Selling pressure weighs on Nepse

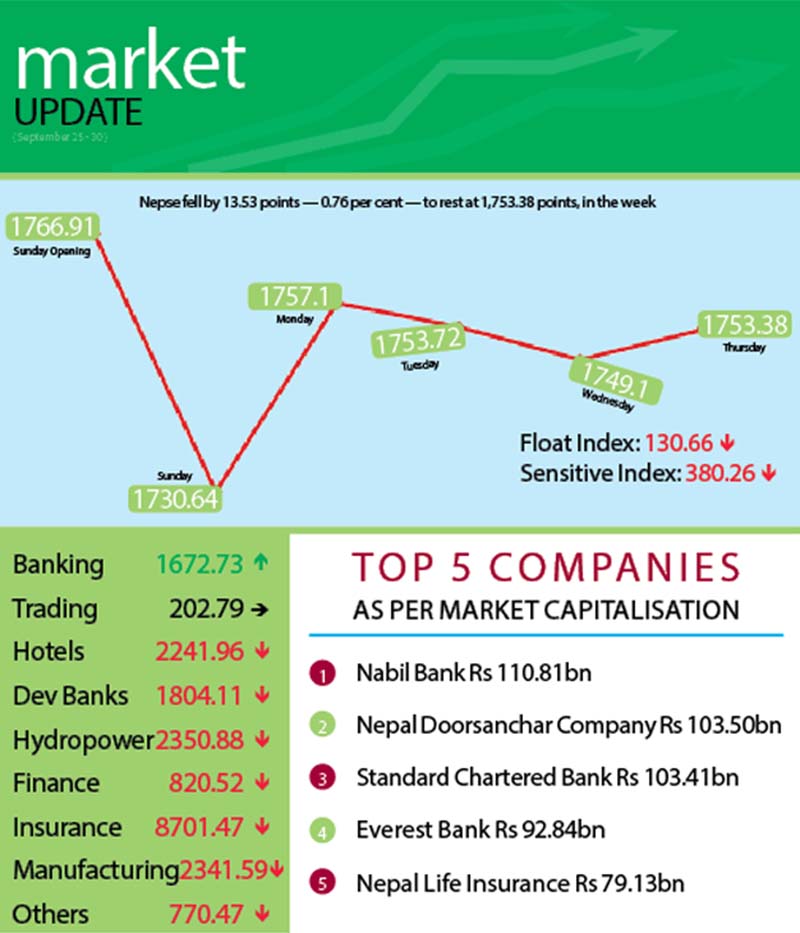

Selling pressure weighed on domestic share market in trading week of September 25 to 30 due to festive fever and announcement of book closure of listed firms, as Nepal Stock Exchange (Nepse) index fell by 13.53 points or 0.76 per cent to 1,753.38 points.

The benchmark index had opened for trading at 1,766.91 points on Sunday and saw its biggest fall in a single day for the week on profit-booking as the index nose-dived 36.27 points by the day’s closing. Nepse recouped some of the loss the next day as the index went up by 26.46 points. However, the local bourse reversed course again and shed 3.38 points and 4.62 points on Tuesday and Wednesday. On Thursday, Nepse inched up by 4.28 points and managed to close above the 1750-point threshold.

Altogether, 5.29 million shares of 158 companies worth Rs 4.45 billion were traded through 24,794 transactions during the week. The traded amount was 21.27 per cent lower than the preceding week, even as the market had remained open for only four days against the normal five days like in the review period. In the past week, 23,885 transactions of 7.24 million scrips of 152 firms that amounted to Rs 5.65 billion had been undertaken.

Sensitive index fell by 2.57 points or 0.67 per cent to 380.26 points. Float index also dipped by 0.99 points or 0.75 per cent to 130.66 points.

Banking — the market heavyweight — was the only subgroup to witness gain in the week, as the sub-index inched up by 11.47 points or 0.69 per cent to 1,672.73 points. Banks like Standard Chartered rose by 2.59 per cent to Rs 3,688 and Nabil by 1.53 per cent to Rs 1,792.

Development banks saw the biggest plunge, as the subgroup plummeted by 65.24 points or 3.49 per cent to 1804.11 points. Chhimek slumped by 5.97 per cent to Rs 1,890, Swabhalamban by 4.82 per cent to Rs 2,490 and Nagbeli by 3.39 per cent to Rs 4,410.

Over-heated insurance stocks underwent correction, as the sub-index dropped 281.9 points or 3.14 per cent to 8,701.47 points.

Hydropower fell by 41.98 points or 1.75 per cent to 2,350.88 points. Chilime lost 2.57 per cent to close at Rs 1,252, Sanima Mai was down 1.82 per cent to Rs 918 and Api descended 2.9 per cent to Rs 602.

After slumping by 4.69 per cent in past week, the manufacturing subgroup managed to limit its loss to 38.63 points or 1.62 per cent to 2,341.59 points. This was mostly on the back of Bottlers Nepal (Tarai) closing at Rs 5,097, down 8.24 per cent and Unilever Nepal shedding two rupees to land at Rs 31,500.

Finance continued its free fall by declining 10.87 points or 1.31 per cent to 820.52 points. Others dipped 6.94 points or 0.89 per cent to 770.47 points and hotels shed 18.55 points or 0.82 per cent to 2,241.96 points.

Trading remained stationary at 202.79 points.

Meanwhile, Everest Bank was the forerunner in terms of weekly turnover with Rs 530.12 million, followed by Nepal Bangladesh Bank with Rs 410.46 million, National Life Insurance with Rs 228.66 million, Siddhartha Bank with Rs 209.83 million and Sunrise Bank with Rs 183.10 million.

Nabil Balanced Fund – I topped the chart in terms of trading volume with 511,000 of its scrips changing hands. With 1,987 transactions, Nepal Bangladesh Bank recorded most number of transactions.