Benchmark index edges up slightly

Kathmandu, September 23

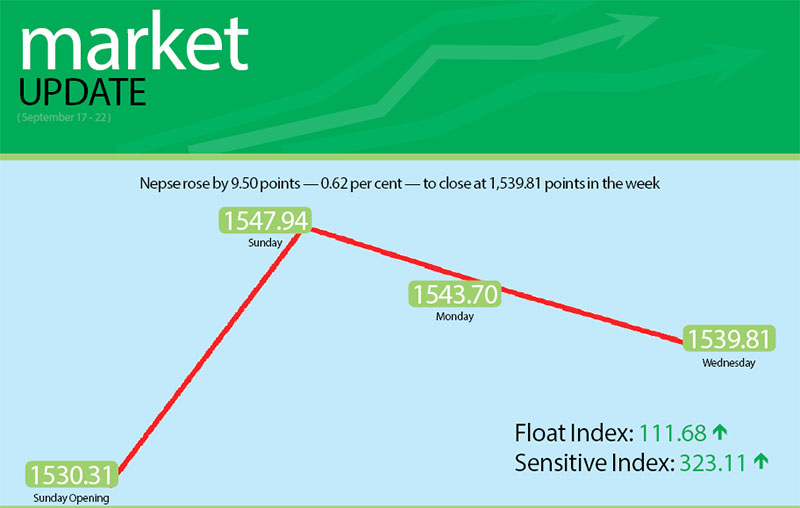

The country’s secondary market rose slightly during the three days of trading between September 17 and 21. The benchmark index, which opened at 1,530.31 points on Sunday had closed at 1,539.81 points on Wednesday.

The Nepal Stock Exchange (Nepse) remained closed on Tuesday and Thursday because of a public holiday on Constitution Day and Ghatasthapana, respectively. Nepse index went up by 17.63 points in the first day of the week to 1,547.94 points, before falling to 1,543.7 points on Monday and further dipping to 1,539.81 points on Wednesday.

The benchmark index went up by 9.5 points or 0.62 per cent in the review period. Similarly, the sensitive index rose by 2.38 points or 0.74 per cent to 323.11 points and the float index closed at 111.68 points, up 0.8 point or 0.72 per cent.

Ambika Prasad Paudel, chairman of Nepal Investors Forum, said speculations of rate cut affected market movement. “As the situation of credit crunch has eased, investors were hoping for a rate cut. However, interest rate did not go down,” he said.

Paudel also said that investors are in a festive mood, which also affected the movement of the market. “The market will likely gather momentum only after Tihar,” he informed.

The sub-index of class ‘A’ financial institutions went up by 16.89 points or 1.28 per cent to 1,333.59 points. Share price of commercial banks like Nabil, Nepal Investment and Standard Chartered rose during the review period. Secondary market price of Nabil Bank went up to Rs 1,254, up 4.07 per cent. Similarly, share price of Nepal Investment Bank went up by 2.26 per cent to Rs 768 and that of Standard Chartered rested at Rs 2,140, up 1.9 per cent.

Sub-index of trading sector surged by 26.95 per cent or 62.33 points to 293.58 points during the review period. This was on the back of share value of Bishal Bazar Company soaring by 33.05 per cent to Rs 2,971.

Sub-indices of manufacturing, development banks, others and hydropower sector also gained slightly during the review period. The manufacturing sector went up to 2,612.79 points, up 0.79 per cent and the development bank sub-index also rose to 1,917.85 points, increasing by 0.02 per cent. Likewise, the others sector gained 4.05 points or 0.56 per cent during the week to close at 723.04 points. The sub-index of hydropower sector rested at 1,778.23 points, gaining 15.25 points or 0.86 per cent.

Meanwhile, the hotels sub-index decreased to 2,331.83 points, falling 42.26 points or 1.78 per cent. Insurance and finance sector also fell slightly. Sub-index of insurance sector slipped to 8,458.25 points, down 0.68 per cent and finance fell to 783.27 points, declining 6.55 points or 0.83 per cent.

Altogether, 6.7 million shares of 169 companies worth Rs 1.79 billion were traded through 18,152 transactions during the review period. The traded amount was 50.34 per cent lower than the total weekly turnover of the previous week of Rs 3.61 billion.

Nepal Life Insurance Company’s promoter share secured the top position in terms of total turnover during the week with Rs 289.09 million. It was followed by Nepal Life Insurance Company with Rs 81.39 million, Sanima Bank with Rs 70.72 million, Everest Bank with Rs 70.13 million and Nepal Investment Bank with Rs 55.38 million.

Nepal Life Insurance Company’s promoter share topped the list in terms of trading volume with 262,000 of its shares changing hands and Sanima Bank was the forerunner in terms of number of transactions — 911.

New listings

Company

Type

Unit

Life Insurance Corporation Nepal

Bonus

2,652,243.75

Pokhara Finance

Ordinary

983,682