Stock market positive bidding adieu to 2073 BS

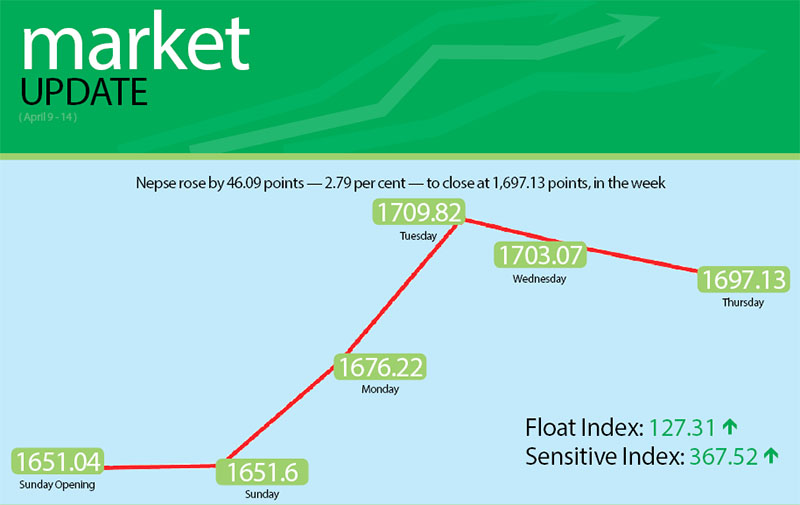

Even with selling pressure towards the end of the week, the domestic share market managed to record a gain week-on-week between April 9 to 13, with the Nepal Stock Exchange (Nepse) index advancing by 46.09 points or 2.79 per cent.

Starting the week at 1,651.04 points on Sunday, the benchmark index had inched up by 0.56 point by the day’s closing. The local bourse jumped 24.62 points on Monday and added another 33.6 points on Tuesday to breach the threshold of 1,700 points. Owing to political development, some short-term investors resorted to profit-booking and Nepse reversed course over the next two days — shedding 6.75 points on Wednesday and dipping by 5.94 points on Thursday — to end the last week of Nepali year 2073 BS at 1,697.13 points.

The sensitive index, which gauges the performance of class ‘A’ stocks, rose by 9.05 points or 2.52 per cent to 367.52 points. Likewise, the float index that measures the performance of shares actually traded also went up by 3.77 points or 3.05 per cent to 127.31 points.

Altogether, 16.39 million shares of 157 companies that amounted to Rs 8.32 billion were traded through 59,622 transactions during the week. The traded amount was 27 per cent higher than the preceding week when 37,654 transactions of 11.06 million shares of 155 firms worth Rs 6.54 billion had been undertaken.

It has to be noted, however, that the country’s only secondary market had remained open for only four days in the past week owing to a public holiday, while Nepse remained open for normal five days during the review period.

Trading was the sole subgroup to remain stationary at 209.25 points. While stock investors continue to flock to shares of insurance companies, it was development banks that led pack of gainers in the week.

Development banks surged by 135.05 points or 7.37 per cent to 1,966.63 points. Nagbeli surged by 20.75 per cent to Rs 2892, Swabhalamban by 20.06 per cent to Rs 2,005, and Chhimek by 13.73 per cent to Rs 1,675, among others.

Finance rose by 28.03 points or 3.82 per cent to 761.65 points. While Citizen Investment Trust was up 0.86 per cent to Rs 3,969, the sub-index was buoyed by finance companies like Manjushree gaining 6.14 per cent to Rs 190, United by 5.88 per cent to Rs 306 and Reliance by 2.13 per cent to Rs 240.

Hotels added 66.86 points or 3.12 per cent to 2,206.2 points. Oriental recorded a gain of 6.32 per cent to Rs 639, Taragaon Regency closed at Rs 273 (up 6.22 per cent) and Soaltee was up 2.27 per cent to Rs 358.

Banking, the share market heavyweight, rose 33.97 points or 2.19 per cent to 1,581.22 points. This was on the back of commercial banks like Standard Chartered ascending 2.17 per cent to Rs 2,350 and Nabil up 1.27 per cent to Rs 1,590.

Compared to previous week’s surge of over 10 per cent, gain made by insurance subgroup was muted at 189.84 points or 2.19 per cent to 8,869 points.

Hydropower more than recovered loss of 0.71 per cent of past week rising 38.13 points or 1.91 per cent to 2,034.12 points. The gain of others and manufacturing was less than one per cent — up 5.21 points or 0.76 per cent to 685.74 points and 8.11 points or 0.37 per cent to 2,207.99 points — respectively.

Meanwhile, Nepal Credit and Commerce Bank secured the top position in all three categories — trading volume, turnover and number of transactions, with 993,000 of its shares worth Rs 447.74 million changing hands in 2,477 transactions.

The other companies to make it to the list of top five in terms of weekly turnover were Gurans Life Insurance with Rs 319.07 million, Nepal Bank with Rs 310.78 million, Prabhu Bank with Rs 296.41 million and Surya Life Insurance with Rs 284.81 million.