Benchmark index buckles under quarter-end pressure

KATHMANDU, OCTOBER 17

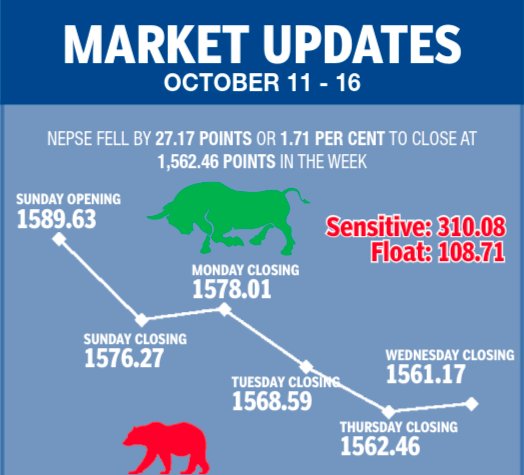

The week leading up to the end of the first quarter of fiscal year 2020-21 saw a relative lull in the share market, with Nepal Stock Exchange (Nepse) dropping 1.71 per cent or 27.17 points week-on-week in the trading period between October 11 and 15.

“It’s quite normal for the stock market to come under pressure towards the end of every quarter,” said a market analyst, adding that a slight market correction is actually a good sign that the market is not being overheated. “Moreover, the festive fever also might have contributed to the drop in the benchmark index, but it was primarily the quarter-end pressure.”

Starting the week at the previous week’s close of 1,589.63 points, the benchmark index had dropped by 13.36 points by the time of closing on Sunday, weighed down by 11 of the subgroups landing in the red. Finance was the only sub-index to rise that day.

The market moved into the green territory on Monday, with the local bourse up 1.74 points, as investors scooped up shares of development banks. Banking, trading, hotels and microfinance were the other subgroups to record gains that day.

The market, however, reversed course over the next two days.

Nepse index fell by 9.42 points on Tuesday and the daily turnover also dropped to Rs 1.82 billion, while on Tuesday, the benchmark index slipped further by 7.42 points, and the total traded amount was recorded at Rs 1.50 billion.

Even as the local bourse inched up by 1.29 points on Thursday to close the trading week at 1,562.46 points, the daily turnover shrunk further to Rs 1.42 billion.

Market analysts are nevertheless upbeat about the coming days as Prime Minister KP Sharma Oli reshuffled his Cabinet on October 14 and inducted Bishnu Paudel as the new Minister for Finance.

This is the second time Paudel has been appointed to the helm of the Finance Ministry. It is to be noted that the secondary market had scaled to an all-time high during Paudel’s earlier stint as the finance minister. He is widely regarded as investor-friendly and had introduced a number of provisions to facilitate the share market earlier.

The sensitive index, which measures the performance of class ‘A’ stocks, lost 1.48 per cent or 4.66 points to 310.08 points.

The float index that gauges the performance of shares actually traded also shed 1.66 per cent or 1.83 points to 1,08.71 points.

Altogether, 33.16 million shares of 206 companies were traded through 145,980 transactions in the review week that amounted to Rs 9.09 billion. The traded amount was 37.97 per cent lower compared to Rs 14.65 billion recorded in the previous week, when 220,152 transactions of 54.42 million shares of 205 companies had been undertaken.

All of the subgroups landed in the red during the review week, with hydropower — the subgroup that had led the pack of gainers in the last review period — landing at the bottom of the pile. The slump of 5.11 per cent or 71.61 points to 1,331.08 points, however, did not wipe out all the gains made in the previous week, when the sub-index had surged by 8.54 per cent.

Manufacturing descended by 3.37 per cent or 105.04 points to 3,016.49 points, with hotels on its heels, down 3.07 per cent or 54.82 points to 1,731.84 points. In the past week, manufacturing sub-index had gone up by 2.68 per cent, trailed closely by hotels with a 2.14 per cent rise.

After advancing by 7.52 per cent in the previous week, the finance subgroup dropped by 2.57 per cent or 21.68 points to 821.63 points this time around.

Adding to the previous week’s loss of 1.82 per cent, non-life insurance fell by 2.45 per cent or 193.48 points to 7,704.2 points.

Trading saw the previous week’s gain of 1.07 per cent wiped out, as the subgroup was down 1.55 per cent or 16.57 points to 1,052.03 points.

Same was the fate of the banking subgroup, which retreated 1.38 per cent or 17.48 points to 1,249.03 points, compared to 0.64 per cent rise in the last week.

Life insurance landed at 9,442.2 points, down 1.34 per cent or 128.33 points; mutual funds slipped to 10.46 points, down 1.32 per cent or 0.14 point; others rested at 1,013.24 points, down 1.17 per cent or 11.98 points; and microfinance closed at 2,515.89 points, down 1.01 per cent or 25.55 points.

The loss of the development banks was limited to 0.12 per cent or 2.37 points to 2,056.58 points.

The sub-index had soared by 6.25 per cent in the past week.

Meanwhile, Muktinath Bikas Bank Ltd had the highest weekly turnover of Rs 310.59 million, followed by Arun Kabeli Power Ltd with Rs 307.23 million, Nepal Reinsurance Co Ltd with Rs 301.76 million, Arun Valley Hydropower Development Co Ltd with Rs 291.99 million, and Nepal Life Insurance Co Ltd with Rs 269.41.

National Hydro Power Co Ltd topped the chart in terms of trading volume with 1.80 million of its shares changing hands. Himal Dolakha Hydropower Co Ltd with 1.34 million shares, Arun Kabeli Power Ltd with 1.24 million shares, Arun Valley Hydropower Development Co Ltd with 1.20 million shares and Jyoti Bikas Bank Ltd with 1.18 million shares rounded up the top five companies whose shares were most traded in the week.

Reliance Life Insurance Ltd recorded 7,845 transactions, the most in the week. Nepal Reinsurance Co Ltd with 4,825 transactions was second, National Hydro Power Co Ltd with 3,800 transactions was third, Muktinath Bikas Bank Ltd with 3,439 transactions was fourth and Api Power Co Ltd with 3,294 transactions was fifth in this category.