Nepse at a two-and-a-half week low

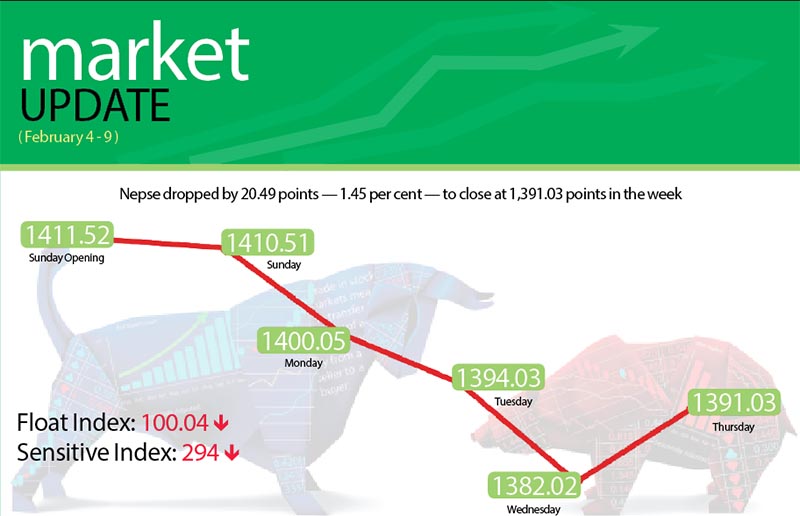

The secondary market saw the marginal improvement of the previous week wiped out in the trading week between February 4 and 8, with the Nepal Stock Exchange (Nepse) index dropping by 20.49 points or 1.45 per cent to settle at a two-and-a-half week low.

Starting the week at 1,411.52 points on Sunday, the benchmark index had dipped by 1.01 points by the day’s closing. The local bourse continued in the downward trajectory for the next three days, down 10.46 points on Monday, 6.02 points on Tuesday and 12.01 points on Wednesday. While Nepse rose by 9.01 points on Thursday to close the week at 1,391.03 points, the last day’s gain was insufficient to offset the losses of the previous trading days. The last time Nepse had closed at the current level was back on January 23, when it had rested at 1,393.04 points.

The sensitive index, which gauges the performance of class ‘A’ stocks, fell by 4.12 points or 1.38 per cent to 294 points. Similarly, the float index that measures the performance of shares actually traded also dipped by 1.57 points or 1.54 per cent to 100.04 points.

Altogether, 4.20 million shares of 172 companies worth Rs 1.55 billion were traded through 16,769 transactions during the review period. The turnover amount, trading volume and number of transactions have taken a beating in the recent days along with the slide in Nepse index. The traded amount in the review week, however, was 13.31 per cent higher than the previous week, when 16,769 transactions of 3.47 million shares of 172 listed firms that amounted to Rs 1.37 billion had been undertaken.

Contrary to the previous trading week when half of the subgroups had managed to land in the green, all the subgroups landed in the negative territory this time around, with hydropower, hotels, insurance and microfinance sub-indices witnessing the biggest drops.

Hydropower subgroup plummeted by 2.83 per cent or 51.95 points to 1,780.32 points. Sanima Mai plunged by 5.25 per cent to Rs 397, and Chilime lost 0.34 per cent to Rs 872, among others.

Hotels retreated by 2.45 per cent or 52.39 points to 2,083.85 points. Soaltee was down 3.26 per cent to Rs 267, Taragaon Regency fell by 1.63 per cent to Rs 301 and Oriental shed 0.89 per cent to Rs 664.

Insurance subgroup slumped by 2.23 per cent or 161.08 points to 7,066.46 points, and microfinance descended by 2.17 per cent or 36.82 points to 1,661.72 points.

Trading lost 1.68 per cent or 3.63 points to 211.99 points, weighed down by share price of Bishal Bazar Co dropping by 3.63 per cent to Rs 1,937.

Bottlers Nepal (Tarai)’s share value plunging by 4.71 per cent to Rs 6,861 and that of Himalayan Distillery by 3.58 per cent to Rs 1,210 caused the manufacturing sub-index to recoil by 1.33 per cent or 33.25 points to 2,450.48 points.

Banking, the subgroup with the highest weightage in the domestic secondary market, fell by 1.22 per cent or 15.03 points to 1,212.05 points, while finance was down 1.19 per cent or 8.53 points to 707.78 points.

Development banks and others managed to limit their losses below one per cent. Development banks shed 0.74 per cent or 11.77 points to land at 1,572.31 points, while others slipped by 0.54 per cent or 4.18 points to 761.65 points.

Meanwhile, Nepal Bank topped the chart in terms of trading volume and turnover, with 461,000 of its shares worth Rs 164.71 million changing hands in the review period. Sanima Mai Hydropower with Rs 84.79 million, Nabil Bank with Rs 56.92 million, Kumari Bank with Rs 54.99 million and Nepal Life Insurance Co with Rs 49.11 million were the other listed companies that made up the top-five in terms of weekly traded amount.

Meanwhile, Kumari Bank was the forerunner in the category of most number of transactions — 403.

NEW LISTINGS

Company

Type

Unit

Bank of Kathmandu

FPO

6,158,067.00

Chhimek Laghubitta Bittiya Sanstha

Bonus

1,659,293.00

ICFC Finance

Bonus

803,885.00

RSDC Laghubitta Bittiya Sanstha

Rights

2,300,000.00

Soaltee Hotel

Bonus

8,688,244.00

Swadeshi Laghubitta Bittiya Sanstha

Bonus

150,000.00

Source: Nepse