Lockdowns, prohibitory orders a boon for Nepse

KATHMANDU, AUGUST 29

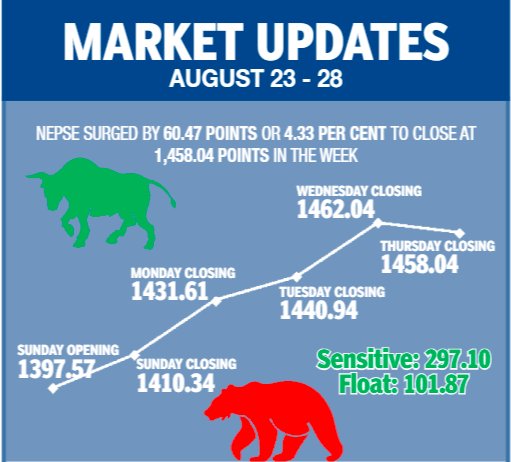

In lack of other investment avenues due to lockdowns and prohibitory orders in place in various places across the country, investors poured their funds into the secondary market in the trading week between August 23 and 27, causing the Nepal Stock Exchange (Nepse) index to record a weekly gain of 4.33 per cent or 60.47 points.

In the earlier review period of August 16 to 20, the benchmark index had slipped 0.8 per cent or 11.22 points.

“With banks not offering attractive returns, many investors have shifted their focus to the share market,” informed a market analyst.

Against the weekly turnover of Rs 4.94 billion in the previous week, the total traded amount in the review week surged by a staggering 97.16 per cent to stand at Rs 9.74 billion. The number of transactions also rose to 131,251 from 80,334 in the previous week and trading volume increased to 22.21 million shares changing hands against trade of 15.77 million shares in the preceding week.

Opening at 1,397.57 points on Sunday, the benchmark index had gone up by 12.77 points to close above the psychological threshold of 1,400 points by the time of closing.

Nepse index was northbound for the next three days — surging by 21.27 points on Monday, up 9.33 points on Tuesday and jumping 21.10 points on Wednesday. On Thursday, however, the local bourse shed four points on profit-booking to close the week at 1,458.04 points.

The sensitive index, which measures the performance of class ‘A’ stocks, rose by 3.03 per cent or 8.74 points to 297.10 points, and float index that gauges the performance of shares actually traded went up by 4.16 per cent or 4.07 points to 101.87 points.

Trading was the lone subgroup to land in the red in the trading week. After leading the gainers in the previous week with a surge of 4.39 per cent or 36.47 points, trading sub-index slipped by 0.84 per cent or 7.32 points to close at 859.54 points this time around.

At the other end of the spectrum, manufacturing led the gainers by advancing 7.21 per cent or 194.40 points to 2,890.91 points.

Adding to the previous week’s rise of 1.24 per cent or 82.76 points, the non-life insurance subgroup went up by 6.91 per cent or 465.53 points to 7,200.83 points.

Similarly, others subgroup rose by 6.26 per cent or 51.89 points to 880.26 points, primarily on the back of Nepal Reinsurance Co Ltd’s share price skyrocketing by a whopping 21.61 per cent to Rs 709.

Life insurance went up by 5.65 per cent or 481.52 points to 9,001.74 points. In the past week, the subgroup had edged up by merely 0.04 per cent or 3.65 points.

Microfinance more than recovered previous week’s loss of 0.93 per cent or 22.06 points as the sub-index rose by 4.97 per cent or 117.06 points to 2,472.62 points.

Banking — the share market heavyweight — gained 3.53 per cent or 41.67 points to 1,220.47 points. This was on the back of share value of commercial banks like Standard Chartered Nepal up 3.44 per cent to Rs 661 and of Nabil by 3.43 per cent to Rs 845.

While hydropower rose by 1.99 per cent or 18.96 points to 969.98 points, development banks salvaged some of the loss of 2.15 per cent or 37.91 points in the previous review to land at 1,758.66 points, after gaining 1.80 per cent or 31.02 points.

Finance was up 1.36 per cent or 8.93 points to 664.47 points. Hotels and mutual funds witnessed only muted gains. Hotels edged up 0.97 per cent or 14.55 points to 1,511.75 points and mutual funds ticked up 0.76 per cent or 0.08 point to 10.66 points.

A version of this article appears in e-paper on August 30, 2020, of The Himalayan Times.