Profit of banks surges by 25 per cent

Kathmandu, February 14

Profit of 23 commercial banks went up by a whopping 25 per cent in the second quarter of this fiscal year, as the central bank introduced relief packages to mask the impact of devastating earthquakes of April and May and supply disruptions along border points on the banking sector.

These banks generated a net profit of Rs 12.04 billion in between mid-July and mid-January, as against Rs 9.61 billion in the same period last fiscal year, show the unaudited financial reports of these financial institutions. Seven commercial banks are yet to publish their balance sheets.

Banks were able to increase their profits as Nepal Rastra Bank, the central bank, allowed borrowers, whose cash flow had shrunk due to earthquakes and border blockade, to defer loan repayment period and restructure debt, without provisioning extra funds.

This meant banks did not have to allocate additional funds to cover debts, whose quality had deteriorated, if borrowers were able to substantiate that their income had been hit by quakes and blockade. Also, NRB allowed banks to book expected income from some of the debt, whose payments were not made, as earnings.

In addition, banks have also been allowed to book income made after the end of the second quarter in mid-January as profit of the second quarter.

“The provisions introduced by NRB have definitely allowed banks to raise their profit level. But this is not genuine profit because problems have currently been swept under the rug. Bigger problems might emerge once the tenure

of the relief packages expires, and banks and borrowers will have to revert to the rules set in the past,” Sanima Bank CEO Bhuvan Kumar Dahal said, adding, “We fear the level of bad debt in the banking sector to go up by around a percentage point in the next quarter.”

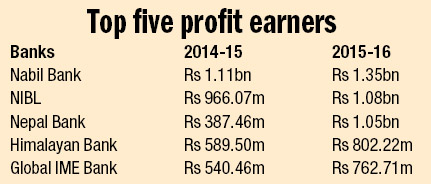

As NRB paved the way for the commercial banks to book bigger profit, three commercial banks, so far, have generated net profit of over Rs one billion

The biggest profit generator in the second quarter was Nabil Bank. The bank’s net profit went up by a whopping 21.60 per cent to Rs 1.35 billion. Second in the league table of biggest earners was Nepal Investment Bank Ltd, which booked net profit of Rs 1.08 billion, up 11.60 per cent than in the same period last fiscal year. Next in line was Nepal Bank Ltd, whose net profit surged by a startling 170.53 per cent to 1.05 billion.

Of the profit generated by these class ‘A’ financial institutions, six banks, however, saw their profit growth

rate shrink in the second quarter. These institutions include Everest Bank, Standard Chartered Bank Nepal, Agricultural Development Bank, Prabhu Bank, Bank of Kathmandu and Civil Bank.