Nepse index descends by 37.15 points

Kathmandu, January 5

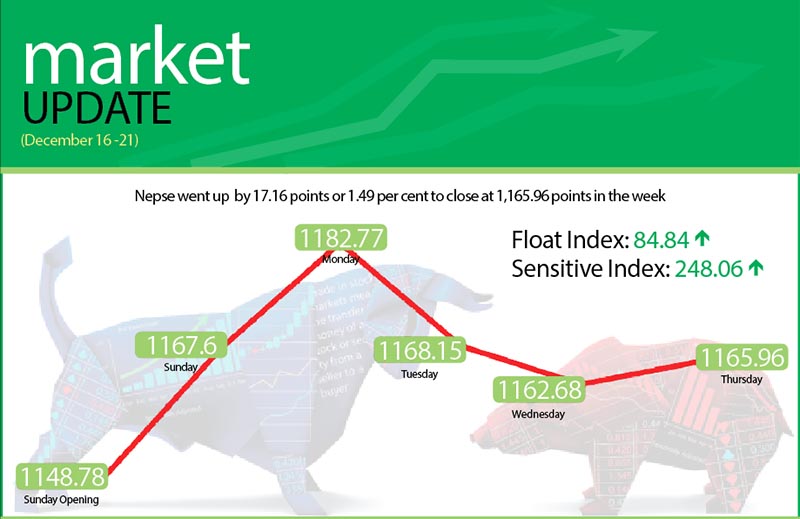

Due to a majority of banks and financial institutions (BFIs) providing cash dividend instead of bonus shares to their shareholders the Nepal Stock Exchange (Nepse) index dropped in the trading week between December 30 and January 3. The index plummeted by 3.05 per cent or 37.15 points.

“Most banks and financial institutions distributed cash dividend instead of bonus shares against the expectations of shareholders and that is why Nepse’s performance was not good last week,” said Ambika Prasad Poudel, chairman of Nepal Investors Forum.

According to Poudel, though the balance sheets unveiled by BFIs reveal that they have made profits the BFIs are not distributing bonus shares as expected by shareholders, hence the secondary market dropped last week. “However, the government has addressed the primary demands of stock investors and I believe that in the coming days the stock market will rebound.”

Along with Nepse index, the sensitive index also fell by 3.40 per cent or 8.80 points to 249.86 points and float index went down by 2.98 per cent or 2.63 points to land at 85.73 points.

In the review period, weekly turnover decreased by 58.82 per cent as compared to the previous week to Rs 1.61 billion. In the previous week the market witnessed turnover of Rs 3.92 billion. Likewise, the daily average turnover also went down to Rs 323.54 million, which was a decline of 58.82 per cent in comparison to the previous week when it stood at Rs 785.73 million.

The secondary market had opened at 1,215.16 points on Sunday and went down by 10.62 points by the end of the trading day. On Monday, the market again dropped by 17.26 points. The local bourse further fell by 1.37 points on Tuesday and by 5.48 points on Wednesday. On Thursday too the index continued with its downward trend to close the week at 1,178.87 points.

In the review week, only the hotels and manufacturing subgroups witnessed gains. The hotels sub-index increased by 0.52 per cent or 9.06 per cent to land at 1,729.18 points and the manufacturing subgroup inched up by 0.01 per cent or 0.25 per cent to land at 2,262.52 points for the week.

Meanwhile, the others subgroup led the pack of losers decreasing by 6.38 per cent or 49.33 points to 723.28 points. Share price of Nepal Telecom slumped by Rs 66 to Rs 731. Similarly, the life insurance subgroup went down by 4.05 per cent or 255.40 points to 6,052.24 points as the share price of Nepal Life Insurance decreased by Rs 65 to Rs 1,090.

Likewise, banking sub-index went down by 3.09 per cent or 32.35 points to 1,015.47 points with the share price of Standard Chartered Bank falling by Rs 17 to Rs 606.

Moreover, development banks subgroup also went down by 2.03 per cent or 29.75 point to 1,454.91 points and the non-life insurance sub-index shrunk by 1.94 points or 112.58 points to 5,683.56 points.

Meanwhile, the hydropower sub-index descended by 1.57 per cent or 19.25 points to 1,209.52. Likewise, the microfinance subgroup also dipped by 1.31 per cent or 18.57 points to 1,395.71 points.

The finance subgroup also fell by 0.62 per cent or 3.79 points to 604.09 points. Likewise, trading sub-index also inched down by 0.07 per cent or 0.17 point to 236.58 points.

In the review week, Nepal Life Insurance was the leader in terms of weekly turnover with Rs 101.64 million. It was followed by Nepal Bank with Rs 93.42 million, National Life Insurance Co with Rs 67.47 million, NCC Bank with Rs 52.76 million and Chhimek Laghubitta Bikas Bank with Rs 49.73 million.

In terms of weekly trading volume, Nepal Bank took the lead with 302,000 of its shares changing hands. NCC Bank with 247,000 shares, Janata Bank with 154,000 shares, Prabhu Bank with 142,000 shares and NMB Bank with 140,000 shares were other top firms to record high trading volume.

Meanwhile, Nepal Life Insurance Co topped the chart in terms of number of transactions — 886. It was followed by Nepal Bank with 586, NMB Bank with 570, Nepal Investment Bank with 526 and Chilime Hydropower Company with 507 transactions.