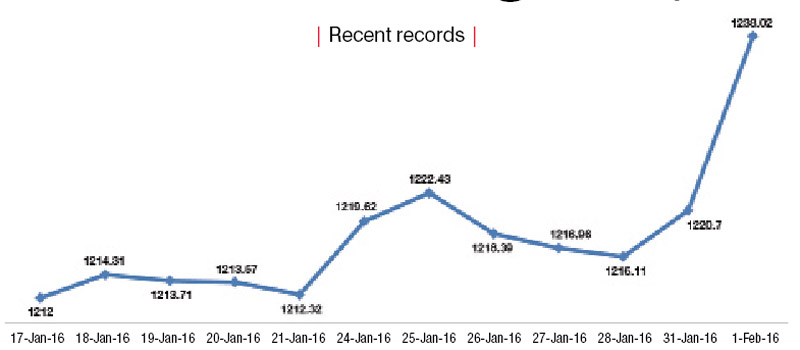

Nepse hits fresh all-time high of 1,238.02 pts

Kathmandu, February 1

Nepal Stock Exchange (Nepse), which has been on a bull run for the last several weeks, breached all past records today to hit a fresh all-time high of 1,238.02 points.

The benchmark index, which opened at 1,220.70 points, gained 1.42 per cent, or 17.32 points, during the intraday trading, as lack of investment opportunity in other sectors and falling lending and deposit rates pulled investors towards the stock market.

“Currently, there is no investment avenue in the country, as supply disruptions have affected almost every economic sector. This has prompted investors to bet on stocks,” Stockbroker Anjan Poudel said.

Another pulling factor, as per Poudel, is declining deposit and lending rates.

Normal savings deposit rates at banks like Rastriya Banijya Bank and Standard Chartered Bank Nepal (SCBN) have now slumped to one per cent. If inflation of 11.6 per cent is taken into account, depositors, in real terms, are losing money by parking funds at banks.

“So, some of these depositors are also buying stocks,” Poudel said.

But even those who do not have cash in hand are getting drawn towards the stock market because credit is becoming cheaper with the fall in lending rates.

“This combination of falling deposit and lending rates is playing quite a big role in luring investors towards stock market,” Poudel said, adding, “Higher profits generated by banks and financial institutions in the second quarter — as shown by balance sheets which are currently being published — have also lifted the confidence of investors.”

However, Poudel warned that investors should be careful as ‘benchmark index is not rising due to change in market fundamentals’.

“Political and economic fundamentals have not changed to support the hike that is currently being witnessed. And corrections do take place after every bull run,” Poudel added.

Today’s market rally was largely led by the banking sector, which advanced 1.87 per cent throughout the day.

Stock of Everest Bank gained Rs 57 to Rs 2,382. Share of SCBN too added Rs 55 to its value to close at Rs 2,715, while stock of Nepal Investment Bank advanced by Rs 48 to end at Rs 873.

Despite the impressive performance of the banking sector, the biggest gainer today was Unilever Nepal Ltd, whose share price surged by a whopping Rs 519 to Rs 26,507. However, only 10 units of the company’s shares were traded today.

The biggest losers today were hydropower companies. Shares of most of the listed hydro companies — Arun Valley Hydropower, Barun Hydropower, Chilime Hydropower, National Hydropower, Sanima Mai Hydropower — fell today.

As these firms booked losses, hydro sub-index lost 17.87 points, or 0.83 per cent, to close at 2,138.41 points. Hydro sub-index was the only sub-index that was in the red today.

“Investors are shunning hydro stocks these days, because firms of financial sector, such as banks, are rapidly extending bonus shares to meet minimum regulatory paid-up capital requirement. Also, problems faced by hydro projects due to shortage of petroleum products have worked as disincentives,” Poudel said.