Gold price down, silver steady

Kathmandu, October 31

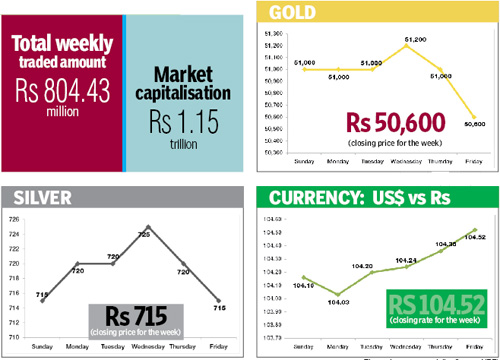

The price of gold slumped by Rs 400 per tola to Rs 50,600, while that of silver remained constant at Rs 715 a tola during the week, from October 25 to 30.

The price of the precious metals had rallied in the international market earlier this month on speculation that the softness in the global economy could prompt the US central bank to delay its rate hike to next year.

However, on Wednesday, the Federal Reserve surprised with a direct reference to its next policy meeting as a possibility for the first US rate hike in nearly a decade. The Fed said raising rates at its next meeting would depend on progress made on employment and inflation, and omitted any reference to global developments affecting US economic activity.

According to Reuters, gold held near its lowest in three weeks on Friday and looked set to post its worst week in two months on expectations that the Fed would raise US rates this year. The precious metals are priced in the domestic market based on the rates in the international market.

Gold was priced at Rs 51,000 per tola in the domestic market on Sunday and its price remained constant until Wednesday. On Thursday, the price of the precious yellow metal edged up Rs 200 to Rs 51,200 a tola. However, the hawkish tone of the US central bank on Wednesday triggered a sell-off in the metal and bullion price dipped by Rs 200 to Rs 51,000 a tola on Thursday and dropped another Rs 400 to be traded at Rs 50,600 per tola on Friday.

Meanwhile, silver was traded at Rs 715 per tola on Sunday. Its price went up by five rupees to Rs 720 a tola on Monday and remained unchanged the next day. On Wednesday, the white metal nudged up by another five rupees to Rs 725 per tola. But on Wednesday, silver reversed the previous day’s gain by dipping five rupees to be traded at Rs 720 a tola again. On Friday, the last trading day of the week, silver price dropped by another five rupees to close the trading week at Rs 715 — the same price as in the beginning of the trading week.