Benchmark index snaps six-week bullish trend

Nepal Stock Exchange entered a correction phase in the trading week between May 5 and 9, taking a break after the sixth week-on-week gain. Share market analysts attributed the trend to bulk investors taking their chances in different subgroups.

“Big investors are shifting their investment from one subgroup to another, and its effect is clearly visible in the share market,” said Uttam Aryal, chairman of Investors Association of Nepal, alleging that they are trying to distort the market.

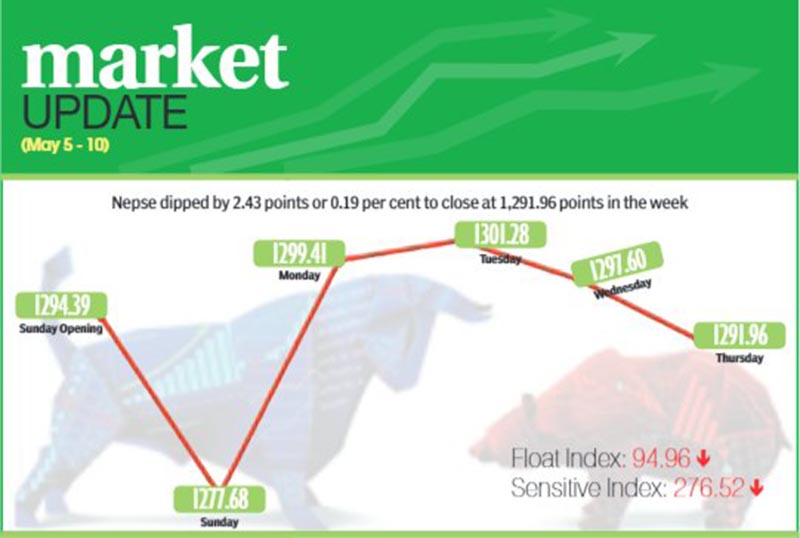

Consequently, Nepse index shed 0.19 per cent or 2.43 points during the review week.

Similarly, sensitive index dropped by 0.46 per cent or 1.30 points to 276.52 points and float index also fell by 0.5 per cent or 0.48 point to 94.96 points.

Weekly turnover fell by 21.39 per cent compared to previous week to Rs 3.47 billion. In previous week, the market had witnessed turnover of Rs 4.41 billion. This was despite the fact that market was open for normal five days in review period against only four days in week ahead due to a public holiday.

Likewise, daily average turnover fell to Rs 693 million, a drop of 37.11 per cent compared to the previous week when it stood at Rs 1.1 billion.

In the review week, trading of mutual funds fell by 2.06 per cent as compared to previous week to Rs 10.94 million. In previous week mutual funds witnessed turnover of Rs 11.17 million. However, trading of promoter shares witnessed tremendous increment — 196.48 per cent — to Rs 409.14 million, as opposed to Rs 138 million in the week before. Likewise, total paid-up value of listed shares went up by 0.25 per cent to Rs 415.21 billion, which in the previous week stood at Rs 414.16 billion.

The secondary market had opened at 1,294.39 points on Sunday and dropped by 16.71 points by the end of the trading day. On Monday, it rebounded strongly by 21.73 points and added another 1.87 points on Tuesday. The gain was however offset by the loss of the next two days — down 3.68 points on Wednesday and 5.64 points on Thursday to close the week at 1,291.96 points.

In the review week, manufacturing, trading, hotels, others and non-life insurance subgroups landed in green zone.

The manufacturing subgroup surged by 9.95 per cent or 215.29 points to 2,379.14 points with share price of Shivam Cement up Rs 67 to Rs 411. Similarly, trading sub-index rose by 5.32 per cent or 13.05 points to 258.54 points. Share price of Bishal Bazaar Company rose by Rs 32 to Rs 1,672.

The hotels subgroup increased by 2.89 per cent or 56.19 points to 2,000.80 points.

Others sub-index also went up by 1.72 per cent or 12.36 points to 730.1 points and non-life insurance subgroup landed at 5,844.79 points, up 0.36 per cent or 20.72 points.

Meanwhile, the hydropower sub-index was biggest loser of the week, dropping by 5.67 per cent or 69.89 points to 1,162.35 points. Share value of Chilime fell by Rs 47 to Rs 530. Similarly, microfinance subgroup went down by 1.59 per cent or 24.71 points to land at 1,524.58 points and life insurance sub-index dropped by 1.52 per cent or 104.3 points to 6,764.65 points.

Moreover, finance subgroup fell by 1.08 per cent or 6.79 points to 618.5 points. Likewise, development banks was down 0.93 per cent or 14.65 points to 1,549.01 points and banking dipped by 0.26 per cent or 3.1 points to 1,161.18 points.

In the review week, Sanima Bank (Promoter Share) was the leader in terms of weekly turnover with Rs 325.08 million. It was followed by Shivam Cement with Rs 236.48 million, Nepal Bank with Rs 180.03 million, NCC Bank with Rs 137.55 million and NMB Bank with Rs 127.6 million.

In terms of weekly trading volume too, Sanima Bank (Promoter Share) took the lead with 1.80 million of its shares changing hands. Civil Bank with 648,000 shares, Shivam Cement with 619,000 shares, Nepal Bank with 577,000 shares and NCC Bank with 564,000 shares were the other top firms to record high trading volume.

Meanwhile, with 3,227 transactions, Shivam Cement was the forerunner in this category.

It was followed by Mega Bank with 1,363, Upper Tamakoshi Hydropower with 1,305, NCC Bank with 1,127 and Prabhu Bank with 1,114 transactions.