Nepse index down by 33.77 points

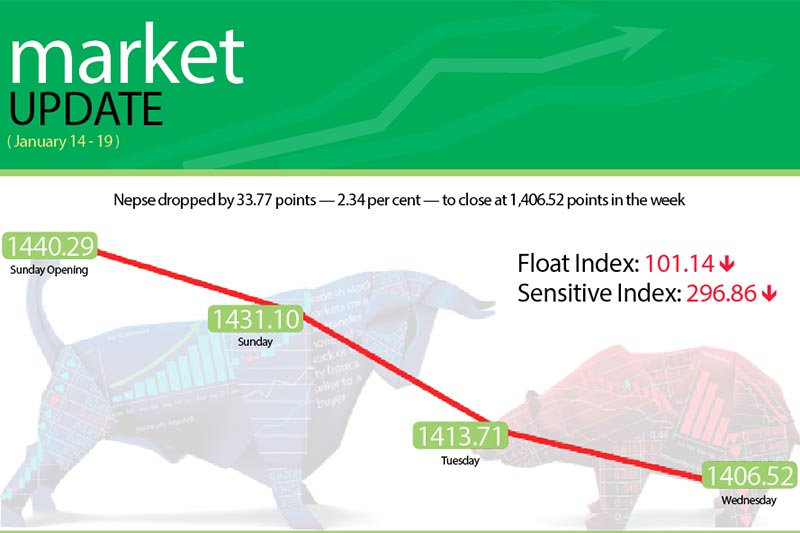

Due to the fluctuating lending rates of banks and financial institutions the secondary market index took a plunge in the trading week between January 14 and 18. The Nepal Stock Exchange (Nepse) index fell by 33.77 points or 2.34 per cent to 1,406.52 points in the review period.

Along with the Nepse index, the sensitive and float indices also fell by more than two per cent. The sensitive index dropped by 2.25 per cent or 6.82 points to 296.86 points and the float index descended by 2.36 points or 2.28 per cent to 101.14 points.

The secondary market was open for only three days during the week. It remained closed on Monday due to public holiday of Maghe Sakranti and on Thursday due to Sonam Losar. The market index had slightly gone up the previous week, however during the three days of this week it closed in the red zone.

The benchmark index opened on Sunday at 1,440.29 points and closed at 1,431.1 points by the time of closing. The market declined to 1,413.71 points on Tuesday and further fell to 1,406.52 points on Wednesday.

Investors expect the market to change direction within the next few trading days because the internal and external factors that affect the market are positive. Nawaraj Subedi, chairman of Nepal Stock Market Investors Association, stated that the secondary market lost some shine last week because of the fear among investors of an increment in lending rates due to shortage of deposits in the banks and financial institutions.

“Data from commercial banks related to their credit to core capital cum deposit ratio has revealed that there is no shortage of funds in the banks. Moreover, a few banks have published information in some newspapers that they will provide loans at nine per cent which has created hope among the investors,” Subedi said. “Also, most political issues have been settled after the elections and this has helped develop a positive sentiment among share investors.”

Subedi also stated that the second trimester results of banks and financial institutions also have had a positive impact on investors. “The second quarter results of banks and financial institutions will be published soon and investors believe that they will be more positive than the result of the first quarter of this fiscal year,” he mentioned.

All the sub-indices were in the red zone during the trading week. The sub-index of class ‘A’ financial institutions plunged by 28.27 points or 2.27 per cent to 1,216.68 points. Stock market price of Everest Bank decreased by 9.65 per cent to Rs 833 per unit, that of Standard Chartered Bank fell by 5.03 per cent to Rs 1,000 per unit and share price of Nabil Bank descended by 2.9 per cent to Rs 1,039 a unit.

The sub-index of the insurance group plunged by 2.51 per cent or 187.19 points to 7,270.44 points. Likewise, sub-index of development banks decreased by 43.97 points or 2.72 per cent to 1,570.85 points. Similarly, sub-index of microfinance sector descended by 39.99 points or 2.29 per cent to 1,701.98 points and

the sub-index of finance companies fell by 16.62 points or 2.26 per cent to 719.12 points.

Similarly, sub-index of hydropower group dropped by 59.88 points or 3.12 per cent to 1,861.23 points. The sub-index of manufacturing sector plunged by 54.26 points or 2.16 per cent to 2,452.54 points and the sub-index of hotels fell by 39.06 points or 1.81 per cent to 2,113.51 points. Following this trend, sub-index of trading group also dipped by 2.87 points or 1.49 per cent to 189.53 points and the others group decreased by 16.25 points or 2.08 per cent to 766.83 points during the review period.

Altogether, 2.46 million shares of 170 companies worth Rs 2.09 billion were traded through 12,728 transactions during the week. The traded amount was 35.98 per cent less than the total weekly turnover of the previous week.

Sanima Mai Hydropower Company secured the top position in terms of total turnover with Rs 190.81 million. It was followed by Nabil Bank with Rs 53.99 million, Nepal Life Insurance with Rs 42.4 million, Standard Chartered Bank with Rs 38.71 million and National Life Insurance with Rs 27.88 million.

Sanima Mai Hydropower also topped the list in terms of trading volume of shares and number of transactions. A total of 447,000 unit shares of the company were traded through 1,184 transactions.