Nepse rebounds at start of new fiscal

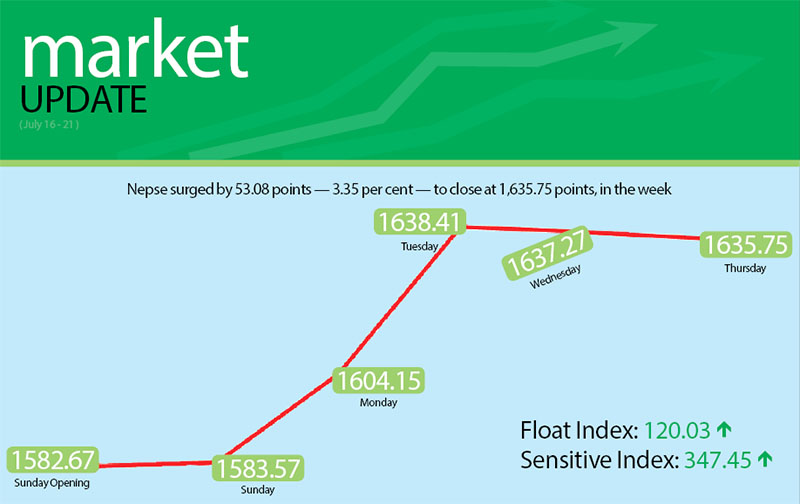

The domestic stock market rebounded by 53.08 points or 3.35 per cent to 1,635.75 points in the first trading week of the new fiscal year 2017-18 between July 16 and 20.

The financial sector, which has a major share in the stock market, had driven the market in the review period. Profit growth of last fiscal reported by financial institutions attracted share investors to market.

Narendra Sijapati, former chair of Stock Brokers Association of Nepal (SBAN) said that two factors propelled the bull run in the market. “Firstly, government expenditure shot up towards the end of the last fiscal, which fuelled hopes that the problem of shortage of credit being faced by the banks will be solved temporarily,” he said.

Moreover, listed companies are preparing to publish their annual balance sheets of the last fiscal year.

“Investor sentiment also got a boost on the belief that the performance of the financial sector was good in the last fiscal, which means the listed companies will report good profit,” he added.

The bull run in the review period was driven by the insurance sector with growth of 7.69 per cent or 642.82 points to 8,993.11 points. Share price of Rastriya Beema Company surged by 5.26 per cent to Rs 14,000. Likewise, price of Nepal Life Insurance Company also soared by 5.77 per cent to Rs 2,272.

The sub-index of class ‘A’ financial institutions went up to 1,462.09 points with a gain of 3.05 per cent or 43.28 points. Share price of commercial banks like Everest increased by 3.10 per cent to Rs 1,395, Himalayan by 2.37 per cent to Rs 907 and that of Standard Chartered by 3.04 per cent to Rs 2,367.

Likewise, development banks also increased by 2.35 per cent or 45.73 points to 1,991.1 points. Share price of Hamro Bikash Bank went up by 12.39 per cent to Rs 263 at the end of the week. Similarly, investors of Miteri Development Bank also gained 5.45 per cent.

The sub-index of finance sector surged by 16.3 points or 2.23 per cent to 745.92 points. Share price of Synergy Finance Company increased by 4.51 per cent over the week. The hydropower sector also gained 24.76 points in the week. The sub-index of this sector closed at 1,942.77 points after clocking a rise of 1.29 per cent.

The manufacturing sector also gained 58.38 points or 2.47 per cent in the week to rest at 2,424.96 points. Likewise, sub-index of hotels also went up to 2,297.56 points, up 3.42 per cent or 75.99 points. In the week, sub-index of trading sector remained unchanged at 212.76 points.

Only the sub-index of others sector landed in the red, shedding 3.76 points or 0.53 per cent to rest at 695.86 points in the week.

In the week, 8.75 million shares of 165 companies worth Rs 4.74 billion were traded through 39,437 transactions. The traded amount was 12.76 per cent higher than the preceding week.

Nepal Life Insurance Company remained at the top in terms of weekly traded amount with Rs 283.44 million, followed by Forward Community Microfinance with Rs 260.9 million, Surya Life Insurance (Promoter Share) with Rs 240.61 million, National Life insurance Company with Rs 155.15 million and Neco Insurance with

Rs 146.97 million.

Forward Community Microfinance topped the table with regards to number of transactions with 3,701 transactions in the week, while Laxmi Value Fund 1 was at the top in terms of number of shares traded — 718,000.