Nepse falls for third consecutive week

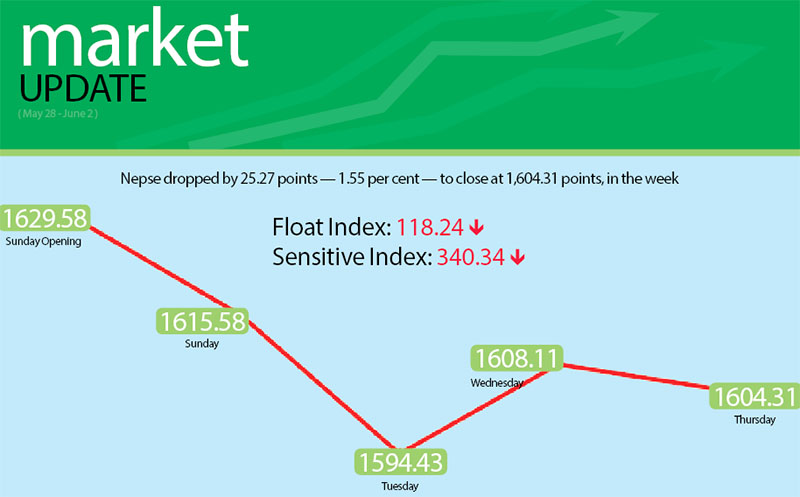

Nepal Stock Exchange (Nepse) index fell by 25.27 points or 1.55 per cent to rest at 1,604.31 points between May 28 and June 1, as the budget unveiled on May 29 disappointed investors.

The benchmark index, which had opened at 1,629.58 points on Sunday had dropped by 14 points by the time of closing for the day. While the market remained closed on Monday to commemorate Republic Day, the budget for fiscal year 2017-18 was announced that day.

With no new programmes, share investors seemed disappointed with the budget announcement and the local bourse fell by 21.15 points to retreat below the threshold of 1,600 points. Nepse managed to recover some of the loss the next day by adding 13.68 points on positive political cues and scrambled above the psychological level of 1,600 points again. The gain was enough for Nepse to close above 1,600 points for the week, even though the benchmark index shed 3.8 points on Thursday.

The sensitive index, which gauges the performance of class ‘A’ stocks, slipped by 5.65 points or 1.63 per cent to 340.34 points. Similarly, the float index that measures the performance of shares actually traded also fell by 2.16 points or 1.79 per cent to 118.24 points.

In total, 5.12 million shares of 158 companies that amounted to Rs 2.84 billion were traded through 27,341 transactions in review period. Traded amount was 5.81 per cent higher than the previous week when 23,735 transactions of 4.57 million shares of 155 firms worth Rs 2.69 billion had been undertaken.

Among the subgroups, trading held steady at 212.76 points. All remaining subgroups landed in red, with banking — the share market heavyweight — witnessing the biggest drop of 1.97 per cent or 28.71 points to 1,429.46 points.

Adding to previous week’s plunge of 1.45 per cent, insurance subgroup slumped by 143.88 points or 1.64 per cent to 8,614.87 points.

Development banks was down 22.67 points or 1.15 per cent to 1,947.59 points.

Finance, which had managed to land in the green zone in the past week, lost 8.24 points or 1.05 per cent to land at 772.41 points.

The rest of the subgroups managed to limit their losses below one per cent. Manufacturing was down 17.21 points or 0.7 per cent to 2,447.25 points, hydropower fell by 13.17 points or 0.64 per cent to 2,052.99 points, others shed 1.73 points or 0.25 per cent to 689.5 points and hotels dipped 3.26 points or 0.14 per cent to 2,241.48 points.

Meanwhile, Standard Chartered Bank was the forerunner in terms of turnover with Rs 179.25 million, followed by Siddhartha Bank with Rs 153.19 million, Himalayan General Insurance Co Ltd with Rs 125.37 million, Bank of Kathmandu Lumbini with Rs 83.76 million and Prabhu Bank with Rs 83.41 million.

Siddhartha Bank was the forerunner in terms of trading volume, with 247,000 of its shares changing hands. Standard Chartered Bank also topped the chart with regard to most number of transactions — 3,209.