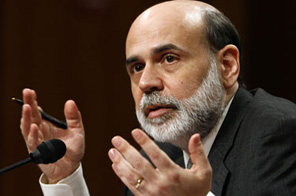

Obama to reappoint Bernanke as Fed chairman

OAK BLUFFS, Massachusetts: US President Barack Obama will announce Tuesday he is awarding Ben Bernanke a second term as Federal Reserve chairman, following their months of joint combat against the financial crisis.

A White House official said on condition of anonymity that Obama would break his vacation on well-heeled Martha's Vineyard off the US east coast to re-appoint Bernanke to a second four-year term beginning in January.

Obama will deliver the statement, with Bernanke by his side, in the resort town of Oak Bluffs at 9 am (1400 GMT) before US markets open, the official said.

White House chief of staff Rahm Emanuel told the Wall Street Journal that Obama was reappointing the cerebral Bernanke because he credits him with "pulling the economy back from the brink of depression."

Bernanke was selected as Federal Reserve chairman by Obama's predecessor George W. Bush in 2005 to replace retiring Fed chairman Alan Greenspan, who served for 18 years and presided over a golden era of economic prosperity.

At the tail end of Bush's second term, and the beginning of Obama's presidency, Bernanke has been a key player in stabilizing markets and prescribing the antidote to the worst crisis since the 1930s Great Depression.

He has enjoyed broad support on Wall Street, for the sweeping and sometimes unorthodox methods he has used to save the banking sector, redefine the financial industry and keep the recession from turning into a depression.

But Obama may face some opposition in Congress to his decision to reappoint the central banker.

The president offered Bernanke the position, which requires Senate confirmation, in a meeting in the Oval Office last week, the Wall Street Journal reported.

Obama's move may be calculated to send a signal of continuity and to reassure financial markets that are still fragile, despite signs the global economy is returning slowly to growth -- especially outside the United States.

Changing the Fed chairman at such a time might have spooked investors and been seen as a dramatic reversal of policy, considering Bernanke was such a key player in fighting off the crisis.

Bernanke, who turns 56 this year, has worked closely with the Treasury Department and the White House in plotting a route out of the recession and stabilizing and reforming the debt-laden US financial sector.

He now faces the delicate decision of how quickly to scale back the massive government effort to pump liquidity into the financial system.

The central bank said earlier this month that it would begin to pull back from the purchase of Treasury bonds and mortgage-backed securities, in a sign seen by analysts of a step away from extraordinary support of the economy.

Bernanke, meanwhile, said just last week that prospects for world recovery appeared good despite financial market strains, but cautioned that any economic growth would be slow at first.

"After contracting sharply over the past year, economic activity appears to be leveling out, both in the United States and abroad, and the prospects for a return to growth in the near term appear good," he told central bankers at a meeting in Jackson Hole, Wyoming.

Bernanke said that while fears of financial collapse had receded substantially, critical challenges remained as the world grappled with a financial crisis that sharply halted growth following a US home mortgage meltdown.

"Strains persist in many financial markets across the globe, financial institutions face significant additional losses, and many businesses and households continue to experience considerable difficulty gaining access to credit," he said.

Bernanke is a former economics professor who was once chairman of the Council of Economic Advisors under Bush.

He famously railed against the specter of deflation, which he saw as one of the factors which prolonged the Great Depression, and that view informed his thinking on the financial crisis which battered the US economy at his own moment of history.

Bernanke was born in Augusta, Georgia to a pharmacist father and a schoolteacher mother on December 13, 1953.

He graduated from Harvard in 1975 with top honors and received his PhD in economics from the Massachusetts Institute of Technology, and worked at Princeton University before joining the Federal Reserve Board in 2002.