Contrary to previous years, Nepse index on bull run before Dashain

KATHMANDU, OCTOBER 10

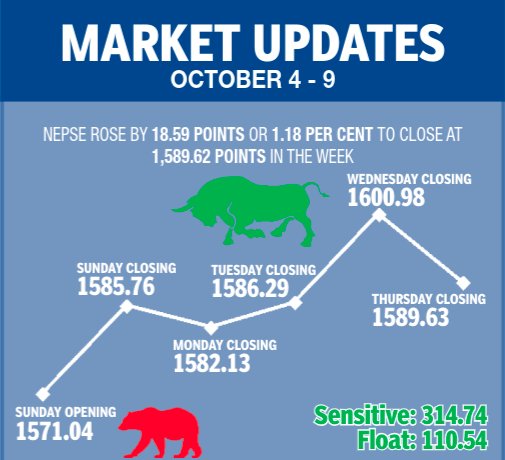

Profit-booking on the last trading day limited the week-on-week gain of Nepal Stock Exchange (Nepse) index in the trading period between October 4 and 8 to 1.8 per cent or 18.59 points, although the weekly turnover, trading volume and number of transactions all went up notably.

The share market usually drops during the festive season, but this year has been different due to the coronavirus pandemic.

“In the normal times people would offload their shares to cover the expenses for Dashain and Tihar, but with the COVID-19 cases on the rise, the festivals will likely be muted this year,” said an investor, explaining the current market movement. “Moreover, share investors have finally warmed up to online trading and lack of other investment avenues has bolstered the appeal of the share market.”

Opening at 1,571.04 points on Sunday, the benchmark index had gained 14.72 points by the end of the day, led by the surge of 4.78 per cent by the manufacturing subgroup. While hydropower and mutual funds subgroups had landed in the red that day, banking, trading, development banks and others subgroups had jumped more than one per cent.

Moreover, the total market capitalisation of the local bourse surged to a new high of Rs 2.12 trillion.

The share market witnessed a slight correction on Monday, with the Nepse index shedding 3.63 points. Manufacturing recorded the biggest drop of 1.67 per cent, while hydropower surged by over two per cent. However, even with seven of the subgroups landing in the red, the market regulator clamped the positive circuit breaker on two of the listed companies as their stock price surged by the maximum daily limit of 10 per cent.

Nepse more than recovered the loss of the previous day, as investors scooped up shares of hydropower companies. The subgroup surged by 5.12 per cent with a number of hydropower firms hitting the positive circuit breaker, but the gain of the local bourse was limited to 4.16 points, weighed down by sub-indices of banking, non-life insurance, microfinance, life insurance and mutual funds.

As investors continued to flock towards the shares of hydropower companies, Nepse index jumped by 14.69 points to 1,600.98 points. The last time the local bourse had closed above the psychological threshold of 1,600 points was back on February 27.

The hydropower subgroup had led the gainers with a surge of 5.54 per cent, whereas manufacturing and microfinance subgroups had witnessed slight losses.

The total market capitalisation of Nepse also reached a new peak of Rs 2.13 trillion.

The optimism of the earlier day, however, could not sustain as the local bourse dropped by 11.35 points to close at 1,589.63 points for the week. Investors, nevertheless, continued to make a beeline for hydropower stocks, because of which the top three stocks by turnover on the last trading day were that of hydropower companies.

The sensitive index, which measures the performance of class ‘A’ stocks, rose by 1.48 per cent or 4.58 points to 314.74 points. The float index that gauges the performance of shares actually traded also went up by 1.18 per cent or 1.29 points to 110.54 points.

A total of 54.42 million shares were traded through 220,152 transactions in the review week that amounted to Rs 14.65 billion.

The weekly turnover was 28.28 per cent higher compared to the previous week when 189,951 transactions of 52.22 million shares that amounted to Rs 11.42 billion had been undertaken.

Most of the subgroups landed in the green during the review week, with hydropower leading the pack of gainers with a surge of an eye-popping 8.54 per cent or 110.31 points to 1,402.69 points.

Adding to the previous week’s rise of 3.85 per cent, the finance subgroup advanced by 7.52 per cent or 59 points to 843.31 points.

Also continuing its uphill climb after soaring by 6.25 per cent in the past week, development banks ascended by 5.76 per cent or 112.05 points to 2,058.95 points.

Manufacturing went up by 2.68 per cent or 81.55 points to 3,121.53 points, trailed closely by hotels sub-index that rose by 2.14 per cent or 37.49 points to 1,786.66 points.

Others more than recovered the previous week’s dip of 0.63 per cent by gaining 1.35 per cent or 13.61 points to 1,025.22 points.

Trading managed to recover some of the earlier week’s 2.95 per cent loss by going up 1.07 per cent or 11.27 points to 1,068.6 points.

Banking, the subgroup with the highest weightage on the market capitalisation, inched up 0.64 per cent or 8.03 points to 1,266.51 points.

Meanwhile, mutual funds landed at the bottom of the pile, down 1.94 per cent or 0.21 point to 10.6 points. The subgroup had gone up by 1.12 per cent in the previous week.

Non-life insurance also saw its past week’s gain of 1.43 per cent wiped out, as the sub-index fell by 1.82 per cent or 146.37 points to 7,897.68 points.

Life insurance fell by 0.71 per cent or 68.61 points to 9,570.53 points and microfinance slipped by 0.60 per cent or 15.42 points to 2,541.44 points.

Arun Kabeli Power Ltd had the highest weekly turnover with Rs 586.43 million, followed by Shivam Cements with Rs 576.62 million and Nepal Reinsurance Co Ltd with Rs 552.06 million.

Himal Dolakha Hydropower Co Ltd recorded the highest trading volume with 3.24 million of its shares changing hands. National Hydropower Co Ltd was on its heels with 3.13 million shares, followed by Arun Kabeli Power Ltd with 2.32 million shares.

Meanwhile, Reliance Life Insurance Ltd was the forerunner in terms of number of transactions with 11,547 transactions.

Nepal Reinsurance Co Ltd with 7,526 transactions and Himal Dolakha Hydropower Co Ltd with 6,118 transactions rounded up the top three in this category.

A version of this article appears in print on October 11, 2020, of The Himalayan Times.