 a tola and advanced by another Rs 10 per tola to be priced at Rs 875 a tola on Tuesday.

Silver price dipped marginally by five rupees a tola to be traded at Rs 870 per tola on Wednesday. On Thursday, however, silver price surged by Rs 20 a tola to be traded at Rs 890 per tola and its price remained the same on Friday.