Secondary market welcomes 2017 in positive territory

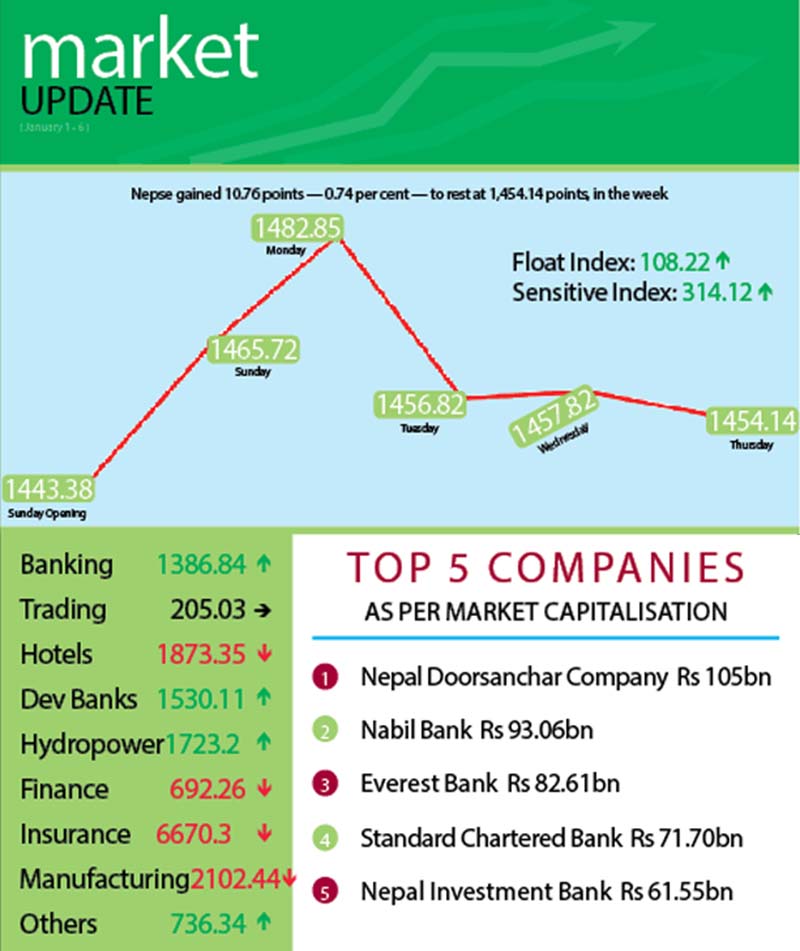

Snapping four weeks of losses, the domestic share market ushered in the year 2017 in positive territory with the Nepal Stock Exchange (Nepse) index recording weekly gain of 10.76 points or 0.74 per cent between January 1 and 5.

Starting the week at 1,443.38 points on Sunday, the benchmark index had surged by 22.34 points by the day’s closing. Nepse added another 17.13 points on Monday. However, on Tuesday, the local bourse plunged by 26.03 points on profit booking. While Nepse inched up by one point on Wednesday, the benchmark index shed 3.68 points on Thursday to end the week at 1,454.14 points.

The sensitive index, which gauges the performance of class ‘A’ stocks, went up by 2.48 points or 0.79 per cent to 314.12 points. Similarly, the float index that measures the performance of shares actually traded also inched up by 1.09 points or 1.02 per cent to 108.22 points.

In total, 4.54 million shares of 149 companies that amounted to Rs 2.16 billion changed hands through 18,551 transactions during the week. The traded amount was 2.71 per cent higher than the preceding week when 17,424 transactions of 5.24 million scrips of 147 firms worth Rs 2.11 billion had been undertaken.

Apart from trading remaining stationary at 205.03 points, half of the remaining subgroups witnessed gains, while the other half recorded losses.

Banking — the share market heavyweight — led the pack of gainers with the subgroup advancing by 21.76 points or 1.59 per cent to settle at 1,386.84 points. This was on the back of share value of commercial banks like Standard Chartered going up by 1.11 per cent to Rs 1,912, and Himalayan surging by 5.49 per cent to Rs 865, among others.

Others increased by 6.94 points or 0.95 per cent to land at 736.34 points. Even as Hydroelectricity Investment and Development Company shed 1.33 per cent to Rs 223, the sub-index was propped up by Nepal Telecom’s share price rising by 1.45 per cent to Rs 700.

Hydropower recovered some of the loss of the previous week, as the sub-index rose by 12.86 points or 0.75 per cent to rest at 1,723.2 points. Chilime went up by 0.87 per cent to Rs 807 and Sanima Mai gained 1.27 per cent to Rs 785.

Similarly, development banks added 8.11 points or 0.53 per cent to close at 1,530.11 points. Chhimek climbed 3.24 per cent to Rs 1,115 and Swabhalamban advanced four per cent to Rs 1,300.

Meanwhile, insurance continued its free fall with the subgroup taking a dive of 115.74 points or 1.7 per cent to 6,670.3 points. Nepal Life slumped by 5.36 per cent to Rs 2,650 and Shikhar was down 1.46 per cent to Rs 2,030.

After holding constant in the past week, manufacturing dropped by 34.47 points or 1.61 per cent to 2,102.44 points, weighed down by Unilever Nepal falling nearly two per cent to Rs 27,000.

Hotels retreated by 11.88 points or 0.63 per cent to 1,873.35 points and finance dipped 3.49 points or 0.5 per cent to close at 692.26 points during the review period.

Meanwhile, Nepal Telecom topped the chart of top-five in terms of weekly turnover with Rs 135.95 million, followed by Everest Bank with Rs 121.90 million, Nepal Life Insurance Co with Rs 107.55 million, Kumari Bank with Rs 89.67 million and Bank of Kathmandu Lumbini with Rs 81.42 million.

NMB Sulav Fund – I was forerunner with regards to trading volume with 736,000 of its scrips changing hands and Kumari Bank took the lead in number of transactions — 950.