NRB faces two-pronged challenge of attaining 6pc growth, controlling inflation

KATHMANDU, July 19

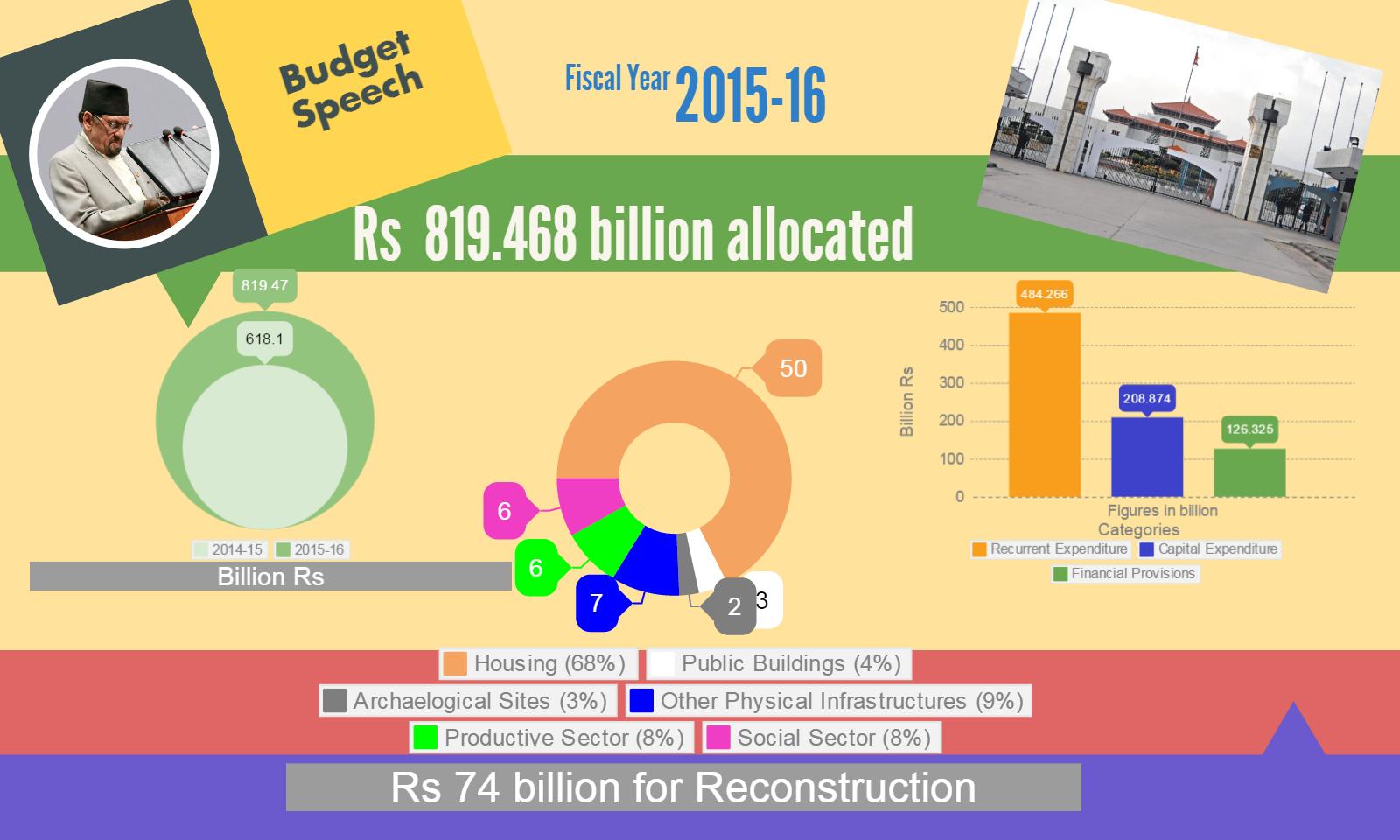

With the introduction of budget of Rs 819.47 billion for the current fiscal year, officials of Nepal Rastra Bank (NRB), the central monetary authority, are now busy framing the Monetary Policy.

If things go according to plan, NRB will unveil the Policy later this week or by next week.

The main purpose of the monetary policy is to ensure price and fiscal stability, while helping the government achieve economic growth target set for the financial year.

The upcoming monetary policy would also try to achieve these goals. But it will be challenging to address these issues this time, because the budget of this fiscal year is much more expansionary than those of previous years.

The government raised the size of the budget by 32.6 per cent this fiscal largely to support reconstruction drive in the aftermath of the earthquakes of April and May. This means more funds will flow into the economy this fiscal, building inflationary pressure. This will raise prices of goods and services, thereby eroding the value of money.

Also, surge in imports in the current fiscal year to meet reconstruction needs are expected to heap pressure on current account and balance of payments, which are currently in surplus.

Further, a bigger hike in wages of skilled and unskilled workers is also on the cards in this fiscal due to greater demand for labourers during reconstruction phase. This may further exert pressure on prices.

“Considering these scenarios, the Monetary Policy cannot be very loose as it would reduce interest rates, which would increase money supply and build inflationary pressure,” Head of the Research Department at NRB, Min Bahadur Shrestha, told The Himalayan Times.

But, on the other hand, the Monetary Policy also cannot be very tight, as the government has set economic growth target of six per cent for the current fiscal.

So to attain this growth, lending has to go up; and to scale-up lending, credit should be relatively cheaper.

“So, the challenge for us is to help the government achieve economic growth target of six per cent, while preventing consumer prices from rising rapidly,” said Shrestha, adding, “Taming inflation would be biggest challenge in current fiscal.”

In this regard, NRB has said it will not be able to limit inflation at last fiscal year’s level.

NRB had set inflation target of eight per cent for fiscal year 2014-15, which ended on July 16.

Although NRB is yet to announce final figure on last fiscal year’s inflation, it is expected to remain within the target.

NRB is on the way to achieving its inflation target after many years, largely because of last year’s slump in international oil prices and, most importantly, moderate level of inflation in India.

An easing inflation in India is always good news for Nepal, because the country imports over 60 per cent of merchandise goods from the southern neighbour.

And going forward, NRB can expect derived inflation — passed through imports from India — to remain at a moderate level, as the Indian central bank has already pegged inflation target at under six per cent for the period till January 2016 and two to six per cent from 2016-17 onwards.

This move made by Reserve Bank of India has provided a big relief to NRB, but in a country — which was suffering from double-digit inflation until some time ago — monetary policy alone may not be a sufficient tool to tame inflation.

For this, supply-side problems, such as problems seen in transport sector, also need to be well addressed. While containing inflation at a certain level is important to maintain price stability, what is also important is to expand credit so that the government can achieve the economic growth target.

“For this, the NRB must come up with a qualified credit policy to scale up lending in productive sectors,” former NRB governor Yubaraj Khatiwada told THT.

The central bank had previously asked commercial banks to divert 20 per cent of their total credit towards the productive sector — including 12 per cent to agriculture and energy sectors — within mid-July 2015. However, many banks earlier said they may not be able to attain this target because of ‘fragile investment and business climate’.

“Since NRB has already made it mandatory for banks to extend 12 per cent credit to agriculture and energy sectors, the new monetary policy should focus on raising credit flow towards small and medium enterprises and other labour-intensive sectors to attain economic growth of six per cent,” said Khatiwada.

A study conducted earlier by Neelam Timsina, director at the Research Department of NRB said one percentage point rise in the flow of bank loans here can push up the country’s economic growth by 0.4 percentage point.