Nepse slightly up as election nears

Kathmandu, November 25

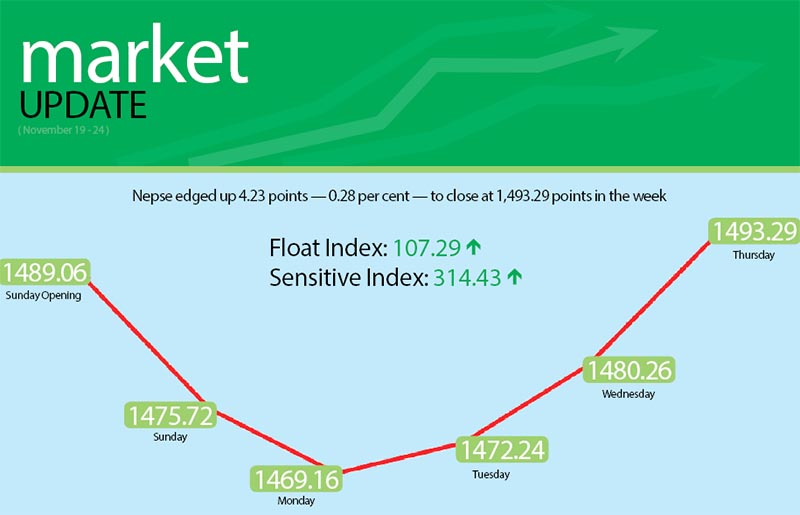

The secondary market index inched up slightly during the trading week between November 19 and 23. The Nepal Stock Exchange (Nepse) index went up to 1,493.29 points, up 4.23 points or 0.28 per cent in the review period.

Following the Nepse index, the sensitive and float indices also rose in the five-day trading period. The sensitive index went up by 1.31 points or 0.42 per cent to 314.43 points and the float index edged up to 107.29 points, gaining 0.39 point or 0.36 per cent.

The benchmark index opened at 1,489.06 points on Sunday and fell to 1,475.72 points by the end of the day, down 13.34 points. It again dropped on Monday to 1,469.16 points, however it ascended slightly to 1,472.24 points on Tuesday. The Nepse index was northbound on Wednesday and Thursday, rising to 1,480.26 points and 1,493.29 points, respectively.

Share investors say that the market is waiting for the elections to conclude and will increase in the near future. “Investors just want a strong and stable government after the elections and are not so concerned about who will head the government,” said Ambika Prasad Paudel, president of Nepal Investors’ Forum.

Paudel also said that due to the elections most investors are out of the Valley, which resulted in the trading volume declining in the last week. “Share trading volume has decreased because a majority of investors are out of the Valley for the elections,” he added.

Meanwhile, the sub-index of class ‘A’ financial institutions rose by 9.48 points or 0.75 per cent to 1,280.18 points during the review period. Share price of Standard Chartered Bank went up to Rs 2,060 per unit increasing by 1.88 per cent and Everest Bank’s share price rose by 5.66 per cent to Rs 1,179 per unit.

Similarly, the hydropower subgroup increased by 2.61 per cent or 48.97 points to 1,922.14 points. Share price of Butwal Power Company surged by five per cent to Rs 650 a unit. Likewise, Chilime Hydropower Company’s share also went up 3.22 per cent to Rs 866.

The manufacturing sector ascended by 7.45 points or 0.30 per cent to 2,477.69 points. Similarly, development banks also inched up by 2.82 points or 0.16 per cent to 1,752.8 points. The trading group landed at 215.63 points, up 0.68 points or 0.32 per cent.

However, the hotel sector fell by 1.81 per cent or 38.86 points to 2,102.36 points in the week. Share price of Soaltee Hotel declined by 15.28 per cent to Rs 273 per unit.

Similarly, the insurance sector fell by 66.6 points or 0.83 per cent to 7,981.09 points. Share price of Himalayan General Insurance dropped by 12.43 per cent to Rs 620 per unit.

Meanwhile, the others sector decreased by 6.35 points or 0.75 per cent to 835.25 points, finance sector fell by 2.21 points or 0.29 per cent to 753.47 points and the microfinance group shed 1.35 points or 0.08 per cent to 1,776.35 points.

Altogether, 5.47 million shares of 185 companies worth Rs 2.24 billion were traded through 23,499 transactions during the week. The traded amount was 23.38 per cent less

than the total weekly turnover of the previous week.

Sana Kisan Bikas Bank (promoter share) secured the top position in terms of total turnover with Rs 219.92 million. It was followed by Everest Bank with Rs 168.49 million, Nepal Life Insurance Company with Rs 86.7 million, Standard Chartered Bank with Rs 67.15 million and Civil Bank with Rs 58.47 million.

Civil Bank topped the list in terms of trading volume, with 272,000 of its shares changing hands and Everest Bank was forerunner in terms of number of transactions — 1,450.

New listings

Company

Type

Unit

Arun Valley Hydropower Dev Co

Bonus

848,193

Laxmi Bank

Bonus

11,563,652

Machhapuchchhre Bank

Rights

160,742.64

Raptibheri Bikas Bank

Bonus

132,983

Western Development Bank

Bonus

313,920