Nepse edges up 1.77pc, turnover tepid

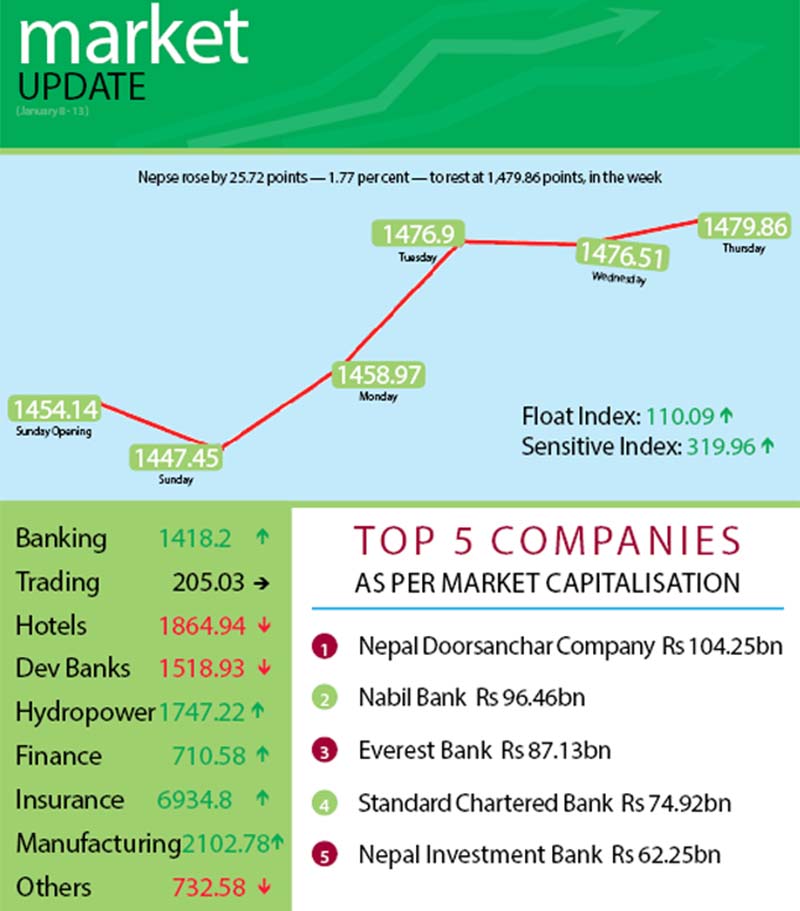

Despite the tepid turnover, the country’s only share market recorded a weekly gain of 25.72 points or 1.77 per cent between January 8 and 12.

“One of the prime reasons for the volume of transactions in the secondary market dropping in recent days could be because of new offerings,” explained Shreejesh Ghimire, CEO of NMB Capital.

Moreover, with banks not having enough loanable funds and fixed deposit rates going up significantly might have also diverted investors’ attention.

Perhaps because of all these factors, the daily transaction amount had dropped to a multi-year low of merely Rs 264.59 million on January 9. Even as the traded amount averaged more than Rs 350 million over the remainder of the week, the total weekly turnover was limited to Rs 1.74 billion — 19.74 per cent lower than the previous week’s Rs 2.16 billion. All in all, 10.03 million shares of 148 companies changed hands through 13,140 transactions in the review period against 18,551 transactions of 4.55 million shares of 149 firms in the preceding week.

The market movement was mostly horizontal in the review period. Nepal Stock Exchange (Nepse) index, which had opened at 1,454.14 points on Sunday had dropped 6.69 points to retreat below the 1,450-point threshold. However, index rebounded by 11.52 points on Monday and advanced 17.93 points on Tuesday. After shedding 0.39 point on Wednesday, local bourse ended week on a positive territory by inching up 3.35 points to 1,479.86 points on Thursday.

The sensitive index went up by 5.84 points or 1.86 per cent to 319.96 points. Similarly, the float index also inched up by 1.87 points or 1.73 per cent to 110.09 points.

Apart from trading remaining stationary at 205.03 points, most of the remaining subgroups witnessed gains.

Insurance subgroup snapped five consecutive week-on-week loss to take the lead among the gainers. The sub-index surged by 264.5 points or 3.96 per cent to 6,934.8 points. Nepal Life surged by 7.17 per cent to Rs 2,840, Prime Life gained 6.09 per cent to Rs 1,690 and Shikhar rose by 4.38 per cent to Rs 2,119.

Finance also managed to more than recoup the dip of 0.5 per cent of the previous week by gaining 18.32 points or 2.65 per cent to land at 710.58 points, primarily due to Citizen Investment Trust ascending 5.95 per cent to Rs 3,899.

Banking — the subgroup with the highest weightage in Nepse — rose by 31.36 points or 2.26 per cent to 1,418.2 points. This was on the back of Standard Chartered rising by 4.5 per cent to Rs 1,998 and Nabil up 3.65 per cent to Rs 1,560.

Adding to the previous week’s increase of 0.75 per cent, hydropower subgroup went up by 24.02 points or 1.39 per cent to 1,747.22 points. Chilime edged up 1.24 per cent to Rs 817 and Api rose by 2.53 per cent to Rs 405.

Meanwhile, manufacturing inched up 0.34 point or 0.02 per cent to 2,102.78 points owing to Shree Ram Sugar Mills ascending two per cent to Rs 102.

The losers, on the other hand, managed to limit their losses to below one per cent. Development banks was down 11.18 points or 0.73 per cent to 1,518.93; others shed 3.76 points or 0.51 per cent to 732.58 points and hotels dipped 8.41 points or 0.45 per cent to 1,864.94 points.

Meanwhile, Nepal Life Insurance topped the chart in terms of weekly turnover of Rs 134.87 million, followed by Bank of Kathmandu Lumbini with Rs 124.18 million, NB Insurance with Rs 70.20 million, Everest Bank with Rs 68.44 million and Kumari Bank with Rs 67.05 million.

Nabil Balanced Fund – I was the forerunner with regards to trading volume with 2.55 million of its scrips changing hands and Kumari Bank, with 683 transactions to its name, took the lead in this category.