Nepse index loses 5.35 points

Kathmandu, September 7

Rumours about the government’s plan to tax parental property added to the woes of share investors already rattled by the government’s unwillingness to resolve long disputed capital gains tax (CGT) in share transaction. Consequently, the secondary market recorded seventh week-on-week loss between September 1 and 5.

“The investor sentiment has been further dampened by the rumours that the government is preparing to introduce additional taxes on the citizens,” explained Uttam Aryal, chairman of Investors Association of Nepal.

However, he expressed hope that the bearish run will come to a halt soon as the central bank is expected to soon amend the Monetary Policy in favour of the share market and banks and financial institutions.

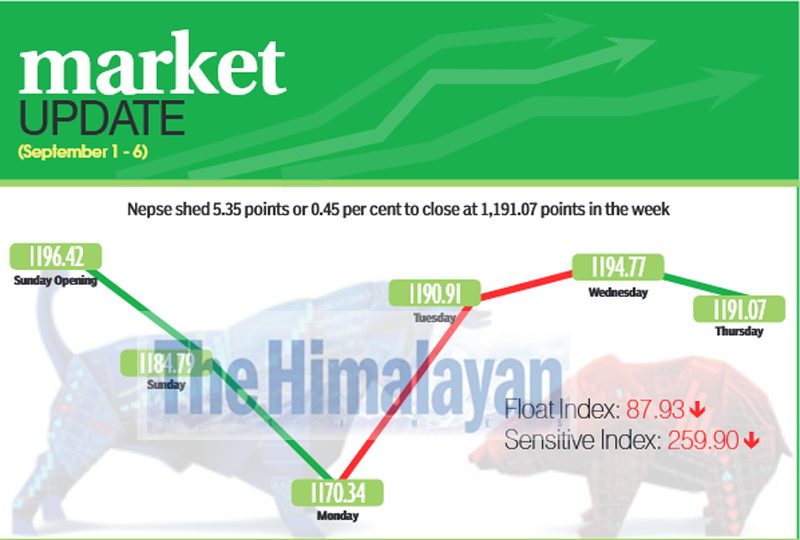

In the review week, Nepal Stock Exchange (Nepse) index fell by 0.45 per cent or 5.35 points to 1,191.07 points. Sensitive index also went down by 0.51 per cent or 1.35 points to 259.90 points and float index dipped by 0.15 per cent or 0.14 point to 87.93 points.

On the other hand, the weekly turnover increased by 19.53 per cent as compared to the previous week to Rs 1.94 billion. In the previous week, the market had witnessed transactions worth Rs 1.62 billion. Similarly, the trading volume also increased to 7.04 million stocks changing hands this week from 6.02 million in the preceding week.

Trading of mutual funds shares went down by 31.2 per cent against the previous week to Rs 3.33 million. In the previous week, the mutual funds had witnessed turnover of Rs 4.84 million.

The secondary market had opened on Sunday with the benchmark index at 1,196.42 points. It had dropped by 11.63 points by the end of the trading day. Nepse index plunged by 14.45 points on Monday. However, the local bourse reversed course over the next two days — surging by 20.57 points on Tuesday and adding another 3.87 points on Wednesday. The optimism could not sustain, however, as Nepse again shed 3.70 points on Thursday to close the week at 1,191.07 points.

In the review week, development banks and banking subgroups managed to land in the green zone. Trading subgroup remained constant at 282.13 points.

The development banks sub-index increased by 0.33 per cent or 5.18 points to 1,589.08 points and banking subgroup also ascended by 0.21 per cent or 2.32 points to 1,090.25 points.

At the other end of the spectrum, hotels sub-index was the biggest loser of the week, plunging by 2.12 per cent or 42.37 points to 1,958.89 points due to share price of Soaltee down six rupees to Rs 222.

Others subgroup lost 2.10 per cent or 14.41 points to land at 671.48 points, with share value of Nepal Telecom dropping by Rs 16 to Rs 651.

Moreover, life insurance sub-index slumped by 1.88 per cent or 103.36 points to land at 5,388.44 points. The hydropower subgroups fell by 1.74 per cent or 17.70 points to 996.87 points and manufacturing sub-index descended by 1.57 per cent or 39.48 points to 2,476.03 points.

The finance subgroup slipped by 0.60 per cent or 3.51 points to 577.18 points and mutual funds sub-index went down by 0.51 per cent or 0.05 point to 9.73 points.

The microfinance subgroup dipped by 0.34 per cent or 5.15 points to 1,505.60 points and non-life insurance sub-index inched down by 0.05 per cent or 2.48 points to 4,636.15 points.

In the review week, Machhapuchchhre Bank was the leader in terms of weekly turnover with Rs 110.20 million. It was followed by Nepal Life Insurance Co with Rs 96.16 million, Nepal Bank with Rs 94.99 million, Kumari Bank with Rs 59.99 million and Shivam Cements with Rs 57.92 million.

In terms of weekly trading volume too Machhapuchchhre Bank was the forerunner with 432,000 of its shares changing hands. Nepal Bank with 299,000 shares, Kumari Bank with 296,000 shares, Prabhu Bank with 220,000 shares and Api Power Company with 207,000 shares rounded up the top-five in this category.

Meanwhile, Sabaiko Laghubitta Bittiya Sanstha topped in terms of number of transactions with 5,194 transactions. It was followed by Sanjen Jalavidhyut with 2,896, Rasuwagadhi Hydropower with 2,880, Nepal Life Insurance Co with 1,028 and Upper Tamakoshi Hydropower with 1,026 transactions.