20pc of quake claims require no compensation

Kathmandu, December 11

At least 20 per cent of insurance claims related to damage and destruction caused by the earthquakes of April and May are either not eligible for compensation or were withdrawn by property owners.

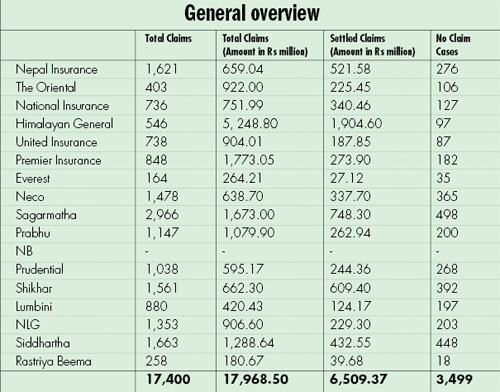

Non-life insurance companies here had received 17,400 claims after the devastating quakes. Of these claims, 3,499 have been categorised as 'no claim' cases, shows the latest report of the Insurance Board (IB), the insurance sectorregulator.

“This means property owners either withdrew their complaints because of insignificant losses caused to their properties or the claim amount was equal or lower than the amount that insurers are allowed to deduct while extending compensation,” a senior IB official said.

In Nepal, the deductible amount on fire insurance policy, which covers earthquake, is fixed at 2.5 per cent of the insured amount. This legal provision enables non-life insurers to deduct 2.5 per cent of the sum insured while extending compensation.

So, to be able to get some compensation from insurers, the claim amount should be higher than 2.5 per cent of the sum insured. In other words, if the insurance of a house is worth, say, Rs five million, an owner must make a claim of more than Rs 125,000 — 2.5 per cent of Rs five million. If the claim amount is lower than the deductible amount, owners will not get any compensation.

This provision has reduced some of the liabilities of non-life insurance companies here, although the total worth of ‘no claim’ cases has not been mentioned in the IB report.

Non-life insurance companies had received claims worth Rs 17.97 billion after the quakes. Of these, 9,312 claims worth Rs 6.51 billion have already been settled. Non-life insurers are yet to settle cases worth Rs 11.46 billion.

“We were hoping insurers to settle all the cases by now, but that hasn’t been the case. We are pushing them to expedite claim settlement process,” said the IB official, adding, “At the same time, some of the claim amounts appear inflated because of erroneous valuation of losses during the time of disaster.”

The official, however, said these problems have not ‘affected settlement of smaller claims filed by individuals and households, as they have already been settled’.

IB data show that Shikhar Insurance so far ranks at the top in terms of claim settlement. The company had received claims worth Rs 662.30 million, of which Rs 609.4 million, or 92 per cent, has been returned to property owners.

Similarly, Nepal Insurance Company Ltd has extended Rs 521.58 million in compensation, which is 79.14 per cent of its earthquake insurance liability, while Neco Insurance has settled Rs 337.70 million worth of claims, which is 52.87 per cent of its earthquake insurance liability.

The worst is Everest Insurance, which has only extended Rs 27.12 million in compensation, which is 10.26 per cent of the total amount claimed by property owners.