Benchmark index posts 12th weekly gain

Kathmandu, March 12

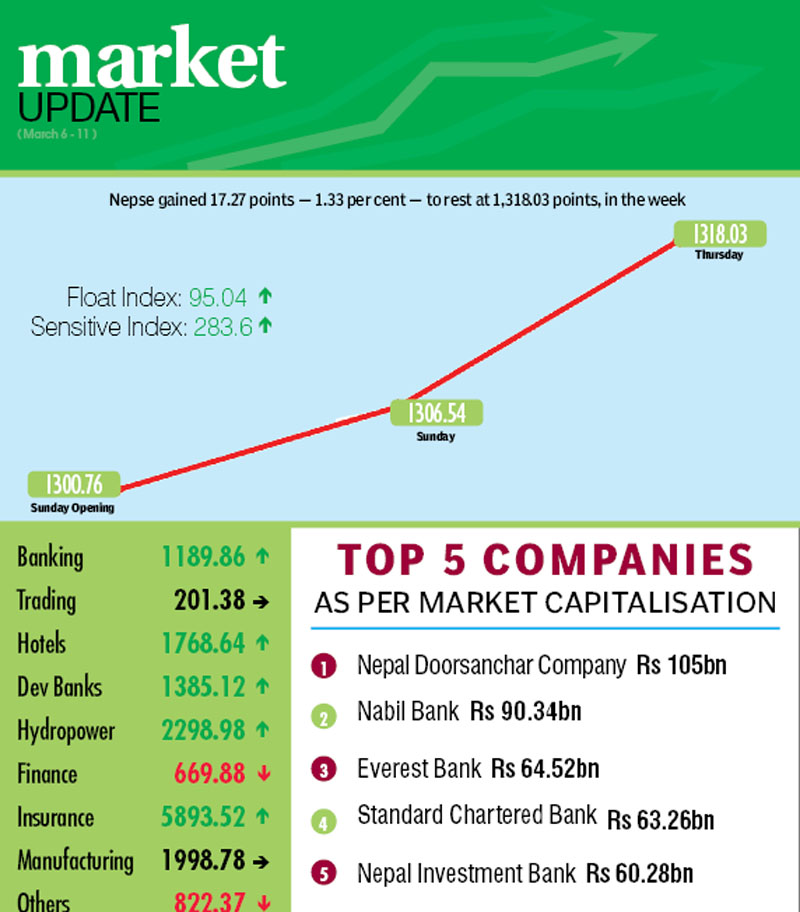

Encouraged by the persistent market rally, stock traders flocked to the country’s only secondary market in the trading week of March 6 to 10. Hence, the Nepal Stock Exchange (Nepse) index posted a weekly gain of 17.27 points or 1.33 per cent.

Even as the share market was open for trading for only two days during the week due to public holidays from Monday through Wednesday, Nepse index managed to record fresh highs on Sunday as well as Thursday. The benchmark index, which had opened at a previous high of 1,300.76 points on Sunday, had gained 5.78 points to record a new high of 1,306.54 points by the day’s closing. On Thursday, the local bourse surged by 11.49 points to reach a fresh peak of 1,318.03 points.

While stock analysts have been warning that bull markets usually die amid excessive optimism, Securities Board of Nepal (SEBON) has also advised investors to adopt caution.

In a media release issued recently, SEBON said, “Investors have been urged to make their investment decisions only after gauging the overall economy, based on detailed information about the company and its field of operation, situation of the secondary market along with various developments related to Nepse.”

Though the secondary market is also considered to be the mirror of the overall economy, SEBON has said ‘since small investors still constitute a majority in the securities market and the presence of institutional investors remains comparatively low, the market movement could be based on rumours and speculations’.

SEBON’s statement is in line with concerns voiced by stock analysts, who have said controlled pullback may be necessary to prevent the market from crashing.

In total, 2.94 million shares of 134 companies that amounted to Rs 1.74 billion were traded through 7,669 transactions during the review period. The traded amount was 37.24 per cent less than the preceding week when 13,464 transactions of 4.75 million scrips of 143 firms that amounted to Rs 2.80 billion had been undertaken.

The sensitive index rose 1.02 per cent to 283.6 points. Similarly, the float index that measures the performance of shares actually traded also went up 1.42 per cent to 95.04 points.

Among the subgroups, manufacturing and trading held steady at 1,998.78 points and 201.38 points, respectively. Except for finance and others, all the remaining subgroups landed in the green zone.

The market rally of the week was on the back of insurance subgroup, which surged by 5.45 per cent to 5,893.52 points. Share value of Siddhartha soared by Rs 259 to Rs 1,499, that of Premier by Rs 252 to Rs 1,452, and of Shikhar by Rs 200 to Rs 1,760.

Development banks continued to post impressive gain — ascending 3.51 per cent to 1,385.12 points. Mithila Laghubitta advanced by Rs 437 to Rs 2,521, Sana Kisan by Rs 294 to Rs 1,985 and Swabalamban by Rs 148 to Rs 2,398.

Hydropower more than recovered the previous week’s dip of 0.6 per cent by climbing 2.97 per cent to 2,298.98 points. Api went up by Rs 118 to Rs 686, Sanima Mai by Rs 40 to Rs 890 and Ridi by Rs 47 to Rs 452.

Adding to last week’s gain of 1.27 per cent, hotels subgroup rose 2.08 per cent to 1,768.64 points. Although Oriental shed four rupees to Rs 450, the loss was offset by Taragaon up Rs 18 to Rs 227 and Soaltee up seven rupees to Rs 330.

Banking subgroup inched up by a marginal 0.37 per cent to 1,189.86 points.

Meanwhile, after securing top spot among gainers for a few weeks, finance subgroup plunged by 3.06 per cent to 669.88 points, as jittery traders looked to book profits. Share price of Citizen Investment Trust fell by Rs 21 to Rs 3,700, Pokhara Finance by Rs 50 to Rs 332, Jebils by eight rupees to Rs 173, and Lalitpur Finance by five rupees to Rs 305.

Others subgroup dipped by 0.71 per cent to 822.37 points, as Nepal Telecom’s share value fell by five rupees to Rs 700.

Neco Insurance topped the chart in terms of turnover and number of transactions with Rs 137.64 million and 447, respectively.

Other companies that recorded highest traded amount were Siddhartha Insurance with Rs 81.26 million, United Insurance with Rs 67.09 million, National Life Insurance with Rs 64.67 million and Agricultural Development Bank with Rs 60.85 million.

Meanwhile, Siddhartha Equity Oriented Scheme was the forerunner with regards to shares traded with 606,000 of its scrips changing hands.