Total trade deficit in Q1 widens 77.5 per cent to Rs 201.75 billion

Kathmandu, November 18

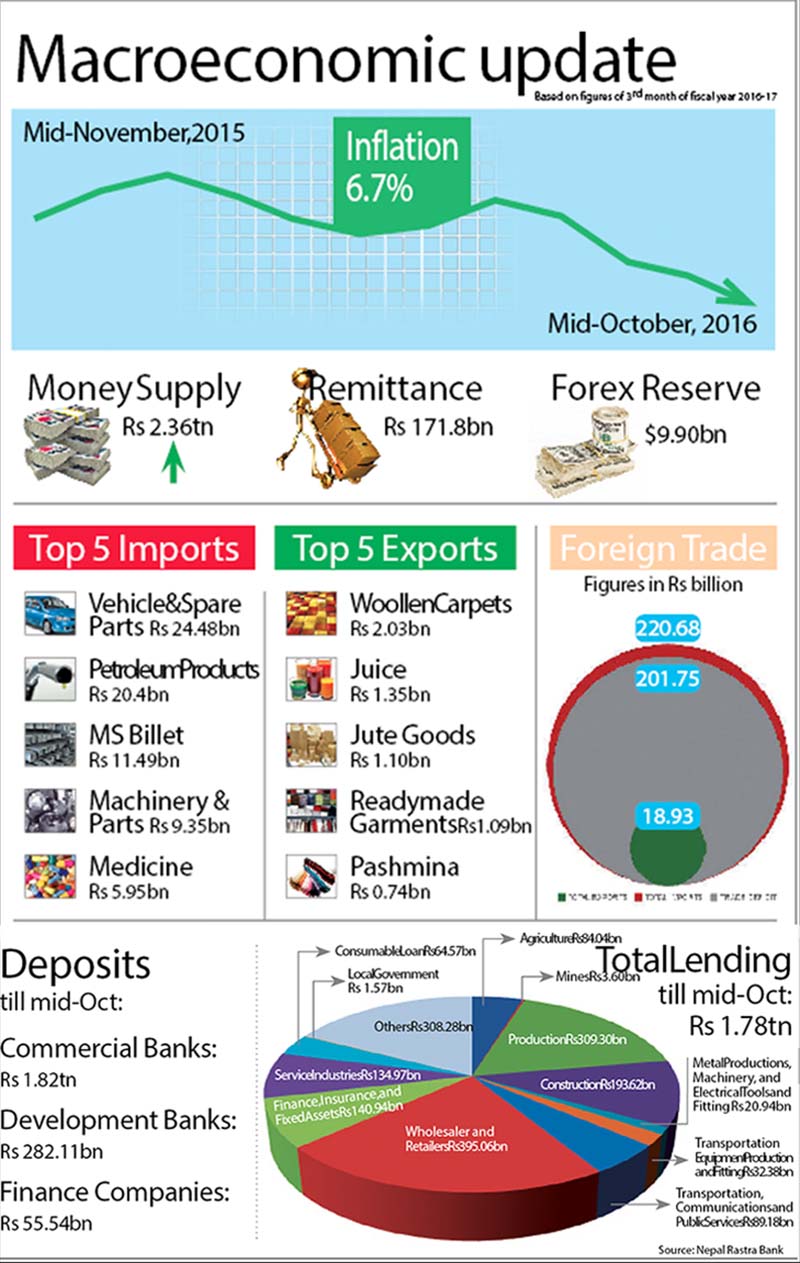

The country’s total trade deficit in the first three months of fiscal 2016-17 (mid-July to mid-October) expanded by 77.5 per cent to a staggering Rs 201.75 billion compared to a contraction of 32.8 per cent in the same period of previous year, shows the latest macroeconomic update unveiled by Nepal Rastra Bank (NRB) today.

The export-import ratio fell to 8.6 per cent in the review period from 12.9 per cent in the same period of previous year.

In the first quarter of 2016-17, merchandise exports increased 12.6 per cent to Rs 18.93 billion and imports surged by 69.1 per cent to Rs 220.68 billion. In contrast, both export and export had dropped by 25.4 per cent and 69.1 per cent in the corresponding period of previous fiscal owing to tensions in the southern plains.

Based on imports of first quarter of the current fiscal, the foreign exchange holdings of banking sector is sufficient to cover prospective merchandise imports of 14.6 months, and merchandise and services imports of 12.5 months.

Meanwhile, the sluggish pace of government expenditure relative to resource mobilisation resulted in accumulation of cash balance of Rs 196.62 billion at NRB in the first three months of this fiscal.

According to the macroeconomic update, the total government expenditure increased 92.7 per cent to Rs 95.16 billion in the review period, compared to a decrease of 10.6 per cent in the corresponding period of the previous year.

This was on back of both recurrent expenditure and capital expenditure rising to Rs 86.79 billion and Rs 7.29 billion, respectively, in the review period. The government’s recurrent and capital expenditure had stood at Rs 41.07 billion and Rs 2.87 billion in the same period the previous year.

“Government budget announcement one-and-a-half months before the start of new fiscal year and timely approval of Appropriation Bill resulted in relatively higher growth in recurrent and capital expenditure,” explains the NRB report. “However, out-turns in various heads of government expenditure have remained far below the annual targets.”

At the same time, the government revenue collection increased 66.7 per cent to Rs 126.12 billion against a drop of 10.2 per cent in the corresponding period of the previous year. Higher growth rate of major tax heads such as value added tax, customs, excise and others tax heads contributed to the overall rise in revenue collection in the review period.

On account of an increase in trade deficit, decrease in grants and slower growth of workers’ remittances, the current account slipped into a deficit of Rs 1.97 billion in the review period from a surplus of Rs 85.88 billion in the same period of the previous year, shows the central bank report.

However, the overall balance of payments (BoP) recorded a surplus of Rs 19.70 billion compared to a surplus of Rs 63.96 billion in the same period of previous year.

In the review period, Nepal received capital transfer amounting to Rs 2.41 billion and foreign direct investment (FDI) inflow of Rs 5.02 billion. In the same period of the previous year, capital transfer and FDI inflows were Rs 3.95 billion and Rs 1.12 billion, respectively.

“The macroeconomic performance during the review period remained satisfactory with a deceleration in consumer price inflation and a return of BoP position to a surplus,” says the report, adding uptick in tourism, boost in summer crops due to favourable monsoon, better industrial capacity utilisation, an upsurge in services sector and a pickup in credit off-take have potentially improved economic growth outlook. “However, acceleration in capital spending and reconstruction-related activities is the key to unlock the growth potential going forward.”