Resurgent dollar extinguishes precious metals uptick

Stronger dollar and mixed views on the likelihood of a rate increase by the Federal Reserve in December following the presidential election in November dragged the price of precious metals lower in the week of September 25 to 30.

A stronger dollar is typically bearish for gold, because it makes the metal less affordable for investors who hold other currencies.

“Gold traders remain focused on the chances for a rate increase this year at the Fed’s policy meeting in December,” the Wall Street Journal reported. “In the long wait for that meeting, investors will be closely watching economic data for clues on the strength of the country’s economy, and the upcoming weeks could be particularly key.”

The price of precious metals in the domestic market is governed by their rates in international market.

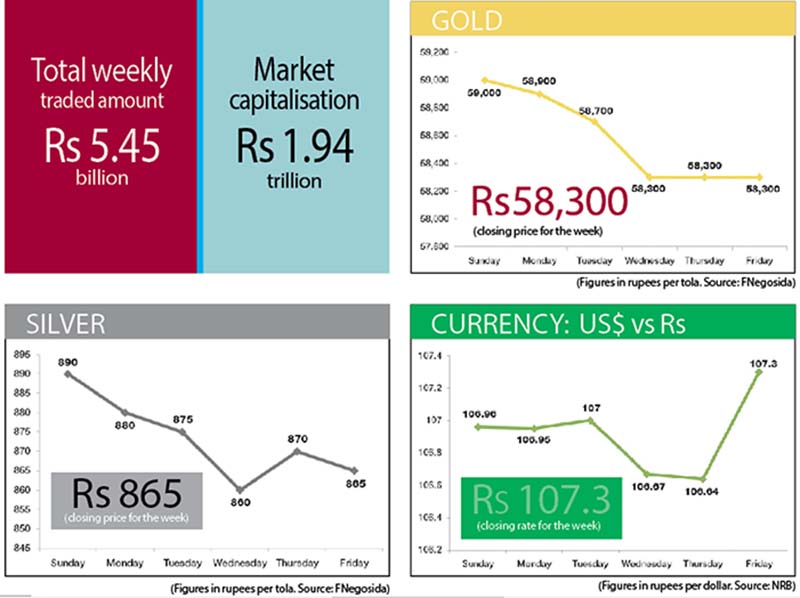

Gold was priced at Rs 59,000 per tola on Sunday and its price fell by Rs 100 a tola to be traded at Rs 58,900 per tola on Monday. On Tuesday, bullion price went down by another Rs 200 a tola to be traded at Rs 58,700 per tola. The price of the precious yellow metal slumped by Rs 400 a tola in a single day on Wednesday to be priced at Rs 58,300 per tola. Its price remained the same on Thursday and Friday. Bullion price dropped by Rs 700 or 1.19 per cent in the week.

Similarly, silver was being traded at Rs 890 per tola on Sunday. The price of the white metal went down by Rs 10 a tola to be traded at Rs 880 per tola on Monday. On Tuesday, silver price fell by five rupees a tola to be fixed at Rs 875 per tola. The white metal’s price dropped by Rs 15 a tola to be traded at Rs 860 per tola on Wednesday. On Thursday, silver recouped some of the loss as its price went up by Rs 10 a tola to be traded at Rs 870 per tola. On Friday, the last trading day of the week, the price of white metal fell by five rupees a tola to be traded at Rs 865 per tola. Silver price went down by Rs 25 or 2.81 per cent in the course of the week.

According to Federation of Nepal Gold and Silver Dealers’ Association, even as the deal to limit oil output by Organisation of the Petroleum Exporting Countries in the week and growing tension between India and Pakistan could push up the rally for precious metals, the factors to push down the price are stronger. Hence, the price of precious metals is likely to dip further in the coming week.