Nepse limits weekly loss to 0.01 per cent

Kathmandu, March 31

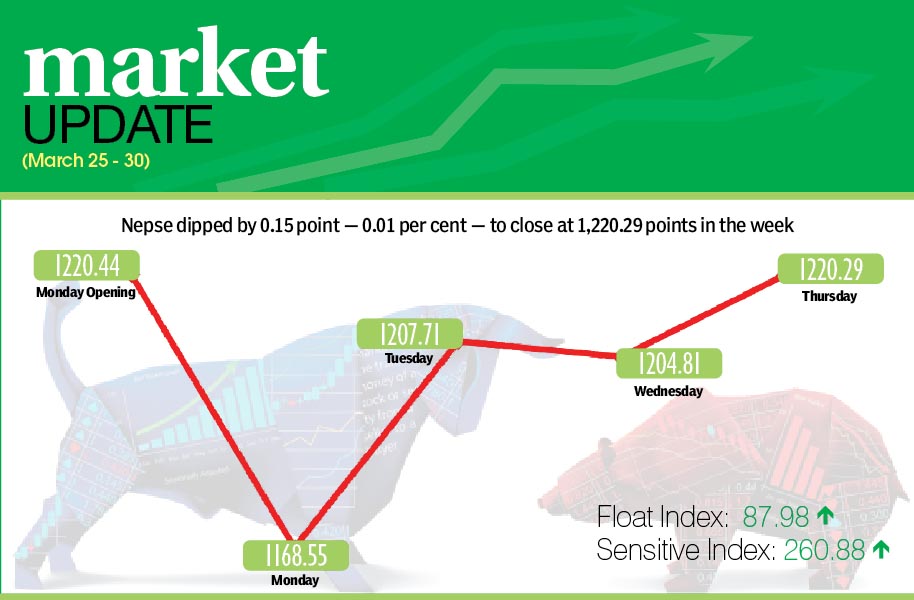

See-sawing throughout the trading period between March 25 and 29, the Nepal Stock Exchange (Nepse) index managed to limit its week-on-week loss to 0.01 per cent or 0.15 point.

After remaining closed on Sunday in celebration of Chaite Dashain, the country’s sole secondary market had witnessed massive selling pressure as soon as trading opened on Monday. Consequently, the benchmark index, which had opened at 1,220.44 points on Monday had plunged by three per cent within the first hour of trading, prompting the market regulator to clamp down circuit breaker for 15 minutes.

Even as the market stabilised thereafter, Nepse had slumped by 51.89 points to retreat below the 1,200-point threshold by the day’s closing — over a 26-month low.

The following day, however, the local bourse made a strong recovery by surging 39.16 points to breach the 1,200-point mark again. OnWednesday, the Nepse shed 2.90 points again before rising by 15.48 points to close the week at 1,220.29 points.

Investor sentiment has been downbeat in recent weeks after Finance Minister Yubaraj Khatiwada flagged risks in investing in unproductive sectors, including the share market. Moreover, increasing interest rates also added to the selling spree. The recovery seen towards mid-week can be attributed to expectations of the white paper on economy, which the finance minister unveiled on Friday.

“The dismal scenario painted in the white paper could further weigh on investor sentiment, although it was time for the market to undergo correction after a long bull run,” said one share market analyst.

Contrary to the benchmark index, the sensitive and float indices witnessed nominal gains during the review period. The sensitive index, which gauges the performance of class ‘A’ stocks, edged up by 0.18 per cent or 0.47 point to 260.88 points. Similarly, the float index that measures the performance of shares actually traded also inched up by 0.25 per cent or 0.22 point to 87.98 points.

Among the sub-indices, hotels, banking, hydropower and development banks managed to land in the green, while the remainder of the subgroups recorded losses.

Hotels led the pack of gainers with the subgroup rising by 1.94 per cent or 34.03 points to 1786.27 points. Soaltee jumped by 2.56 per cent to Rs 240, Taragaon Regency gained 1.17 per cent to Rs 260 and Oriental inched up by 0.64 per cent to

Rs 468.

The gain of the three other subgroups that landed in the green was less than one per cent. Banking advanced by 0.91 per cent or 9.94 points to 1,101.83 points, hydropower was up 0.88 per cent or 12.73 points to 1,455.72, and development banks rose by 0.83 per cent or 12.04 points to 1,458.50 points.

At the other end of the spectrum, trading — after holding steady in the previous week — took a dive of 5.11 per cent or 10.73 points to 199.06 points. The sub-index was weighed down by share value of Bishal Bazar Co plummeting by 6.85 per cent to Rs 1,728.

Others plunged by 2.20 per cent or 15.22 points to 677.54 points, mostly because of Nepal Telecom losing 2.22 per cent to

Rs 704.

Insurance slumped by 2.02 per cent or 115.12 points to 5,569.35 points and microfinance fell by 1.41 per cent or 19.12 points to 1,340.23 points. Manufacturing and finance subgroups managed to limit their losses to below one per cent. Manufacturing shed 0.97 per cent or 21.24 points to 2,162.99 points, whereas finance dipped by 0.38 per cent or 2.44 points to 644.03 points.

The country’s sole secondary market recorded 27,522 transactions of 5.89 million shares of 180 companies that amounted to Rs 1.89 billion during the review period. The traded amount was 9.85 per cent higher than the preceding week when 23,869 transactions of 4.60 million shares of 173 companies worth Rs 1.72 billion had been undertaken.

Nepal Life Insurance retained its top position in terms of number of transactions and weekly turnover, with 2,170 transactions to its name that totalled Rs 194.41 million. Nabil Bank with Rs 80.12 million, Nepal Bank with Rs 76.35 million, Nepal Investment Bank with Rs 70.25 million and Everest Bank with Rs 56.98 million rounded up the top five companies in terms of top trading firms.

Meanwhile, Nepal Bank was the forerunner in terms of trading volume with 256,000 of its shares changing hands.

NEW LISTINGS

Company

Type

Units

Everest Insurance

Bonus

202,500.00

Machhapuchchhre Bank

Bonus

6,651,490.00

NMB Microfinance Bittiya Sanstha

Bonus

281,750.00

Standard Chartered Bank

Bonus

40,057,153.33

Source: Nepse