Insurance stocks fuel Nepse rally

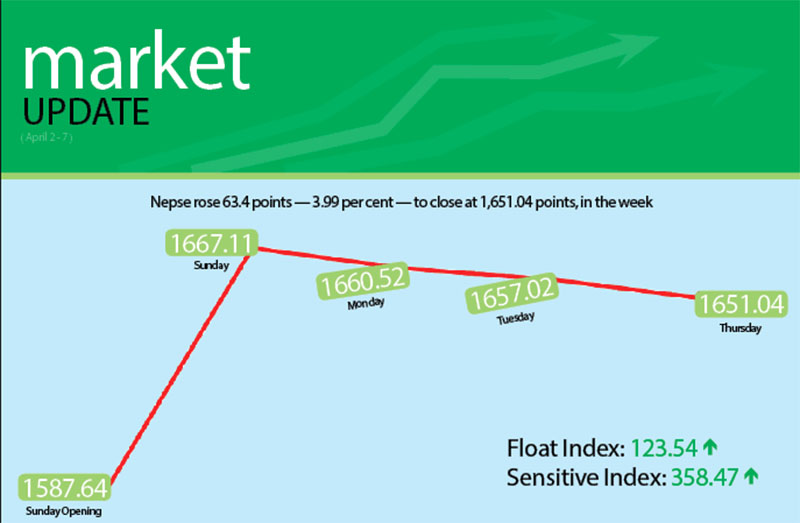

The domestic share market recorded a fifth consecutive weekly gain, with the Nepal Stock Exchange (Nepse) index up 63.4 points or 3.99 per cent week-on-week to rest at 1,651.04 points between April 2 and 6.

The rise can mostly be attributed to the increased attraction towards the stocks of insurance companies following the direction of the Insurance Board — the insurance sector regulator — to increase their paid-up capital by four folds within the next 15 months.

According to the new rule introduced late last week, life insurance companies will have to increase their paid-up capital to Rs two billion while non-life insurance companies will have to raise their paid-up capital to Rs one billion by mid-July, 2018. At present the minimum paid-up capital requirement for life insurance firms stands at Rs 500 million, while that for non-life insurance companies is Rs 250 million.

Consequently, on Sunday, the first trading day of the week, the benchmark index surged by a whopping 79.47 points to close at 1,667.11 points. Trading was suspended within two hours of opening that day. The local bourse reversed course for the remainder of the week, down 6.59 points on Monday, shedding 3.5 points on Tuesday and dipping 5.98 points on Thursday. The country’s sole secondary market remained closed on Wednesday, as the country observed Ram Navami.

The sensitive index, which gauges the performance of class ‘A’ stocks, rose by 12.65 points or 3.66 per cent to 358.47 points. Likewise, the float index that measures the performance of shares actually traded also went up by 5.24 points or 4.43 per cent to 123.54 points.

In total, 11.06 million shares of 155 companies that amounted to Rs 6.54 billion were traded through 37,654 transactions during the week. The traded amount was 9.08 per cent less than the preceding week when 45,072 transactions of 14.04 million shares of 159 firms worth Rs 7.20 billion had been undertaken.

While hydropower and others subgroups saw marginal drops, all the remaining subgroups recorded gains in the review period.

Insurance led the pack of gainers, posting an impressive surge of 828.17 points or 10.55 per cent to 8,679.16 points. Share value of insurance companies like National Life soared by 7.74 per cent to Rs 2,505, and that of Sagarmatha by 12.76 per cent to Rs 1,635, among others.

Adding to the previous week’s gain of 5.45 per cent, hotels subgroup went up by 74.97 points or 3.63 per cent to 2,139.34 points. Soaltee rose by 3.55 per cent to Rs 350, Oriental by 4.70 per cent to Rs 601 and Taragaon Regency by 4.47 per cent to Rs 257.

Banking advanced by 53.43 points or 3.58 per cent to 1,547.25 points. This was on the back of stock price of commercial banks like Standard Charted up 3.37 per cent to Rs 2,300, Nabil up 1.29 per cent to Rs 1,570 and Nepal Investment closing at Rs 794, up 1.79 per cent.

Development banks ascended by 55.11 points or 3.10 per cent to 1,831.58 points. Swabhalamban climbed 4.05 per cent to Rs 1,670 and Chhimek rose by 5.90 per cent to Rs 1,472.

Unilever Nepal ascended by 1.28 per cent to Rs 30,587, which helped manufacturing subgroup recover the dip of 0.58 per cent of the past week by rising 31.09 points or 1.43 per cent to 2,199.88 points.

Similarly, finance edged up by 8.84 points or 1.22 per cent to 733.62 points and trading inched up 1.41 points or 0.68 per cent to 209.25 points.

Conversely, hydropower lost 14.31 points or 0.71 per cent to 1,995.99 points and others fell 3.76 points or 0.55 per cent to 680.53 points.

Meanwhile, Nepal Bank secured the top position in terms of turnover with Rs 397.39 million, followed by Nepal Credit and Commerce Bank with Rs 384.62 million, National Life Insurance with Rs 294.21 million, Lumbini General Insurance with Rs 227.83 million and Shikhar Insurance with Rs 206.90 million.

With regard to trading volume, Sidhhartha Equity Oriented Scheme topped the chart with 934,000 of its scrips changing hands. Nepal Credit and Commerce Bank recorded the most number of transactions — 1,947.