Nepse records third weekly decline

Kathmandu, June 22

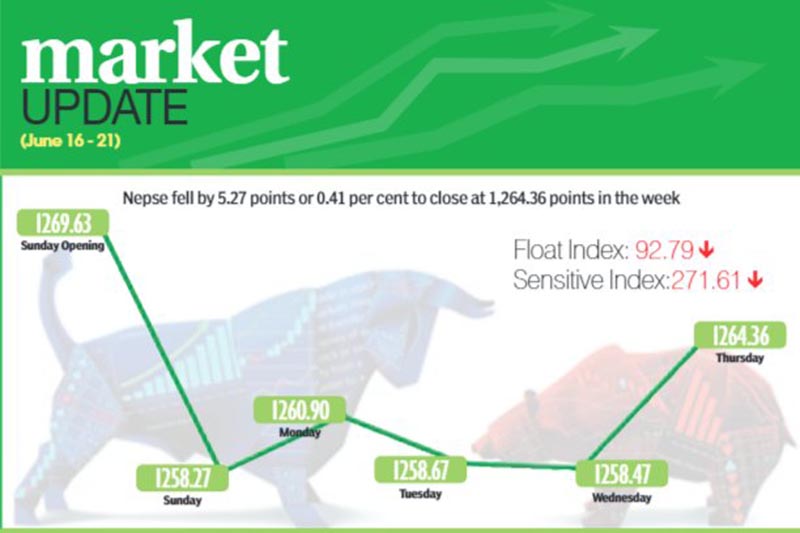

The country’s sole secondary market witnessed selling pressure for third consecutive week as investors continued to offload shares to pay their fiscal-end interests to banks and financial institutions (BFIs). As a result, the Nepal Stock Exchange (Nepse) index slipped by 0.41 per cent or 5.27 points in the trading week between June 16 and 20.

According to Radha Pokharel, chairperson of Nepal Pujibazar Laganikarta Sangh, share investors are currently feeling the pressure to pay the interest on loans they have taken from BFIs.

She further mentioned that though BFIs are providing margin loans, the interest rate on such loans is as high as 17 per cent. “The high interest on margin loans has also adversely affected the market,” she added.

Hence, in tandem with Nepse, sensitive index went down by 0.08 per cent or 0.24 point to 271.61 points and float index also decreased by 0.28 per cent or 0.27 point to 92.79 points.

The weekly turnover dropped by 6.6 per cent as compared to the previous week’s Rs 2.05 billion to stand at Rs 1.91 billion in the review period. Likewise, the average daily turnover fell to Rs 383 million, down 25.28 per cent from the preceding week’s Rs 512.6 million.

In the review week, trading of mutual funds surged by 75.17 per cent against the previous week to Rs 5.08 million. In the previous week, mutual funds had witnessed turnover of Rs three million.

The benchmark index had opened at 1,269.63 points on Sunday and dropped by 11.36 points by the time of closing. On Monday, the market went up by 2.63 points. On Tuesday and Wednesday, it again fell by 2.23 points and 0.20 point, respectively.

On Thursday, the local bourse bounced back by 5.9 points to close the week at 1,264.36 points.

In the review week, only hydropower and banking subgroups landed in the green zone. The trading subgroup remained constant at 263.9 points as it did not witness any transaction.

The hydropower subgroup went up by 0.17 per cent or two points to land at 1,202.79 points and the banking subgroup also increased by 0.07 per cent or 0.84 point to 1,135.92 points.

Meanwhile, non-life insurance subgroup was the biggest loser of the week, dropping by 2.6 per cent or 140.04 points to 5,239.15 points, with the share price of Everest Insurance down Rs 13 to Rs 365.

Similarly, life insurance sub-index lost 1.40 per cent or 86.88 points to 6,111.91 points and manufacturing subgroup fell by 1.22 per cent or 33.54 points to 2,710.98 points. Microfinance sub-index also went down by 1.15 per cent or 16.51 points to 1,424.93 points.

Hotels sub-index landed at 2,078.61 points, descending by 1.12 per cent or 23.58 points and finance subgroup rested at 617.47 points, dipping by 0.69 per cent or 4.31 points. Others subgroup shed 0.49 per cent or 3.62 points to 725.80 points and development bank sub-index dipped by 0.17 per cent or 2.79 points to 1,596.95 points.

In the review week, Nepal Bank topped in terms of weekly turnover with Rs 123.48 million. It was followed by Shivam Cements with Rs 117.88 million, Prabhu Bank with Rs 93.17 million, NIC Asia Bank with Rs 87.15 million and Taragaon Regency Hotel with Rs 74.54 million.

In terms of weekly trading volume, Nepal Bank was the forerunner with 382,000 of its shares changing hands. It was followed by Prabhu Bank with 348,000 shares, Taragaon Regency Hotel with 239,000 shares, NCC Bank with 217,000 shares and Siddhartha Bank with 199,000 shares.

Meanwhile, Upper Tamakoshi Hydropower took the lead in number of transactions with 1,338 deals.

It was followed by Shivam Cements with 1,195, Nepal Bank with 884, Prabhu Bank with 834 and Mega Bank with 723 transactions.