Nepse hovers in the periphery of 1,400 points

Kathmandu, August 22

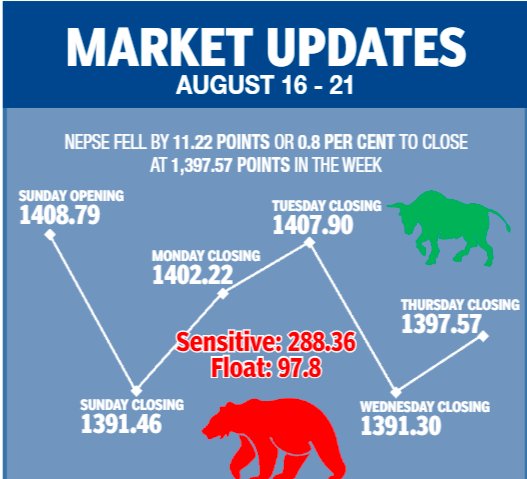

Nepal Stock Exchange (Nepse) index dipped by 0.8 per cent or 11.22 points week-on-week in the trading period between August 16 and 20 due to the uncertainty related to the coronavirus pandemic and the disappointing financial results of listed companies in the final quarter of last fiscal. In the previous week, Nepse had salvaged some of earlier losses by recording a weekly gain of 27.41 points or 1.98 per cent.

The dismal performance of the listed companies in the fourth quarter of the previous fiscal due to the lockdown and the rising cases of COVID-19 in the country that resulted in the prohibitory order being clamped down in Kathmandu valley weighed on the share investor sentiment, as per share market analysts.

Against the weekly turnover of Rs 5.29 billion in the previous week, the traded amount slipped 6.62 per cent in the review period to Rs 4.94 billion.

Also, the number of transactions fell to 80,334 from 132,681 in the previous week and trading volume dropped to 15.77 million shares changing hands against trade of 17.47 million shares in the preceding week.

The benchmark index had opened at 1,408.79 points on Sunday, but the weak performance of the listed firms weighed on the investor sentiment, which caused Nepse to fall 17.33 points to retreat below the threshold of 1,400 points by the time of closing.

However, the market rebounded 10.76 points to close above 1,400 points on Monday.

“Investors are largely pessimistic due to the pandemic, but there is also hope that the local bourse will not drop too much, which is reflected in the market movement,” explained an analyst.

While Nepse rose by 5.68 points on Tuesday, it reversed course to drop 16.60 points to below 1,400 points again on Wednesday.

The gain of 6.27 points on Thursday was insufficient to make up for earlier losses and the local bourse settled at 1,397.57 points for the week.

The sensitive index, which measures the performance of class ‘A’ stocks, fell 1.87 per cent or 5.49 points to 288.36 points, and float index that gauges performance of shares actually traded shed 0.94 per cent or 0.93 point to 97.80 points.

Only four subgroups landed in the green.

The trading subgroup that had recorded minimal loss in the previous week led the pack of gainers by surging 4.39 per cent or 36.47 points to 866.86 points. Adding to previous week’s rise of 1.83 per cent, others jumped 2.34 per cent or 18.94 points to 828.37 points.

Compared to last week’s impressive surge of 5.48 per cent, the non-life insurance subgroup’s gain was muted at 1.24 per cent or 82.76 points to 6,735.30 points. Similarly, life insurance edged up by merely 0.04 per cent or 3.65 points to 8,520.22 points. The sub-index had increased by 2.86 per cent in the previous review period.

On the other hand, development banks saw the gains of previous week wiped out as the subgroup dropped 2.15 per cent or 37.91 points to 1,727.64 points. Shareholders of commercial banks too saw their holdings shrink as banking subgroup descended by 1.91 per cent or 22.93 points to 1,178.80 points.

Six subgroups — mutual funds, microfinance, hotels, manufacturing, finance and hydropower — although in the red, managed to limit their losses to below one per cent.

Mutual funds fell 0.94 per cent or 0.10 point to 10.58 points; microfinance slipped 0.93 per cent or 22.06 points to 2,355.56 points; hotels lost 0.86 per cent or 13.05 points to 1,497.20 points; manufacturing was down 0.63 per cent or 16.98 points to 2,696.51 points; finance dropped 0.54 per cent or 3.59 points to 655.54 points; and hydropower shed 0.46 per cent or 4.40 points to 951.02 points.

A version of this article appears in e-paper on August 23, 2020, of The Himalayan Times.