Lack of investors’ confidence affects NepseLack of investors’ confidence affects Nepse

Kathmandu, August 24

Investors’ confidence has taken a hit with the government’s inability to settle the long-disputed issue of capital gains tax (CGT) in share transactions, causing the country’s sole secondary market to record the fifth consecutive week-on-week loss between August 18 and 22.

“Investors are panicking as the government has failed to walk the talk on earlier agreement on CGT,” explained Uttam Aryal, chairperson of Investors Association of Nepal.

Aryal further blamed the government and concerned officials for the bearish market due to dilly-dallying in resolving the tax issues.

“Even as the credit crunch problem has been resolved and banks have not raised interest on margin loans, investors lack the confidence to invest in the secondary market.”

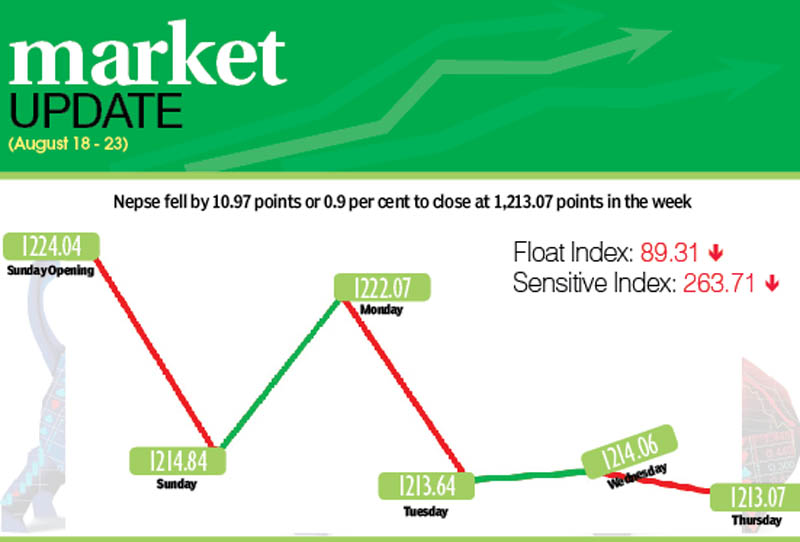

Nepal Stock Exchange (Nepse) index fell by 0.9 per cent or 10.97 points to land at 1,213.07 points in the review week. Sensitive index also went down by 0.37 per cent or 0.99 point to 263.71 points and float index dropped by 0.72 per cent or 0.65 point to 89.31 points.

Both the trading volume and weekly turnover decreased in the review week. Over the week, a total of 6.10 million shares were traded that amounted to Rs 1.54 billion. The transaction amount was 13.53 per cent lower compared to the preceding week when transactions of 7.53 million shares worth Rs 1.78 billion had been undertaken.

Trading of mutual funds’ shares also plummeted by 44.02 per cent to Rs 5.85 million compared to previous week’s Rs 10.45 million.

The secondary market had opened on Sunday with benchmark index at 1,224.04 points. It had dropped by 9.20 points by the end of the trading day. The local bourse bobbed for the rest of the week — recovering 7.23 points on Monday, losing 8.43 points on Tuesday, inching up by 0.42 point on Wednesday and then sliding by 0.99 point on Thursday to close the week at 1,213.07 points.

In the review week, only trading subgroup recorded a gain. The sub-index soared by 3.28 per cent or 8.87 points to land at 279.13 points, with the share price of Bishal Bazar Company ascending by Rs 105 to Rs 1,494.

Finance subgroup was the biggest loser of the week, plunging by 6.61 per cent or 41.22 points to 582.07 points. It was due to share price of Progressive Finance falling by six rupees to Rs 98, among others.Hydropower subgroup plummeted by 3.32 per cent or 36.08 points to 1,048.03 points. Share value of Chilime dropped by Rs 25 to Rs 447 and Upper Tamakoshi by six rupees to Rs 255.

Similarly, non-life insurance fell by 2.75 per cent or 134.87 points to 4,759.17 points owing to share price of Everest Insurance down Rs 16 to Rs 320. Life insurance sub-index also dipped by 1.71 per cent or 99.73 points to 5,702.96 points.

Mutual funds went down by 0.60 per cent or 0.06 point to 9.9 points. The banking sub-index shed 0.40 per cent or 4.51 points to 1,097.95 points and others subgroup dipped by 0.36 per cent or 2.56 points to 696.31 points.

Similarly, development banks subgroup slipped by 0.23 per cent or 3.76 points to 1,588.98 points and microfinance sub-index inched down by 0.01 per cent or 0.26 point to 1,516.9 points.

In the review week, Soaltee Hotel was the leader in terms of weekly turnover with Rs 104.95 million. It was followed by NIC Asia Bank with Rs 91.43 million, Rasuwagadhi Hydropower with Rs 70.90 million, Agricultural Development Bank with Rs 60.91 million and Nepal Investment Bank with Rs 54.45 million.

In terms of weekly trading volume too Soaltee Hotel was the forerunner with 454,000 of its shares changing hands. It was followed by Rasuwagadhi Hydropower with 348,000 shares, NIC Asia Bank with 201,000 shares, Machhapuchchhre Bank with 193,000 shares and Prabhu Bank with 186,000 shares.

Meanwhile, Rasuwagadhi Hydropower topped the list in terms of number of transactions with 6,255 transactions. It was followed by Sanjen Jalavidhyut with 5,685, Upper Tamakoshi Hydropower with 990, Nepal Investment Bank with 986 and NIC Asia Bank with 832 transactions.

New listing

Company

Type

Units

Gurans Life Insurance

Rights

2,970,000

Sabaiko Laghubitta Bittiya Sanstha

Ordinary

1,650,000

Source: Nepse