Nepse crosses new milestones

KATHMANDU, JANUARY 16

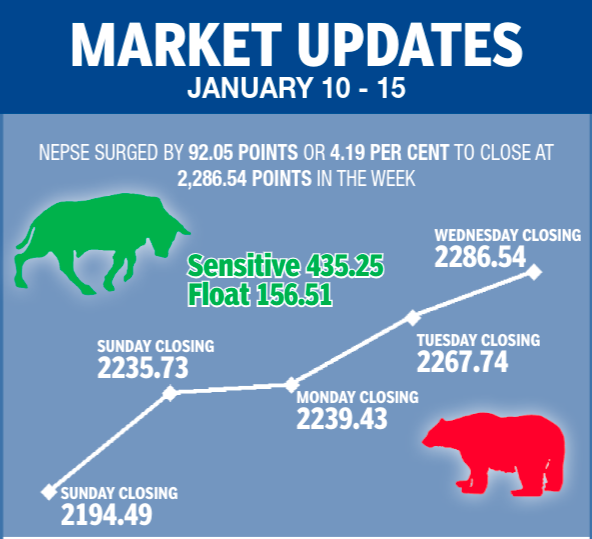

The country’s sole secondary market sailed past new milestones in the trading period between January 10 and 14, with Nepal Stock Exchange (Nepse) index advancing by 4.19 per cent or 92.05 points weekon-week to settle at a new high.

The share market continues to be an attractive investment option for investors as other sectors are only gradually recovering from the coronavirus pandemic, according to market analysts.

The benchmark index that had opened at 2,194.49 points on Sunday had surged 41.24 points to sail past the threshold of 2,200 points to a new all-time high by the time of closing for the day. Moreover, the total market capitalisation of Nepse crossed Rs three trillion on the very first trading day of the week.

Nepse was northbound for the remainder of the week, thereby continuing its record-breaking streak. It edged up by 3.70 points on Monday, jumped by 28.31 points on Tuesday and rose by 18.80 points on Wednesday to rest at a fresh peak of 2,286.54 points.

The share market was closed on Thursday in celebration of Maghe Sankranti.

The sensitive index, which measures the performance of class ‘A’ stocks, went up by 3.33 per cent or 14.03 points to 435.25 points. The float index that gauges the performance of shares actually traded rose by 4.72 per cent or 7.06 points to 156.51 points.

Altogether, 55.41 million shares were exchanged through 201,743 transactions in the review week that amounted to Rs 22.75 billion.

The weekly turnover was 16.27 per cent lower than the preceding week when 234,513 transactions of 58.78 million shares had been undertaken that totalled Rs 27.17 billion.

However, as the market was open for only four days in the review week against the normal five days in the past week, the average daily turnover rose 4.79 per cent to Rs 5.69 billion compared to Rs 5.43 billion in the preceding week.

Similar to the past week, all the subgroups recorded gains this time around as well.

Finance subgroup led the pack of gainers, with the sub-index surging by 11.09 per cent or 99.24 points to 993.81 points.

In terms of points gained, life insurance topped the chart, with the sub-index surging by 689.90 points or 4.94 per cent to 14,653.01 points.

Prabhu Bank was the forerunner in all three categories — trading volume, transactions and weekly turnover. Nearly 2.24 million of its shares changed hands through 6,538 transactions that amounted to Rs 916.16 million.

Siddhartha Bank Ltd (SBL) had second highest weekly turnover of Rs 768.95 million, Nepal Reinsurance Co Ltd (NRIC) had the third highest at Rs 726.17 million, Nepal Telecom had fourth highest at Rs 674.11 million and Nepal Life Insurance Co had the fifth highest at Rs 627.47 million.

In terms of trading volume, Civil Bank Ltd (CBL) was second with 2.19 million shares traded, Siddhartha Investment Growth Scheme – II was third with 2.09 million shares, Kumari Bank Ltd (KBL) was fourth with 2.08 million shares and SBL was fourth with 1.68 million shares.

KBL with 5,721 transactions, NRIC with 5,329 transactions, Upper Tamakoshi Hydropower Ltd with 5,284 transactions, and CBL with 5,179 transactions rounded up the top five in this category.