Fiscal federalism, discipline must for higher growth

Kathmandu, April 3

Effective implementation of fiscal federalism and maintaining fiscal discipline are crucial for Nepal to achieve higher economic growth, as per the Asian Development Bank (ADB).

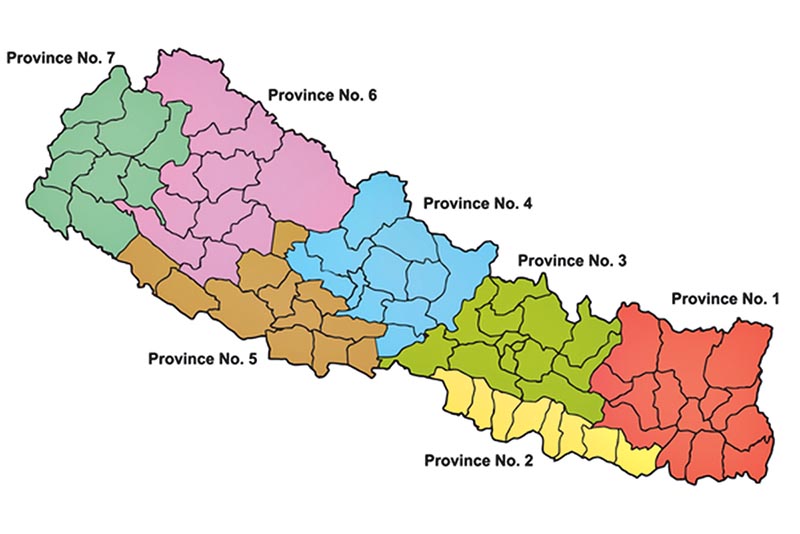

Amid the release of the latest ADB Nepal Macroeconomic Update, Mukhtor Khamudkhanov, ADB’s country director for Nepal, said, “The outlook is for a stable growth on the back of strong domestic demand, fuelled by a larger budget allocation to sub-national governments and accelerated post-earthquake reconstruction.

However, challenges to smooth implementation of fiscal federalism and maintaining fiscal discipline at large could pose potential risks to the outlook.”

As per Khamudkhanov, Nepal has the potential to achieve and sustain higher growth rate over a long period of time if these challenges are addressed.

Meanwhile, the ADB has projected the country’s economy to grow at 6.2 per cent in the ongoing fiscal year while it has anticipated that the economy will grow at 6.3 per cent in the next fiscal year.

The ADB update has projected the agriculture sector to grow from 2.8 per cent in fiscal year 2018-19 to 4.5 per cent in 2019-20, owing to a good monsoon that is expected to boost paddy production to 5.5 million tonnes, a rise of 8.4 per cent from the previous year. Similarly, the industry sector is expected to expand by 7.1 per cent in 2018-2019 buoyed by improved electricity supply and efforts to improve the investment climate while the services sector will likely grow by 6.4 per cent in 2018-19 with the expansion of wholesale and retail trade, hotels and restaurants, and financial intermediation, as per ADB.

Meanwhile, ADB’s Nepal Macroeconomic Update has projected inflation to rise to 4.4 per cent in 2018-19 from 4.2 per cent in 2017-18, partly reflecting somewhat higher inflation expected in India, stable oil prices, and higher government expenditures under the new federal structure.

As per ADB, revenue collection has primarily increased on higher import growth and an improvement of the tax system while the budget as of mid-January 2019 is in surplus by Rs 173.3 billion owing to strong revenue growth and a marginal slowdown in recurrent expenses.

Though capital expenditure has surged in the fiscal year through mid-February, its execution stands at only 22.5 per cent. This could again lead to a spending spree in the last month of the fiscal year, undermining the quality of capital projects, says the update.

Meanwhile, ADB has stated that with rising trade and current account deficit, Nepal increasingly faces the risk of external sector instability. Data to mid-February 2019 show that trade deficit has surpassed net invisible earnings, widening the current account deficit to $1.5 billion, marginally up from a deficit of $1.4 billion in the year earlier period.

ADB has projected the current account deficit to widen further to 9.3 per cent of gross domestic product in 2018-19, up from 8.2 per cent a year earlier on increased imports of capital and consumer goods and services, notwithstanding a healthy growth of remittances and stable oil prices.

“Given the growing importance of the services sector in Nepal’s economy, coherent actions are needed to bridge trade deficit via export diversification in the services sector,” said Manbar S Khadka, ADB’s economist for Nepal, adding that a host of issues pertaining to infrastructural, institutional, and procedural barriers need to be addressed to promote the services sector.