GDP report is likely to show recession eased in 2Q

WASHINGTON: The recession likely eased in the spring, with the economy no longer in free-fall.

Many analysts predict that when the Commerce Department releases its first estimate of second-quarter activity Friday, it will say the economy shrank at a 1.5 percent pace from April though June. If they are correct, it would mark a vast improvement from the 5.9 percent annualized drop recorded over the prior six months the weakest showing in 50 years.

"The recession kind of came in like a lion and is going out like a lamb," said economist Ken Mayland of ClearView Economics.

Less drastic spending cuts by businesses, a resumption of spending by the federal government and an improved trade picture factor into expectations for a better performance. Consumers, though, probably pulled back a bit. Rising unemployment, shrunken nest eggs and lower home values have weighed down their spending.

President Barack Obama said Thursday that while he thinks economic activity contracted in the spring, Friday's report also should show that the United States has "stepped away from the precipice."

Business inventories could be the key swing number in Friday's report. If companies slash the stockpiles on their shelves more deeply than expected, the report could show the economy suffering from an unexpectedly big contraction.

There's a silver lining to the scenario of rock-bottom inventories, though: It likely would mean that the economy would fare better in the third quarter because businesses would have to ramp up production to satisfy customer demand.

"There will probably be another huge decline in inventories, but it will be setting up the economy for some growth in the second half of this year," said Stuart Hoffman, chief economist at PNC Financial Services Group.

Federal Reserve Chairman Ben Bernanke has said he thinks the recession will end later this year. And many analysts think the economy will start to grow again perhaps at around a 1.5 percent pace in the July-to-September quarter. That would be anemic growth by historical measures, but it would signal that the downturn has ended.

Obama's stimulus package of tax cuts and increased government spending provided some support to second-quarter economic activity. But it will have more impact through the second half of this year and will carry a bigger punch in 2010, economists said.

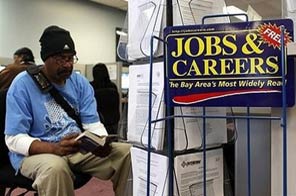

Even if the recession ends later this year, the job market will remain weak. Companies are expected to keep cutting payroll through the rest of this year, but analysts say monthly job losses likely will continue to narrow.

Still, unemployment now at a 26-year high of 9.5 percent will keep rising. The Fed says it will top 10 percent at the end of this year. Businesses will be unlikely to boost hiring until they're certain the recovery has staying power.

Friday's report on gross domestic product provides a tally of all the goods and services produced within the United States. It is considered the best barometer of the economy's health.

The convergence of a collapse in the housing market, a near shutdown of credit and a financial crisis created what Bernanke and others have called a perfect storm for the economy. Those negative forces — the scale of which hasn't been seen since the 1930s — plunged the country into a recession in December 2007. It is the longest since World War II.

Bernanke and his Fed colleagues warned earlier this month that it could take five or six years for the economy and the labor market to return to long-term health. Recoveries after financial crises tend to be especially slow.

The economy's still-fragile state makes it vulnerable to any further shocks, Fed officials say. Given that, Fed policymakers are expected to keep a key bank lending rate which influences rates on many consumer loans at a record low near zero at its meeting in August and probably through the rest of this year, analysts say.