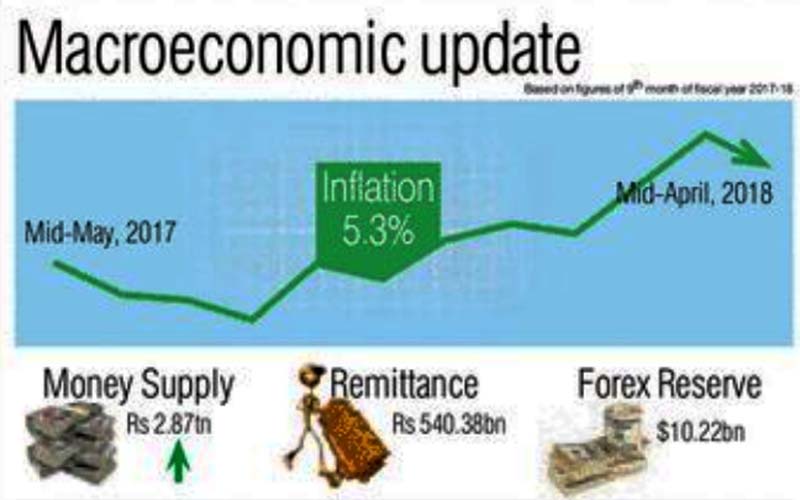

Consumer price inflation at 5.3pc

Kathmandu, May 17

Consumer price inflation has been gradually picking up in recent months along with the increase in money supply during the election and increased inflation in India.

The ‘Current Macroeconomic and Financial Situation of Nepal' for nine months from mid-July to mid-April unveiled by Nepal Rastra Bank (NRB) shows that the consumer price inflation in the ninth month jumped to 5.3 per cent against 3.8 per cent of the corresponding period of the previous fiscal.

Broad money supply increased by 10.9 per cent in the review period compared to a rise of 9.8 per cent in the corresponding period of the last fiscal, according to the macroeconomic report of the central bank.

“The rise in food inflation contributed to the increase in the overall inflation.”

Consumer price inflation could rise further in the coming months as the Nepali currency has been sliding vis-à-vis the US dollar since mid-April and the import of goods have become costlier, said Nara Bahadur Thapa, executive director of the Research Department of NRB. “We have to worry on the oil price rise in the international market because fuel price hike simultaneously affects various sectors.”

Inflation is also increasing in India along with depreciation of the Indian currency vis-à-vis the US dollar. Inflation wedge between Nepal and India was a marginal 0.7 per cent in the review period. Consumer price in India stood at 4.6 per cent compared to three per cent of the corresponding period of last year.

Similarly, current account deficit widened to Rs 171.64 billion due to skyrocketing imports compared to sluggish exports, whereas the balance of payments (BoP) deficit was recorded at Rs 14.60 billion in the review period. BoP surplus stood at Rs 50.60 billion and current account deficit at Rs 10.34 billion in the corresponding period of the previous fiscal.

Trade deficit ballooned to Rs 816.55 billion as the country imported goods worth Rs 876.29 billion in the first nine months of the fiscal against exports worth Rs 59.74 billion in the review period.

Remittance inflow also went up by 5.6 per cent in the review period compared to the previous fiscal to Rs 540.38 billion. In the review period, the flow of foreign direct investment (FDI) amounted to Rs 14.41 billion compared to Rs 11.07 billion in the corresponding period of the previous year, as per the central bank report.

The country's gross foreign exchange reserve depleted by 2.6 per cent in nine months to stand at $10.22 billion compared to $10.49 billion in the beginning of this fiscal year.