Central bank to soon introduce new CPI

Nepal Rastra Bank (NRB) has almost completed revising the Consumer Price Index (CPI), which once introduced would reflect changes in the purchasing pattern of Nepalis in the last one decade.

NRB updates the CPI once every 10 years to capture changes in consumption or purchasing pattern brought about by alteration in income level, taste and other factors, including social and psychological. This is the fourth time the central bank is revising the index.

“We are about to finalise the new CPI and will introduce it in less than a month. The inflation of the current fiscal year (which began on July 17) and upcoming fiscal years will be calculated using the new index,” said a senior NRB official.

It is necessary to revise the CPI on a periodic basis so that prices of goods and services that are commonly purchased by consumers can be captured.

Once the new CPI is introduced, the base year for comparing changes in consumer prices will be revised to 2015-16 from 2005-06.

NRB is revising the CPI based on surveys conducted in 55 districts, 84 market centres, 207 municipalities and village development committees, and 8,028 households.

“We conducted these surveys continuously for a year beginning February 13, 2014, during which consumption of 1,150 different goods and services, and changes in their prices were recorded,” said the official, adding, “Previously, such surveys used to be carried out for only a week.”

Based on these surveys, NRB is including around 500 goods and services in new CPI basket. The existing CPI basket comprises 410 different types of food, beverage, non-food items, such as clothes and footwear, and services, such as transportation and communication.

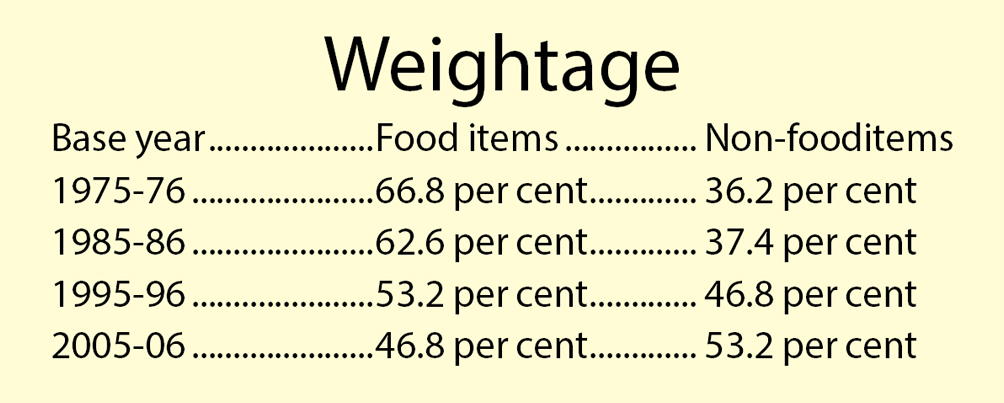

Each of these items in the CPI basket is given a weightage based on which inflation is derived.

Since the 1970s, when the first CPI was introduced, the weightage of food items in consumer basket has been continuously declining.

The contribution of food items in the first CPI stood at 66.8 per cent and that of non-food items stood at 36.2 per cent. Ten years later, when the second household survey was conducted, the contribution of food items in the CPI had fallen down to 62.6 per cent. It further came down to 53.2 per cent when the third household survey was carried out.

Then in 2005, when the fourth household survey was conducted, contribution of food items in CPI fell below 50 per cent — to 46.8 per cent — for the first time.

The NRB official did not mention the contribution of food and non-food items in the new CPI. But considering the previous trends, there is ground to believe that the contribution of food items to new consumer basket will come down further.

Once the weightages of all food and non-food items are finalised, NRB will start referring to the new list to derive inflation.

Beginning this fiscal, NRB will collect samples from 60 market centres to derive inflation figure. Currently, NRB has been collecting samples from 33 market centres to calculate inflation.