Inter-bank lending rate shoots up to 5.08pc

Kathmandu, April 20

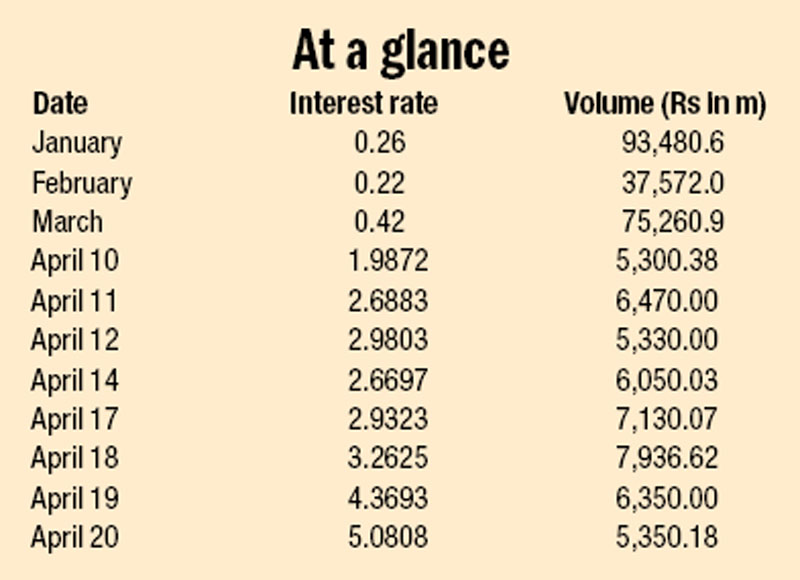

Commercial banks that were complaining about excess liquidity and low interest rates until a few weeks ago have suddenly seen a sharp rebound in inter-bank lending rates, signalling scarcity of funds in the banking sector.

Weighted average inter-bank lending rate today stood at 5.081 per cent, with the interest jumping to as high as 5.5 per cent during intra-day trading. This implies commercial banks paid an interest of up to 5.5 per cent to borrow money from other Class ‘A’ financial institutions.

Banks generally borrow money from other institutions to meet urgent needs of clients looking for loans or seeking to withdraw deposits. But sudden hike in demand for money was not expected until end of March, when banks were sitting atop piles of cash.

Due to abundance of cash, weighted average interbank lending rate hovered around 0.42 per cent in March.

“Lately, cash in many commercial banks’ vaults has started to deplete, as the central bank is mopping up liquidity by issuing debt and money market instruments,” Sanima Bank CEO Bhuvan Kumar Dahal said.

Since March 14 alone, the central bank, on behalf of the government, has issued treasury bills worth Rs 34.33 billion. A huge chunk of these instruments, with a maturity period ranging from 91 to 364 days, had been rolled over from the previous issues.

In the same period, Nepal Rastra Bank (NRB) also issued Rs 38 billion worth of development bonds with maturity period of eight, 11 and 12 years, Rs three billion worth of five-year Citizen Savings Bonds and another Rs three billion worth of reverse repo.

“Also, the government has just collected second instalment of income tax, which channelled around Rs 30 billion from vaults of banks to government coffers,” Dahal said. “This also reduced the stockpile of cash at banks.”

The government collects first income tax instalment of 40 per cent of the committed amount in mid-January. The second income tax instalment of 30 per cent of the committed amount is raised in mid-April and the final instalment is collected in mid-July.

The banking sector generally faces cash crunch when the government starts collecting instalments of income tax.

Last year, on February 12, for example, inter-bank lending rate had shot up to as high as five per cent due to the same reason. But the rate had started to moderate within a few days after government spending went up.

“So, we are taking the latest rate hike as a temporary phenomenon,” Dahal said.

But the catch is: public spending has to go up for rates to moderate, as it will transfer money parked in government coffers back into the vaults of banks. Government’s treasury surplus currently stands at around Rs 150 billion.

However, even if government spending does not go up, cash stockpile is expected to go up in the banking sector in the coming days, as Rs 101.20 billion is being injected back into the banking system in between April 25 and May 23 upon expiry of term deposit instruments, which were previously used by the NRB to mop up excess liquidity.

This is an indication that chances of the banking sector facing another bout of credit crisis are very slim.