CGT calculation method dilemma hits Nepse index

Kathmandu, July 27

With the government remaining undecided regarding the method of calculating the capital gains tax (CGT) on share transactions, the country’s sole secondary market slumped in the trading week between July 21 and 25.

Share market investors have said they have consulted and discussed with the concerned stakeholders for a way out of the CGT dispute but nothing concrete has materialised yet.

“Normally the share market goes on a bull run at the beginning of the fiscal year, but it was not the case this time around because the CGT issue has remained unresolved,” said Radha Pokharel, chairperson of Nepal Punjibazaar Laganikarta Sangh.

According to Pokharel, share investors had urged the government to calculate CGT by taking the share price of one particular day as the base price. “However, the government authorities are refusing to budge from their stance that the base price would be calculated on the opening price of the shares on a daily basis,” she explained.

Earlier, the Securities Board of Nepal (SEBON) had summoned concerned officials of Nepal Stock Exchange (Nepse) and CDS and Clearing Ltd (CDSC) for talks to seek a viable solution, but there has been no headway yet. Hence, the Ministry of Finance has now called a meeting with concerned stakeholders on Sunday for a feasible way out.

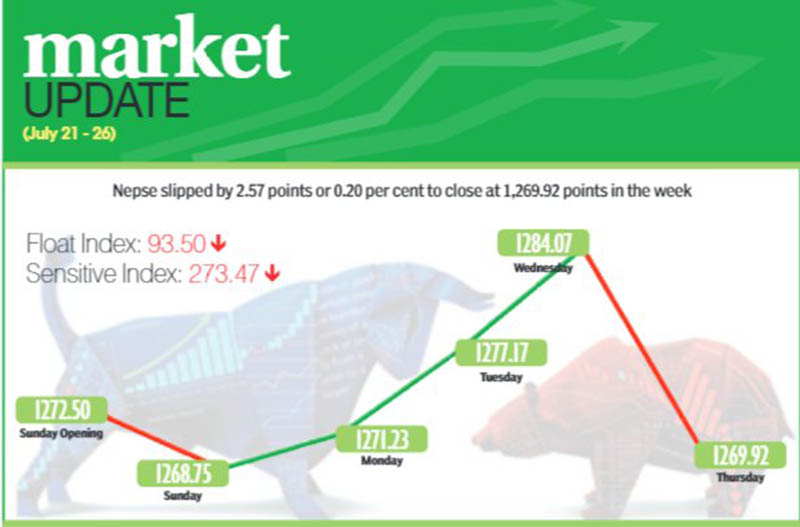

All this confusion hit the investor sentiment in the review week, causing Nepal Stock Exchange (Nepse) index to drop by 0.20 per cent or 2.57 points.

Similar to Nepse, the sensitive index descended by 0.13 per cent or 0.37 point to 273.47 points and float index also dipped by 0.11 per cent or 0.11 point to 93.50 points.

The weekly turnover, on the other hand, rose by 4.03 per cent as compared to the previous week to Rs 1.98 billion. In the previous week, the market had witnessed turnover of Rs 1.90 billion. The trading volume, however, dropped from 8.6 million shares traded last week to 7.19 million stocks changing hands this week.

The trading of mutual funds also took a hit, with weekly turnover of mutual shares dropping by a whopping 59.9 per cent to Rs 12.23 million.

The secondary market had opened with the benchmark index at 1,272.50 points on Sunday and it dropped by 3.74 points by the time of closing.

The market more than recovered the loss over the next three days, with the index up 2.48 points on Monday, 5.94 points on Tuesday and 6.90 points on Wednesday. However, the gain was wiped out on Thursday as the local bourse dropped by 14.15 points to close the week at 1,269.92 points.

In the review week microfinance, others, hotels and banking sub-indices landed in the green zone.

The microfinance subgroup was the leader among gainers, surging by 2.10 per cent or 30.68 points to 1,491.16 points, with share price of Chhimek Laghubitta Bikas Bank up Rs 16 to Rs 990.

The others sub-index inched up by 0.31 per cent or 2.25 points to 723.01 points and hotels subgroup ascended by 0.29 per cent or 6.21 points to 2,076.83 points. The banking subgroup saw marginal gain of 0.03 point to land at 1,148.42 points.

The mutual funds sub-index was the biggest loser of the week, dropping by 2.27 per cent or 0.23 point to 9.89 points.

Hydropower subgroup fell by 2.13 per cent or 26.01 points to land at 1,190.61 points and manufacturing sub-index declined by 1.66 per cent or 45.18 points to 2,672.32 points.

Life insurance subgroup was down 1.38 per cent or 83.88 points to 5,956.83 points and trading sub-index lost one per cent or 2.62 points to 257.23 points. Likewise, development banks slipped by 0.83 per cent or 13.66 points to 1,623.21 points.

The finance subgroup dipped by 0.43 per cent or 2.70 points to 624.73 points and non-life insurance shed 0.24 per cent or 12.73 points to close the week at 5,091.53 points.

In the review week, Nepal Bank recorded the highest weekly turnover of Rs 137.56 million. It was followed by Agricultural Development Bank (ADB) with Rs 127.64 million, Prabhu Bank with Rs 121.43 million, Nepal Life Insurance Co with Rs 92.82 million and Civil Bank with Rs 77.92 million.

In terms of weekly trading volume, Civil Bank took the lead with 482,000 of its shares changing hands. It was followed by Prabhu Bank with 435,000 shares, NMB Sulav Investment Fund-1 with 415,000 shares, Nepal Bank with 397,000 shares and ADB with 298,000 shares.

Meanwhile, Infinity Laghubitta Bittiya Sanstha had the highest number of transactions, that is, 1,298. It was followed by Civil Bank with 1,222, Upper Tamakoshi Hydropower with 1,176, Prabhu Bank with 1,038 and ADB with 1,036 transactions.