Mostly a remarkable week for Nepse

Kathmandu, January 23

The trading week from January 17 to 21 was quite remarkable for the country’s only secondary market, with dematerialised stock trading coming into full implementation and Nepal Stock Exchange (Nepse) index breaching the previous records twice.

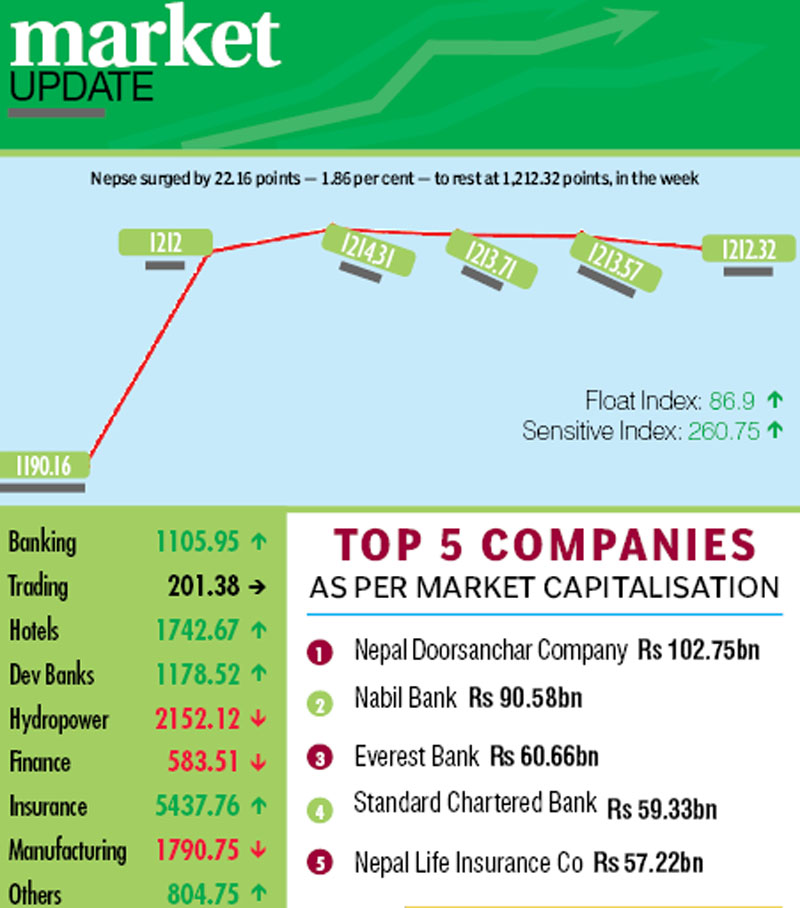

Opening at 1,190.16 points on Sunday, when demat share trading was fully implemented, the benchmark index had surged 21.84 points to set a new record of 1,212 points by the day’s closing. The bull run continued on Monday as well, as Nepse added another 2.31 points to land at a fresh high of 1,214.31 points.

However, the local bourse fell slightly on Tuesday, Wednesday and Thursday — 0.6 point, 0.14 point and 1.25 points, respectively. The gain in the first two trading days helped Nepse to clock a weekly gain of 22.16 points or 1.86 per cent to close the week at 1,212.32 points.

Stock market analysts attributed the bull run to a number of factors — implementation of electronic trading system, large number of shares yet to be dematerialised, positive political cues and lack of other profitable investment avenues in the country at present.

Altogether 3.76 million shares of 106 companies worth Rs 2.50 billion were traded through 11,919 transactions during the week. The traded amount was 2.23 per cent higher than the preceding week when 27,374 transactions of 5.11 million scrips of 161 firms worth Rs 2.45 billion had been undertaken.

The sensitive index, which gauges the performance of class ‘A’ stocks, rose 1.92 per cent to 260.75 points. Likewise, the float index that measures the performance of shares actually traded also went up 2.19 per cent to 86.9 points during the review period.

Among the subgroups, trading remained constant at 201.38 points, while manufacturing, hydropower and finance landed in the red.

Development banks led the pack of gainers, surging by 3.36 per cent to 1,178.52 points. Nagabeli’s stock price surged by Rs 353 to Rs 3,774, that of Swabalamban by Rs 65 to Rs 2,050 and Chhimek’s by Rs 28 to Rs 1,749, among others.

The sub-index of commercial banks went up 2.36 per cent to 1,105.95 points. Nabil rose Rs 55 to Rs 1,905, Everest by Rs 22 to Rs 2,313 and Himalayan by Rs 31 to Rs 971.

Nepal Telecom’s share value rose by Rs 15 to Rs 685, which in turn helped others subgroup to record a gain of 2.24 per cent to 804.75 points.

Adding to the previous week’s rise of 0.34 per cent, insurance subgroup gained 1.15 per cent to 5,437.76 points. Life Insurance Co Nepal’s stock price went up Rs 40 to Rs 3,540 and Prime Life rose Rs 92 to Rs 1,662.

Hotels inched up 0.92 per cent to 1,742.67 points on the back of Soaltee’s share value up two rupees to Rs 328.

Conversely, manufacturing sub-index continued its free fall, weighed down by Unilever Nepal’s share price plunging by Rs 1,009 to Rs 24,491. The subgroup dropped 2.84 per cent to 1,790.75 points.

After leading the pack of gainers in the past week, hydropower dipped 0.56 per cent to 2,152.12 points this time around. Even as Sanima Mai surged by Rs 60 to Rs 885, the gain was offset by Chilime losing Rs 66 to land at Rs 1,294.

Finance too dipped 0.36 per cent to 583.51 points.

Sanima Bank retained its top spot in terms of turnover with Rs 202.96 million. It was followed by Global IME Bank with Rs 149.64 million, Prime Life Insurance Co with Rs 130.86 million, Nepal Bank with Rs 127.49 million and Everest Bank with Rs 114.79 million.

Nepal Bank was the forerunner in terms of shares traded with 382,000 of its scrips changing hands, while Global IME Bank secured top spot in terms of transactions, clocking 870 deals.