Investor optimism lifts local bourse

The country’s sole secondary market seemed buoyant in the trading week of September 2 to 6 on prospects of banks and financial institutions (BFIs) lowering the interest rates on margin loans.

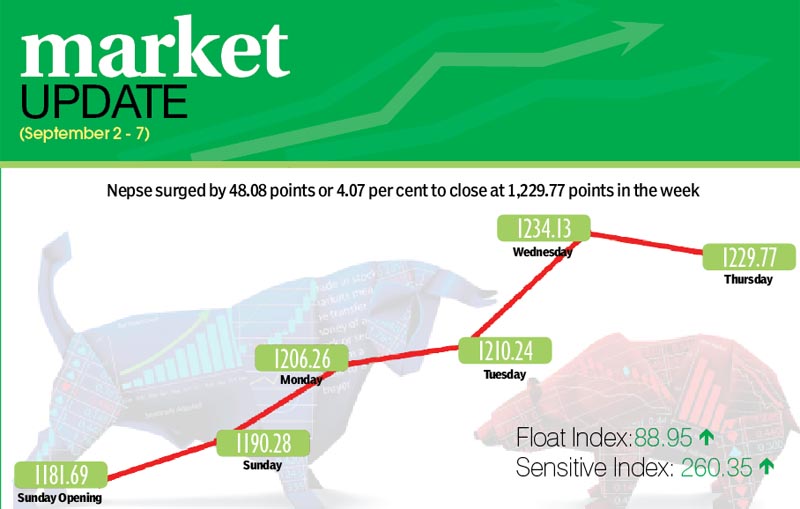

After moving either way in single digits for the past several weeks, the Nepal Stock Exchange (Nepse) index surged by 4.06 per cent or 48.08 points in the review period, with the turnover, trading volume and number of transactions witnessing significant rise.

The country’s only share market recorded an average daily turnover of Rs 576 million during the week, which was almost the total transaction amount of the previous week of Rs 803 million. While it has to be noted that the share market had

remained open for only four days in the previous week against normal five days in the review period, the traded amount in the review week was a staggering 259.34 per cent higher. Compared to previous week’s 2.54 million shares changing hands through 11,788 transactions, 10.25 million shares of 193 companies were traded through 32,285 transactions during this week.

“The market movement was in tandem with investor optimism on prospects of BFIs lowering the interest rate on margin loans,” explained Ambika Prasad Poudel, chairman of Nepal Investors Forum.

While BFIs are currently providing margin loan to institutional investors at around 12 per cent and at 14 per cent for individual investors, Poudel said that BFIs have verbally assured investors the rates would be lowered by up to two percentage points in the near future as the market is becoming flush with liquidity.

Opening at 1,181.69 points on Sunday, the benchmark index had gone up by 8.59 points by the end of the day. On Monday, the market rose by 15.98 points to breach the 1,200-point threshold after 10 trading days and rose by 3.98 points to 1,210.24 points on Tuesday.

On Wednesday, the local bourse surged by 23.89 points, but then dipped by 4.36 points on Thursday to close the week at 1,229.77 points.

Similarly, the sensitive index jumped by 4.22 per cent or 10.56 points to 260.35 points and the float index also went up by 4.56 per cent or 3.88 points to 88.95 points.

All 11 subgroups landed in the green zone in the review period.

The banking subgroup led the pack of gainers, soaring by 4.94 per cent or 50.52 points to 1,072.31 points, on the back of share price of commercial banks like Nabil going up by Rs 18 to Rs 965.

The non-life insurance sub-index ascended by 3.59 per cent or 206.99 points to 5,971.14 points as Everest Insurance’s share value jumped by Rs 74 to Rs 1,304.

Similarly, the manufacturing sub-index advanced by 3.49 per cent or 75.34 points to 2,232.94 points, with Bottlers Nepal (Tarai) gaining Rs 281 to Rs 6,470.

Development banks sub-index went up 3.37 per cent or 48.30 points to 1,477.34 points. Likewise, the hotels subgroup rose by 3.30 per cent or 60.11 points to 1,877.18 points due to share price of Soaltee gaining Rs 10 to Rs 250.

Meanwhile, the hydropower subgroup surged by 2.86 per cent or 39.14 points to 1,405.48 points, on the back of Chilime’s share price increasing by Rs 25 to Rs 736.

Microfinance subgroup climbed 2.72 per cent or 40.22 points to 1,514.15 points, as Chhimek rose by Rs 23 to Rs 913. Similarly, the others sub-index also ascended by 2.71 per cent or 19.45 points to 735.31 points because of Nepal Telecom’s share value up Rs 16 to Rs 760.

The life insurance subgroup went up by 2.30 per cent or 127.23 points to 5,648.38 points. Finance subgroup rose 1.96 per cent or 11.93 points to 619.75 points.

Meanwhile, the trading sub-index also inched up by 0.46 per cent or 0.97 point to 208.3 points.

In the review period, NMB Bank took the lead in terms of trading volume, number of transactions and weekly turnover — with 664,000 of its shares changing hands through 1,546 transactions worth Rs 220.05 million.

NIC Asia Bank with Rs 208.63 million, Nepal Life Insurance Company Ltd with Rs 150.81 million, Kumari Bank with Rs 123.74 million and Nepal Investment Bank (Promoter) with Rs 122.31 million rounded up the top five firms in terms of weekly turnover.

NEW LISTINGS

Company

Type

Unit

Asian Life Insurance Company

Bonus

483,355.94

Green Development Bank

Rights

4,000,000

Prabhu Bank

Rights

2,326,287