Nepse snaps three weeks of losses

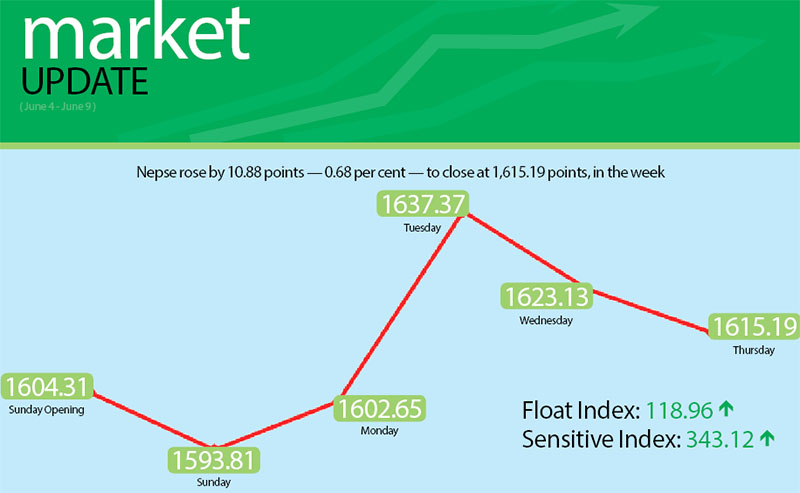

The domestic share market managed to snap the bout of weekly losses in trading week of June 4 to 8, with Nepal Stock Exchange (Nepse) index going up by 10.88 points or 0.68 per cent.

The benchmark index, which had opened at 1,604.31 points on Sunday, had dropped by 10.5 points to retreat below the threshold of 1,600 points by the day’s closing. Nepse, however, went up by 8.84 points on Monday and surged by 34.72 points on Tuesday, in tandem with positive political cues. The gain recorded in the two days was enough to offset the losses of the remainder of the week, when Nepse reversed course and fell by 14.24 points on Wednesday and slipped 7.94 points on Thursday to close at 1,615.19 points for the week.

The sensitive index, which gauges the performance of class ‘A’ stocks, rose by 2.78 points or 0.82 per cent to 343.12 points. Similarly, the float index that measures the performance of shares actually traded also edged up by 0.72 points or 0.61 per cent to 118.96 points.

Altogether 5.94 million shares of 159 companies that amounted to Rs 3.35 billion were traded through 34,274 transactions in the week. The traded amount was 17.64 per cent higher than preceding week when 27,341 transactions of 5.12 million shares of 158 firms worth Rs 2.84 billion had been undertaken. It has to be noted though that the share market had remained open for normal five trading days in the review period against four days in the past week due to public holiday.

Among the subgroups, trading continued to hold steady at 212.76 points.

Others led the pack of gainers with a rise of 14.17 points or 2.05 per cent to settle at 703.67 points. This was basically on the back of Nepal Telecom’s share value ascending by 2.58 per cent to Rs 675.

Banking salvaged some of loss of 1.97 per cent of past week with a gain of 16.38 points or 1.14 per cent to rest at 1,445.84 points. Share price of commercial banks like Standard Chartered surged by 4.93 per cent to Rs 2,298 and Everest soared by 3.45 per cent to Rs 1,739.

Development banks rose by 19.45 points or nearly one per cent to 1,967.04 points, buoyed by Chhimek up 1.2 per cent to Rs 1,604 and Swabhalamban rising by 2.31 per cent to Rs 1,857.

At the other end of the spectrum, hotels fell by 27.81 points or 1.24 per cent to 2,213.67 points. Even as Oriental edged up by 0.74 per cent to Rs 680, the sub-index was weighed down by stock price of Soaltee falling by 1.66 per cent to Rs 355 and that of Taragon Regency slumping by 2.92 per cent to Rs 266.

Although they landed in the red, the remaining subgroups managed to limit their losses below one per cent. Insurance was down 62.97 points or 0.73 per cent to 8,551.90 points; finance shed 4.4 points or 0.57 per cent to 768.01 points, manufacturing fell 13.41 points or 0.55 per cent to 2,433.84 points and hydropower slipped 10.43 points or 0.51 per cent to 2,042.56 points.

Meanwhile, Standard Chartered Bank retained its top position in terms of turnover with Rs 301.20 million, followed by Nepal Life Insurance Co with Rs 121.98 million, Civil Bank with Rs 111.12 million, Nepal Investment Bank with Rs 90.13 million and Himalayan General Insurance Co with Rs 82.13 million.

Civil Bank was the forerunner in terms of trading volume, with 452,000 of its shares changing hands. Similar to the previous week, Standard Chartered Bank also topped the chart with regard to most number of transactions — 3,962.