Gold slumps to three-month low

Kathmandu, November 18

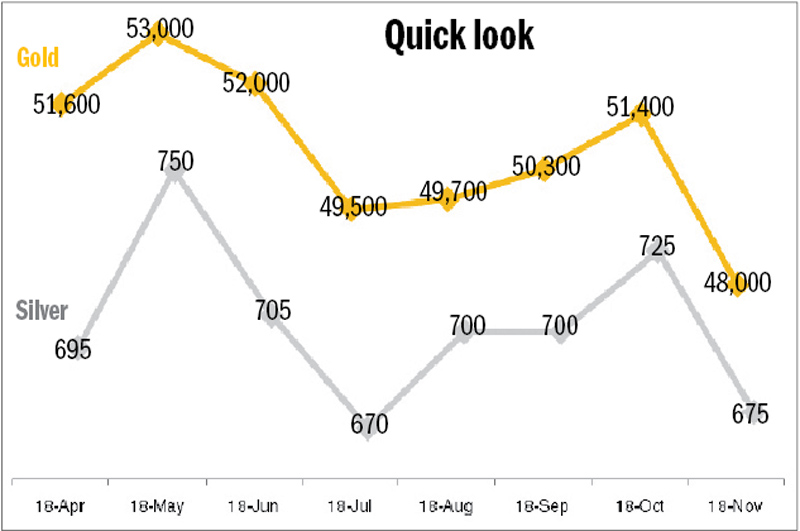

The strengthening of the US dollar and expectations of the US central bank raising the interest rate next month after nearly a decade weighed on the price of precious metals today. Consequently, gold slumped by Rs 500 to Rs 48,000 per tola and silver by five rupees to Rs 675 a tola compared to Tuesday’s price list.

The prices of the precious metals in the domestic market are governed by the rates set in the international market. In the international market, gold prices hit their lowest in nearly six years today, while silver dropped to a two-and-a-half month low. The last time gold was traded at a similar rate in the domestic market was on August 11 and silver on September 16. Back then also the price of precious metals had taken a beating as investors continued to trim holdings in response to US economic data, which showed the economic recovery gathering steam.

Any sign that growth is improving is likely to make it easier for the Fed officials to raise interest rates, a policy shift they have indicated is likely to come before the end of the year. Gold does not pay interest or dividends and is expected to struggle once rates climb.

“Bullion prices have fallen for 15 out of 16 sessions under pressure from expectations that the US Federal Reserve is set to raise interest rates next month,” according to Reuters. The release of US inflation data on Tuesday that showed consumer prices increased in October have further fuelled those expectations.

Minutes of the last Federal Reserve meeting due later today may offer more clues on the near-term trend, but any repeat of the more hawkish tone detected in the Fed’s October decision to leave rates unchanged will likely put further pressure on the price of gold, as per analysts.

Traders, meanwhile, see little chance of anything in the minutes providing support for a significant upward movement. In fact, a poll of investment bankers by the Wall Street Journal suggested the eventual increase in interest rates — whether it comes in December or next year — would hold gold at a lower price throughout next year.

Global gold consumption has also sunk as key buyers in Asia have lost their appetite for the metal.

China and India, which together make up more than 50 per cent of global demand, have seen demand fall by 25 per cent and three per cent, respectively. Whereas the stock market bubble lured away traditional gold investors in China, poor weather in India meant the rural buyers had lower incomes and could not afford to invest in the metal.

However, heightened security concerns in Europe after Friday night’s attacks in Paris in which 129 people were killed continue to underpin gold’s safe-haven appeal, Reuters reported.

The US rate rise is likely to hurt non-yielding commodities such as gold and boost the dollar against which the metal is typically negatively correlated.

The exchange rate for the greenback vis-à-vis Nepali rupee was set at Rs 105.97 today against Rs 105.84 on Tuesday. Nepal Rastra Bank — the central bank — has set the exchange rate at Rs 106.26 for tomorrow.

In the international market, the dollar sat near a seven-month high against a basket of currencies as the euro slid on expectations for more monetary easing by the European Central Bank in December.