NRB flags credit to risky sectors

Kathmandu, January 16

Nepal Rastra Bank (NRB) has shown concerns over the sharp expansion of credit to unproductive sectors in this fiscal.

The central bank has warned the banks and financial institutions (BFIs) that loan expansion to the unproductive sectors for higher returns is inherently risky strategy and may increase the share of non-performing loans in future.

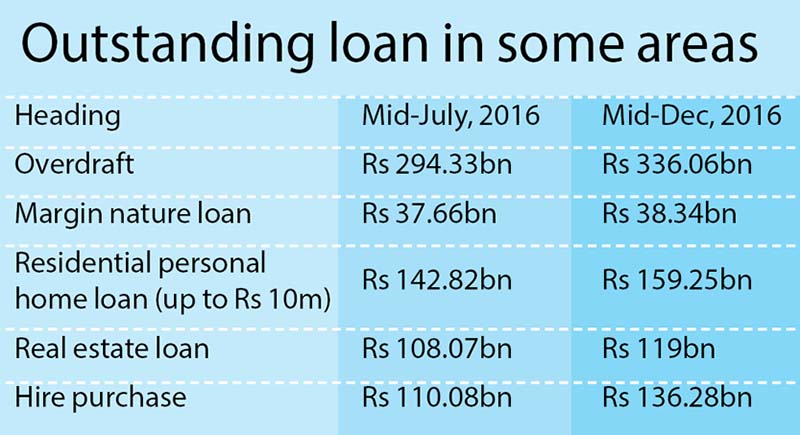

The outstanding credit of BFIs in overdraft, margin lending (against collateral of stock), real estate and hire purchase increased significantly in the period of mid-July to mid-December of 2016 as compared to the level of a year ago, the central bank said in its Macroeconomic Outlook of first five months of this fiscal, which was unveiled today.

NRB has urged the BFIs to focus on productive sectors, which are less risky. Increasing flow of credit to unproductive sector poses a challenge in maintaining financial sector stability going forward, according to the central bank.

NRB has said that the BFIs have been enjoying higher level of profitability as the level of non-performing assets is below two per cent and that requires lower level of loan-loss provisioning. High concentration on margin lending, real estate and hire purchase credit might raise the level of non-performing loan, which would result in higher level of loan-loss provisioning and ultimately hit overall profitability of BFIs.

“Acceleration in overall bank credit to private sector by 30.4 per cent year-on-year basis, including overdraft, hire purchase and real estate loans is a matter of concern,” says the central bank report.

“Excess loans to risky areas could divert bank credit from productive sectors. Therefore, banks and financial institutions are required to exhibit prudent and cautious lending behaviour in days to come.”